Mikasa Ackerman and Eren Yeager agreed to form a partnership contributing their respective assets and liabilities subject to the following adjustments: a. Accounts receivable of P50,000 and P750,000 in their respective books are uncollectible. b. Inventories of P27,500 and P33,500 are worthless in their respective books. c. Other assets of P10,000 and P18,000 in Mikasa Ackerman’ and Eren Yeager’s books are to be written off. How much is the total accounts receivable balance of the partnership at formation? 3,212,130 2,789,450 1,839,685 4,012,130 Total adjustment to capital account of each partner: P95,500, decrease; P793,500, increase P95,500, decrease; P793,500, decrease P801,500, decrease; P87,500, decrease P87,500, decrease; P801,500, decrease

Mikasa Ackerman and Eren Yeager agreed to form a partnership contributing their respective assets and liabilities subject to the following adjustments: a. Accounts receivable of P50,000 and P750,000 in their respective books are uncollectible. b. Inventories of P27,500 and P33,500 are worthless in their respective books. c. Other assets of P10,000 and P18,000 in Mikasa Ackerman’ and Eren Yeager’s books are to be written off. How much is the total accounts receivable balance of the partnership at formation? 3,212,130 2,789,450 1,839,685 4,012,130 Total adjustment to capital account of each partner: P95,500, decrease; P793,500, increase P95,500, decrease; P793,500, decrease P801,500, decrease; P87,500, decrease P87,500, decrease; P801,500, decrease

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 14DQ

Related questions

Question

Mikasa Ackerman and Eren Yeager agreed to form a partnership contributing their respective assets and liabilities subject to the following adjustments:

a. Accounts receivable of P50,000 and P750,000 in their respective books are uncollectible.

b. Inventories of P27,500 and P33,500 are worthless in their respective books.

c. Other assets of P10,000 and P18,000 in Mikasa Ackerman’ and Eren Yeager’s books are to be written off.

a. Accounts receivable of P50,000 and P750,000 in their respective books are uncollectible.

b. Inventories of P27,500 and P33,500 are worthless in their respective books.

c. Other assets of P10,000 and P18,000 in Mikasa Ackerman’ and Eren Yeager’s books are to be written off.

How much is the total accounts receivable balance of the partnership at formation?

3,212,130

2,789,450

1,839,685

4,012,130

Total adjustment to capital account of each partner:

P95,500, decrease; P793,500, increase

P95,500, decrease; P793,500, decrease

P801,500, decrease; P87,500, decrease

P87,500, decrease; P801,500, decrease

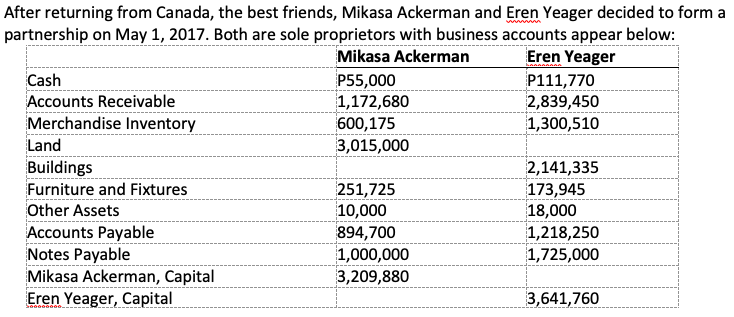

Transcribed Image Text:After returning from Canada, the best friends, Mikasa Ackerman and Eren Yeager decided to form a

partnership on May 1, 2017. Both are sole proprietors with business accounts appear below:

Cash

Accounts Receivable

Merchandise Inventory

Land

Buildings

Mikasa Ackerman

P55,000

1,172,680

600,175

3,015,000

Eren Yeager

P111,770

2,839,450

1,300,510

2,141,335

173,945

18,000

251,725

10,000

894,700

1,000,000

3,209,880

Furniture and Fixtures

Other Assets

Accounts Payable

Notes Payable

Mikasa Ackerman, Capital

Eren Yeager, Capital

1,218,250

1,725,000

3,641,760

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT