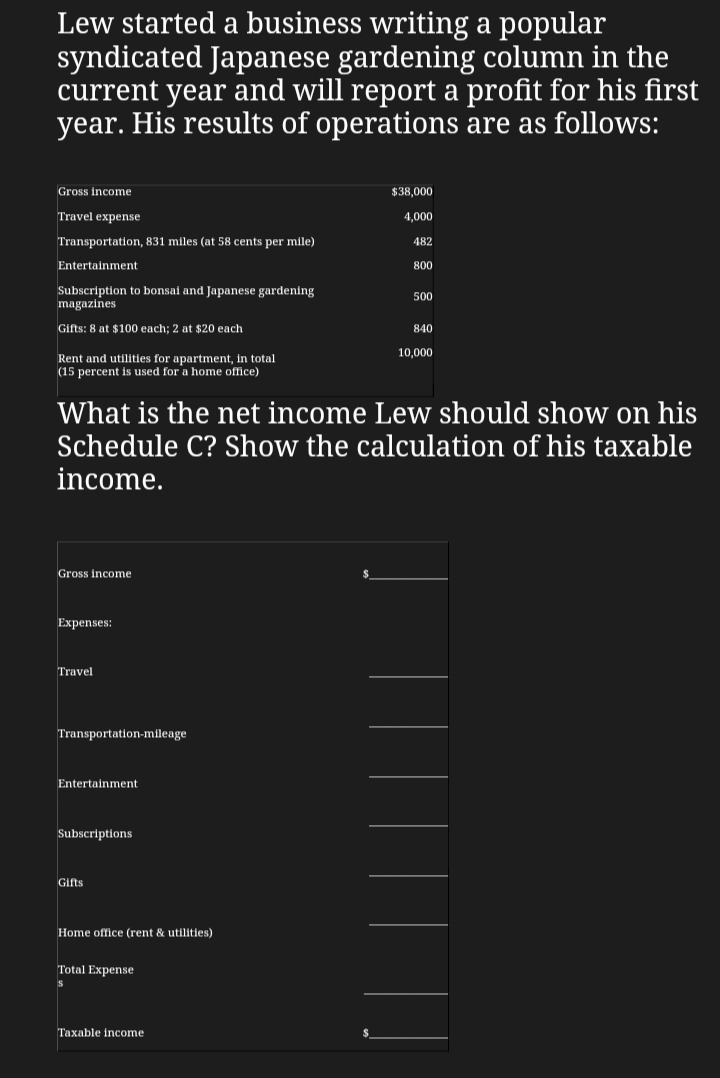

Lew started a business writing a popular syndicated Japanese gardening column in the current year and will report a profit for his first year. His results of operations are as follows: Gross income $38,000 Travel expense 4,000 Transportation, 831 miles (at 58 cents per mile) 482 Entertainment 800 Subscription to bonsai and Japanese gardening magazines 500 Gifts: 8 at $100 each; 2 at $20 each 840 10,000 Rent and utilities for apartment, in total (15 percent is used for a home office) What is the net income Lew should show on his Schedule C? Show the calculation of his taxable income.

Lew started a business writing a popular syndicated Japanese gardening column in the current year and will report a profit for his first year. His results of operations are as follows: Gross income $38,000 Travel expense 4,000 Transportation, 831 miles (at 58 cents per mile) 482 Entertainment 800 Subscription to bonsai and Japanese gardening magazines 500 Gifts: 8 at $100 each; 2 at $20 each 840 10,000 Rent and utilities for apartment, in total (15 percent is used for a home office) What is the net income Lew should show on his Schedule C? Show the calculation of his taxable income.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 39P

Related questions

Question

Please help

Transcribed Image Text:Lew started a business writing a popular

syndicated Japanese gardening column in the

current year and will report a profit for his first

year. His results of operations are as follows:

Gross income

$38,000

Travel expense

4,000

Transportation, 831 miles (at 58 cents per mile)

482

Entertainment

800

Subscription to bonsai and Japanese gardening

magazines

500

Gifts: 8 at $100 each; 2 at $20 each

840

10,000

Rent and utilities for apartment, in total

(15 percent is used for a home office)

What is the net income Lew should show on his

Schedule C? Show the calculation of his taxable

income.

Gross income

Expenses:

Travel

Transportation-mileage

Entertainment

Subscriptions

Gifts

Home office (rent

utilities)

Total Expense

Taxable income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning