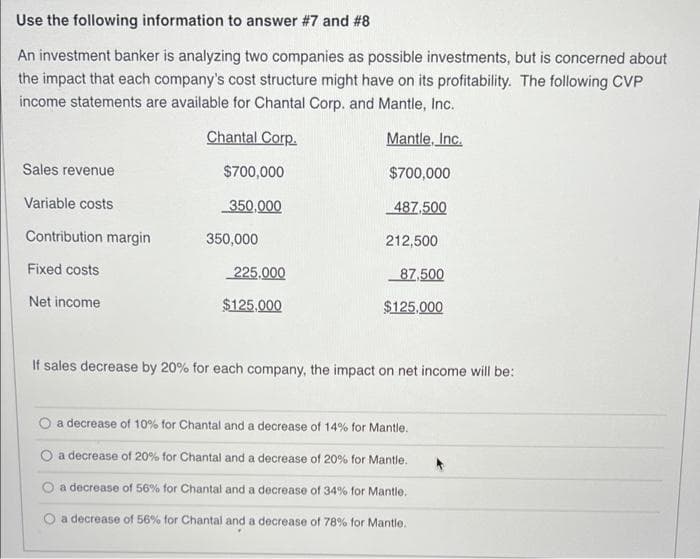

Use the following information to answer #7 and #8 An investment banker is analyzing two companies as possible investments, but is concerned abou the impact that each company's cost structure might have on its profitability. The following CVP income statements are available for Chantal Corp. and Mantle, Inc. Chantal Corp. Mantle, Inc. Sales revenue $700,000 $700,000 Variable costs 350,000 487,500 Contribution margin 350,000 212,500 Fixed costs 225.000 87,500 Net income $125,000 $125,000 If sales decrease by 20% for each company, the impact on net income will be: a decrease of 10% for Chantal and a decrease of 14% for Mantle. O a decrease of 20% for Chantal and a decrease of 20% for Mantle. a decrease of 56% for Chantal and a decrease of 34% for Mantle. a decrease of 56% for Chantal and a decrease of 78% for Mantle.

Use the following information to answer #7 and #8 An investment banker is analyzing two companies as possible investments, but is concerned abou the impact that each company's cost structure might have on its profitability. The following CVP income statements are available for Chantal Corp. and Mantle, Inc. Chantal Corp. Mantle, Inc. Sales revenue $700,000 $700,000 Variable costs 350,000 487,500 Contribution margin 350,000 212,500 Fixed costs 225.000 87,500 Net income $125,000 $125,000 If sales decrease by 20% for each company, the impact on net income will be: a decrease of 10% for Chantal and a decrease of 14% for Mantle. O a decrease of 20% for Chantal and a decrease of 20% for Mantle. a decrease of 56% for Chantal and a decrease of 34% for Mantle. a decrease of 56% for Chantal and a decrease of 78% for Mantle.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 53P

Related questions

Question

Transcribed Image Text:Use the following information to answer #7 and # 8

An investment banker is analyzing two companies as possible investments, but is concerned about

the impact that each company's cost structure might have on its profitability. The following CVP

income statements are available for Chantal Corp. and Mantle, Inc.

Chantal Corp.

Mantle, Inc.

Sales revenue

$700,000

$700,000

Variable costs

350,000

487,500

Contribution margin

350,000

212,500

Fixed costs

225.000

87,500

Net income

$125,000

$125.000

If sales decrease by 20% for each company, the impact on net income will be:

a decrease of 10% for Chantal and a decrease of 14% for Mantle.

O a decrease of 20% for Chantal and a decrease of 20% for Mantle.

O a decrease of 56% for Chantal and a decrease of 34% for Mantle.

O a decrease of 56% for Chantal and a decrease of 78% for Mantle.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning