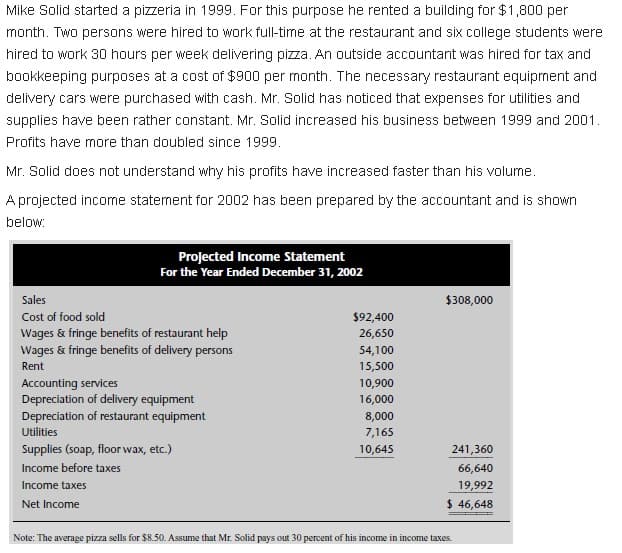

Mike Solid started a pizzeria in 1999. For this purpose he rented a building for $1,800 per month. Two persons were hired to work full-time at the restaurant and six college students were hired to work 30 hours per week delivering pizza. An outside accountant was hired for tax and bookkeeping purposes at a cost of $900 per month. The necessary restaurant equipment and delivery cars were purchased with cash. Mr. Solid has noticed that expenses for utilities and supplies have been rather constant. Mr. Solid increased his business between 1999 and 2001. Profits have more than doubled since 1999. Mr. Solid does not understand why his profits have increased faster than his volume. A projected income statement for 2002 has been prepared by the accountant and is shown below: Projected Income Statement For the Year Ended December 31, 2002 Sales $308,000 Cost of food sold $92,400 Wages & fringe benefits of restaurant help Wages & fringe benefits of delivery persons 26,650 54,100 Rent 15,500 Accounting services Depreciation of delivery equipment Depreciation of restaurant equipment 10,900 16,000 8,000 7,165 Utilities Supplies (soap, floor wax, etc.) 10,645 241,360 Income before taxes 66,640 Income taxes 19,992 Net Income $ 46,648 Note: The average pizza sells for $8.50. Assume that Mr. Solid pays out 30 percent of his income in income taxes.

Mike Solid started a pizzeria in 1999. For this purpose he rented a building for $1,800 per month. Two persons were hired to work full-time at the restaurant and six college students were hired to work 30 hours per week delivering pizza. An outside accountant was hired for tax and bookkeeping purposes at a cost of $900 per month. The necessary restaurant equipment and delivery cars were purchased with cash. Mr. Solid has noticed that expenses for utilities and supplies have been rather constant. Mr. Solid increased his business between 1999 and 2001. Profits have more than doubled since 1999. Mr. Solid does not understand why his profits have increased faster than his volume. A projected income statement for 2002 has been prepared by the accountant and is shown below: Projected Income Statement For the Year Ended December 31, 2002 Sales $308,000 Cost of food sold $92,400 Wages & fringe benefits of restaurant help Wages & fringe benefits of delivery persons 26,650 54,100 Rent 15,500 Accounting services Depreciation of delivery equipment Depreciation of restaurant equipment 10,900 16,000 8,000 7,165 Utilities Supplies (soap, floor wax, etc.) 10,645 241,360 Income before taxes 66,640 Income taxes 19,992 Net Income $ 46,648 Note: The average pizza sells for $8.50. Assume that Mr. Solid pays out 30 percent of his income in income taxes.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter3: Cost Behavior

Section: Chapter Questions

Problem 15E: Penny Davis runs the Shear Beauty Salon near a college campus. Several months ago, Penny used some...

Related questions

Question

100%

What is the break-even point in number of pizzas that must be sold and the cash flow break even point in the number of pizzas that must be sold?

Transcribed Image Text:Mike Solid started a pizzeria in 1999. For this purpose he rented a building for $1,800 per

month. Two persons were hired to work full-time at the restaurant and six college students were

hired to work 30 hours per week delivering pizza. An outside accountant was hired for tax and

bookkeeping purposes at a cost of $900 per month. The necessary restaurant equipment and

delivery cars were purchased with cash. Mr. Solid has noticed that expenses for utilities and

supplies have been rather constant. Mr. Solid increased his business between 1999 and 2001.

Profits have more than doubled since 1999.

Mr. Solid does not understand why his profits have increased faster than his volume.

A projected income statement for 2002 has been prepared by the accountant and is shown

below:

Projected Income Statement

For the Year Ended December 31, 2002

Sales

$308,000

Cost of food sold

$92,400

Wages & fringe benefits of restaurant help

Wages & fringe benefits of delivery persons

26,650

54,100

Rent

15,500

Accounting services

Depreciation of delivery equipment

Depreciation of restaurant equipment

10,900

16,000

8,000

Utilities

7,165

Supplies (soap, floor wax, etc.)

10,645

241,360

66,640

19,992

$ 46,648

Income before taxes

Income taxes

Net Income

Note: The average pizza sells for $8.50. Assume that Mr. Solid pays out 30 percent of his income in income taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning