Mode 6- Lump Sum Acquisition, With Direct Attributable Cost Numbers 14 and 15 On June 1. Thick Company acquired a real property by issuing 35,360 shares of its P100 par value ordinary shares. The shares were selling on the same date at P125. A mortgage of P4,000,000 was assumed by Thick on the purchase. Moreover, the company paid P180,000 of real property taxes in the prior years. Twenty percent of the purchase price should be allocated to the land and the balance to the building. In order to make the building suitable for the use of Thick, remolding costs had to be incurred in the amount of P900,000. This however necessitated the demolition of a portion of the building, which resulted in recovery of salvage material sold for P30,000. Parking lot cost the company P320,000 while repairs in the main hall were incurred at P45,000 prior to its use. 10) The correct cost of the land should be A 1.664,000 B. 1.720,000 C. 2,040,000 D. 2.400,000 11) The correct cost of the building should be A 6,330,000 B. 7.795,000 C. 7,750,000 D. 7,570,000

Mode 6- Lump Sum Acquisition, With Direct Attributable Cost Numbers 14 and 15 On June 1. Thick Company acquired a real property by issuing 35,360 shares of its P100 par value ordinary shares. The shares were selling on the same date at P125. A mortgage of P4,000,000 was assumed by Thick on the purchase. Moreover, the company paid P180,000 of real property taxes in the prior years. Twenty percent of the purchase price should be allocated to the land and the balance to the building. In order to make the building suitable for the use of Thick, remolding costs had to be incurred in the amount of P900,000. This however necessitated the demolition of a portion of the building, which resulted in recovery of salvage material sold for P30,000. Parking lot cost the company P320,000 while repairs in the main hall were incurred at P45,000 prior to its use. 10) The correct cost of the land should be A 1.664,000 B. 1.720,000 C. 2,040,000 D. 2.400,000 11) The correct cost of the building should be A 6,330,000 B. 7.795,000 C. 7,750,000 D. 7,570,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

10-11

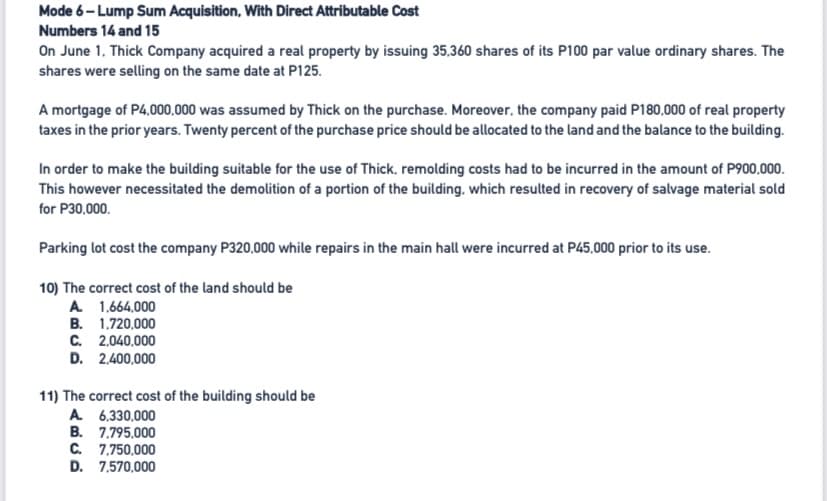

Transcribed Image Text:Mode 6- Lump Sum Acquisition, With Direct Attributable Cost

Numbers 14 and 15

On June 1. Thick Company acquired a real property by issuing 35,360 shares of its P100 par value ordinary shares. The

shares were selling on the same date at P125.

A mortgage of P4,000,000 was assumed by Thick on the purchase. Moreover, the company paid P180,000 of real property

taxes in the prior years. Twenty percent of the purchase price should be allocated to the land and the balance to the building.

In order to make the building suitable for the use of Thick, remolding costs had to be incurred in the amount of P900,000.

This however necessitated the demolition of a portion of the building, which resulted in recovery of salvage material sold

for P30,000.

Parking lot cost the company P320,000 while repairs in the main hall were incurred at P45,000 prior to its use.

10) The correct cost of the land should be

A 1,664,000

B. 1.720,000

C. 2,040,000

D. 2,400,000

11) The correct cost of the building should be

A 6,330,000

B. 7.795,000

C. 7,750,000

D. 7,570,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning