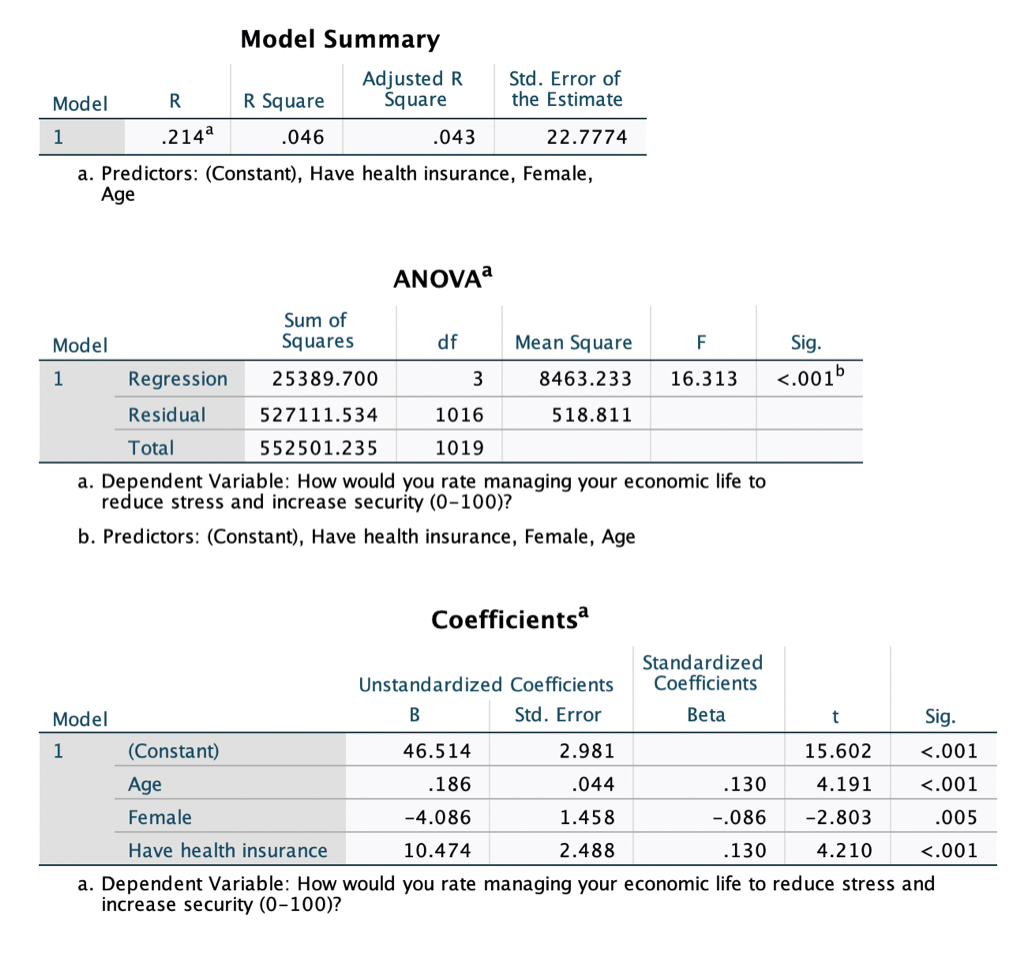

Model Summary Adjusted R Square Std. Error of the Estimate Model R Square 1 .214a .046 .043 22.7774 a. Predictors: (Constant), Have health insurance, Female, Age ANOVAª Sum of Squares Model df Mean Square F Sig. 1 Regression 25389.700 8463.233 16.313 <.001b Residual 527111.534 1016 518.811 Total 552501.235 1019 a. Dependent Variable: How would you rate managing your economic life to reduce stress and increase security (0-100)? b. Predictors: (Constant), Have health insurance, Female, Age Coefficientsa Standardized Coefficients Unstandardized Coefficients Model Std. Error Beta t Sig. 1 (Constant) 46.514 2.981 15.602 <.001 Age .186 .044 .130 4.191 <.001 Female -4.086 1.458 -.086 -2.803 .005 Have health insurance 10.474 2.488 .130 4.210 <.001 a. Dependent Variable: How would you rate managing your economic life to reduce stress and increase security (0-100)?

Model Summary Adjusted R Square Std. Error of the Estimate Model R Square 1 .214a .046 .043 22.7774 a. Predictors: (Constant), Have health insurance, Female, Age ANOVAª Sum of Squares Model df Mean Square F Sig. 1 Regression 25389.700 8463.233 16.313 <.001b Residual 527111.534 1016 518.811 Total 552501.235 1019 a. Dependent Variable: How would you rate managing your economic life to reduce stress and increase security (0-100)? b. Predictors: (Constant), Have health insurance, Female, Age Coefficientsa Standardized Coefficients Unstandardized Coefficients Model Std. Error Beta t Sig. 1 (Constant) 46.514 2.981 15.602 <.001 Age .186 .044 .130 4.191 <.001 Female -4.086 1.458 -.086 -2.803 .005 Have health insurance 10.474 2.488 .130 4.210 <.001 a. Dependent Variable: How would you rate managing your economic life to reduce stress and increase security (0-100)?

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.6: Exponential And Logarithmic Equations

Problem 67E

Related questions

Question

If our desired level of significance is .05 – that is, a 95% level of confidence — then how do we interpret the regression results you’ve obtained? Specifically, please interpret the importance – in a statistical, not substantive, sense – of each of the three independent variables included in the model.

Transcribed Image Text:Model Summary

Adjusted R

Šquare

Std. Error of

the Estimate

Model

R Square

1

.214a

.046

.043

22.7774

a. Predictors: (Constant), Have health insurance, Female,

Age

ANOVAa

Sum of

Squares

Model

df

Mean Square

F

Sig.

1

Regression

25389.700

3

8463.233

16.313

<.001b

Residual

527111.534

1016

518.811

Total

552501.235

1019

a. Dependent Variable: How would you rate managing your economic life to

reduce stress and increase security (0-100)?

b. Predictors: (Constant), Have health insurance, Female, Age

Coefficientsa

Standardized

Coefficients

Unstandardized Coefficients

Model

В

Std. Error

Beta

t

Sig.

1

(Constant)

46.514

2.981

15.602

<.001

Age

.186

.044

.130

4.191

<.001

Female

-4.086

1.458

-.086

-2.803

.005

Have health insurance

10.474

2.488

.130

4.210

<.001

a. Dependent Variable: How would you rate managing your economic life to reduce stress and

increase security (0-100)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage