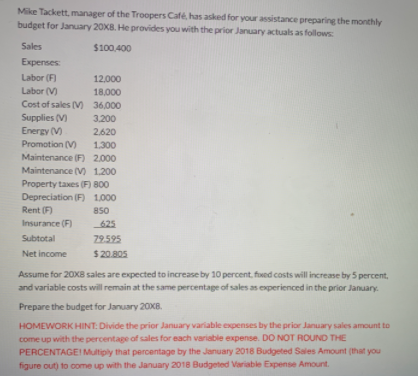

Mike Tackett, manager of the Troopers Café, has asked for your assistance preparing the monthly budget for January 20X8. He provides you with the prior January actuals as follows: Sales $100.400 Expenses: Labor (F) 12,000 Labor (V) 18,000 Cost of sales (V) 36,000 Supplies (V) 3.200 Energy (V) 2.620 Promotion (V) 1.300 Maintenance (F) 2.000 Maintenance (V) 1.200 Property taxes (F) 800 Depreciation (F) 1.000 Rent (F) 850 Insurance (F) 625 Subtotal 79.595 Net income $20.805 Assume for 20X8 sales are expected to increase by 10 percent, fixed costs will increase by 5 percent, and variable costs will remain at the same percentage of sales as experienced in the prior January. Prepare the budget for January 20X8. HOMEWORK HINT: Divide the prior January variable expenses by the prior January sales amount to come up with the percentage of sales for each variable expense. DO NOT ROUND THE PERCENTAGEI Multiply that percentage by the January 2018 Budgeted Sales Amount (that you figure out) to come up with the January 2018 Budgeted Variable Expense Amount.

Mike Tackett, manager of the Troopers Café, has asked for your assistance preparing the monthly budget for January 20X8. He provides you with the prior January actuals as follows: Sales $100.400 Expenses: Labor (F) 12,000 Labor (V) 18,000 Cost of sales (V) 36,000 Supplies (V) 3.200 Energy (V) 2.620 Promotion (V) 1.300 Maintenance (F) 2.000 Maintenance (V) 1.200 Property taxes (F) 800 Depreciation (F) 1.000 Rent (F) 850 Insurance (F) 625 Subtotal 79.595 Net income $20.805 Assume for 20X8 sales are expected to increase by 10 percent, fixed costs will increase by 5 percent, and variable costs will remain at the same percentage of sales as experienced in the prior January. Prepare the budget for January 20X8. HOMEWORK HINT: Divide the prior January variable expenses by the prior January sales amount to come up with the percentage of sales for each variable expense. DO NOT ROUND THE PERCENTAGEI Multiply that percentage by the January 2018 Budgeted Sales Amount (that you figure out) to come up with the January 2018 Budgeted Variable Expense Amount.

Chapter7: Budgeting

Section: Chapter Questions

Problem 1PB: Lens & Shades sells sunglasses for $37 each and is estimating sales of 21,000 units in January and...

Related questions

Question

Transcribed Image Text:Mike Tackett, manager of the Troopers Café, has asked for your assistance preparing the monthly

budget for January 20X8. He provides you with the prior January actuals as follows:

Sales

$100.400

Expenses:

Labor (F)

12,000

Labor (V)

18,000

Cost of sales (V) 36,000

Supplies (V)

3.200

Energy (V)

2.620

Promotion (V)

1.300

Maintenance (F) 2.000

Maintenance (V) 1.200

Property taxes (F) 800

Depreciation (F) 1.000

Rent (F)

850

Insurance (F)

625

Subtotal

79.595

Net income

$20.805

Assume for 20X8 sales are expected to increase by 10 percent, fixed costs will increase by 5 percent,

and variable costs will remain at the same percentage of sales as experienced in the prior January.

Prepare the budget for January 20X8.

HOMEWORK HINT: Divide the prior January variable expenses by the prior January sales amount to

come up with the percentage of sales for each variable expense. DO NOT ROUND THE

PERCENTAGEI Multiply that percentage by the January 2018 Budgeted Sales Amount (that you

figure out) to come up with the January 2018 Budgeted Variable Expense Amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub