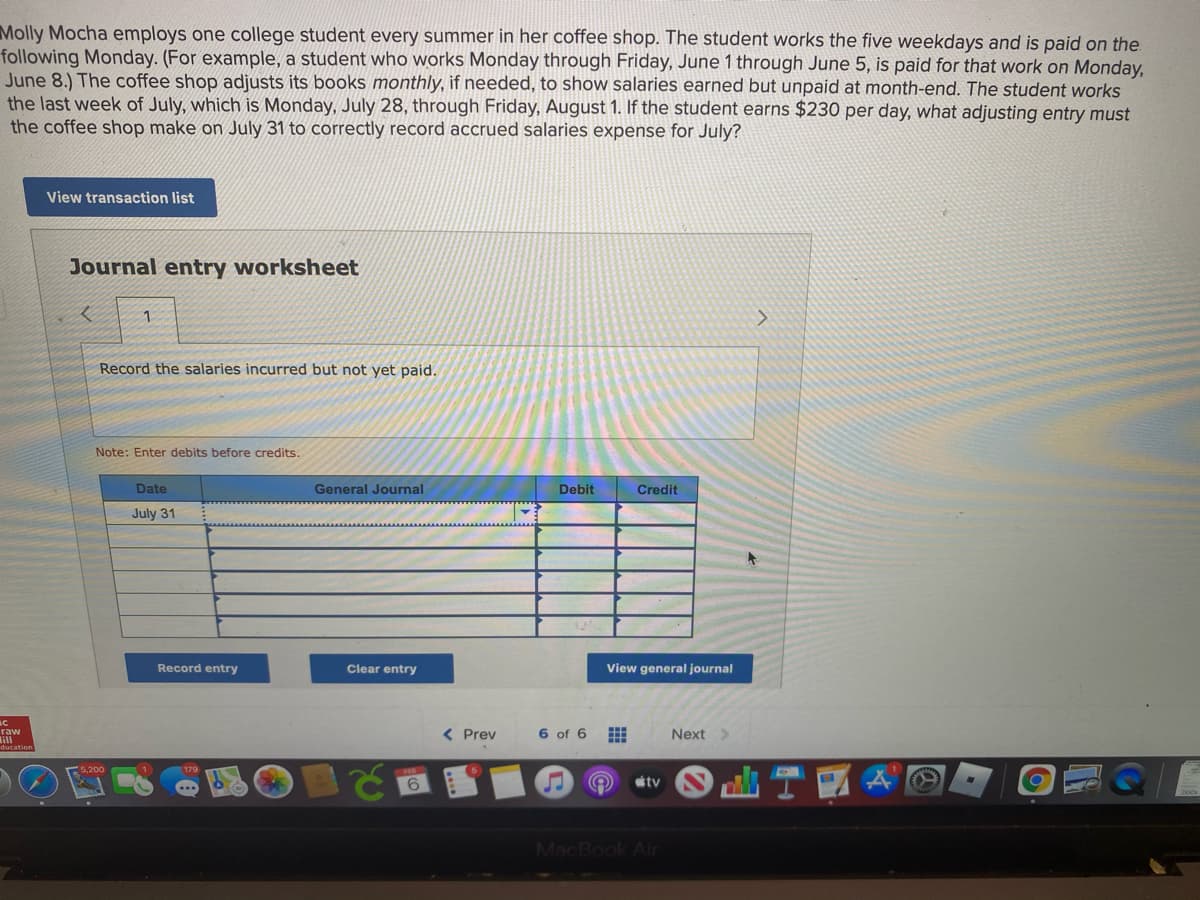

Molly Mocha employs one college student every summer in her coffee shop. The student works the five weekdays and is paid on the following Monday. (For example, a student who works Monday through Friday, June 1 through June 5, is paid for that work on Monday, June 8.) The coffee shop adjusts its books monthly, if needed, to show salaries earned but unpaid at month-end. The student works the last week of July, which is Monday, July 28, through Friday, August 1. If the student earns $230 per day, what adjusting entry must the coffee shop make on July 31 to correctly record accrued salaries expense for July? View transaction list Journal entry worksheet Record the salaries incurred but not yet paid. Note: Enter debits before credits. Date General Journal Debit Credit July 31 Record entry Clear entry View general journal

Molly Mocha employs one college student every summer in her coffee shop. The student works the five weekdays and is paid on the following Monday. (For example, a student who works Monday through Friday, June 1 through June 5, is paid for that work on Monday, June 8.) The coffee shop adjusts its books monthly, if needed, to show salaries earned but unpaid at month-end. The student works the last week of July, which is Monday, July 28, through Friday, August 1. If the student earns $230 per day, what adjusting entry must the coffee shop make on July 31 to correctly record accrued salaries expense for July? View transaction list Journal entry worksheet Record the salaries incurred but not yet paid. Note: Enter debits before credits. Date General Journal Debit Credit July 31 Record entry Clear entry View general journal

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 5PA

Related questions

Question

Transcribed Image Text:Molly Mocha employs one college student every summer in her coffee shop. The student works the five weekdays and is paid on the.

following Monday. (For example, a student who works Monday through Friday, June 1 through June 5, is paid for that work on Monday,

June 8.) The coffee shop adjusts its books monthly, if needed, to show salaries earned but unpaid at month-end. The student works

the last week of July, which is Monday, July 28, through Friday, August 1. If the student earns $230 per day, what adjusting entry must

the coffee shop make on July 31 to correctly record accrued salaries expense for July?

View transaction list

Journal entry worksheet

Record the salaries incurred but not yet paid.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

July 31

Record entry

Clear entry

View general journal

raw

<Prev

6 of 6

Next >

6

tv

MacBook Air

Expert Solution

Step 1 Introduction

Outstanding or Accrued salaries are the expenses that have been occurred and earned by employees but not paid yet.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning