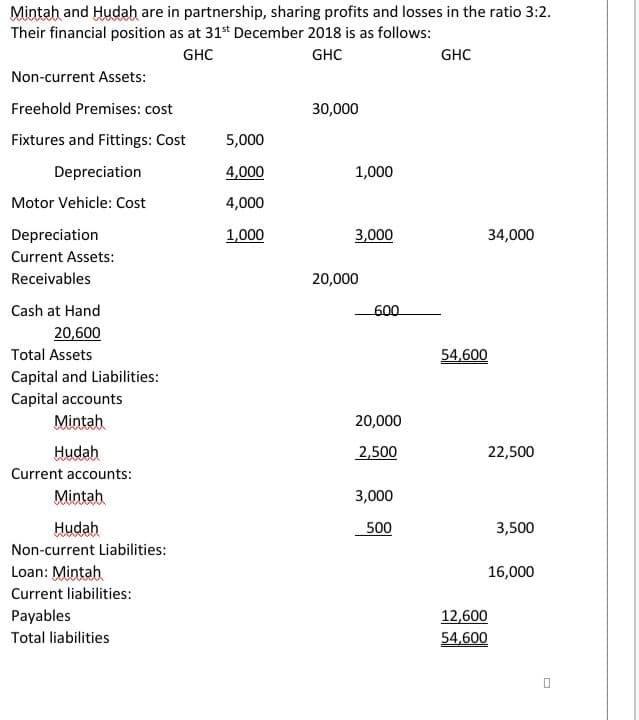

Mintah and Hudah are in partnership, sharing profits and losses in the ratio 3:2. Their financial position as at 31* December 2018 is as follows: GHC GHC GHC Non-current Assets: Freehold Premises: cost 30,000 Fixtures and Fittings: Cost 5,000 Depreciation 4,000 1,000 Motor Vehicle: Cost 4,000 Depreciation 1,000 3,000 34,000 Current Assets: Receivables 20,000 Cash at Hand 600 20,600 Total Assets 54,600 Capital and Liabilities: Capital accounts Mintah 20,000 Hudah 2,500 22,500 Current accounts: Mintah 3,000 Hudah 500 3,500 Non-current Liabilities: Loan: Mintah 16,000 Current liabilities: Payables 12,600 Total liabilities 54,600

Mintah and Hudah are in partnership, sharing profits and losses in the ratio 3:2. Their financial position as at 31* December 2018 is as follows: GHC GHC GHC Non-current Assets: Freehold Premises: cost 30,000 Fixtures and Fittings: Cost 5,000 Depreciation 4,000 1,000 Motor Vehicle: Cost 4,000 Depreciation 1,000 3,000 34,000 Current Assets: Receivables 20,000 Cash at Hand 600 20,600 Total Assets 54,600 Capital and Liabilities: Capital accounts Mintah 20,000 Hudah 2,500 22,500 Current accounts: Mintah 3,000 Hudah 500 3,500 Non-current Liabilities: Loan: Mintah 16,000 Current liabilities: Payables 12,600 Total liabilities 54,600

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

Answer all questions that is a to d

Show all working

Transcribed Image Text:Mintah and Hudah are in partnership, sharing profits and losses in the ratio 3:2.

Their financial position as at 31s* December 2018 is as follows:

GHC

GHC

GHC

Non-current Assets:

Freehold Premises: cost

30,000

Fixtures and Fittings: Cost

5,000

Depreciation

4,000

1,000

Motor Vehicle: Cost

4,000

Depreciation

1,000

3,000

34,000

Current Assets:

Receivables

20,000

Cash at Hand

600

20,600

Total Assets

54,600

Capital and Liabilities:

Capital accounts

Mintah

20,000

Hudah

2,500

22,500

Current accounts:

Mintah

3,000

Hudah

500

3,500

Non-current Liabilities:

Loan: Mintah

16,000

Current liabilities:

Payables

12,600

Total liabilities

54,600

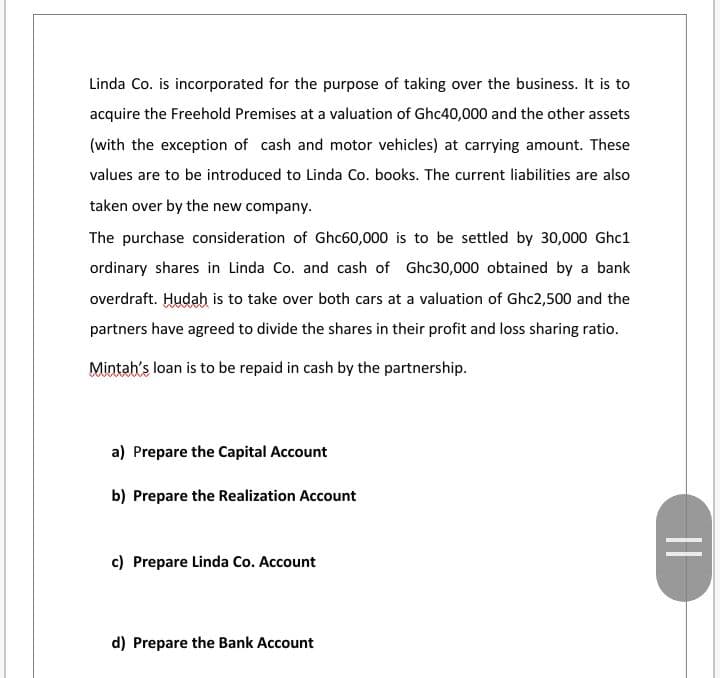

Transcribed Image Text:Linda Co. is incorporated for the purpose of taking over the business. It is to

acquire the Freehold Premises at a valuation of Ghc40,000 and the other assets

(with the exception of cash and motor vehicles) at carrying amount. These

values are to be introduced to Linda Co. books. The current liabilities are also

taken over by the new company.

The purchase consideration of Ghc60,000 is to be settled by 30,000 Ghc1

ordinary shares in Linda Co. and cash of Ghc30,000 obtained by a bank

overdraft. Hudah is to take over both cars at a valuation of Ghc2,500 and the

partners have agreed to divide the shares in their profit and loss sharing ratio.

Mintah's loan is to be repaid in cash by the partnership.

a) Prepare the Capital Account

b) Prepare the Realization Account

c) Prepare Linda Co. Account

d) Prepare the Bank Account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT