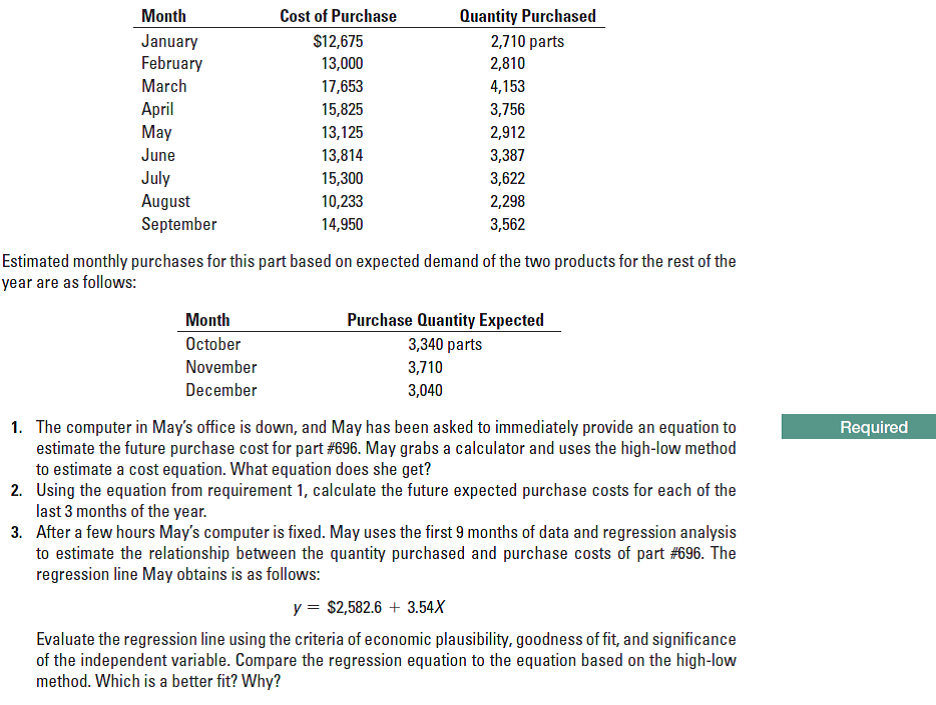

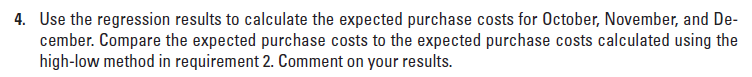

Month Cost of Purchase Quantity Purchased January February $12,675 13,000 2,710 parts 2,810 March 17,653 4,153 April May 15,825 3,756 13,125 2,912 June 13,814 3,387 July August September 15,300 3,622 10,233 2,298 14,950 3,562 Estimated monthly purchases for this part based on expected demand of the two products for the rest of the year are as follows: Purchase Quantity Expected Month October 3,340 parts November 3,710 December 3,040 1. The computer in May's office is down, and May has been asked to immediately provide an equation to estimate the future purchase cost for part #696. May grabs a calculator and uses the high-low method to estimate a cost equation. What equation does she get? 2. Using the equation from requirement 1, calculate the future expected purchase costs for each of the last 3 months of the year. 3. After a few hours May's computer is fixed. May uses the first 9 months of data and regression analysis to estimate the relationship between the quantity purchased and purchase costs of part #696. The regression line May obtains is as follows: Required y = $2,582.6 + 3.54X Evaluate the regression line using the criteria of economic plausibility, goodness of fit, and significance of the independent variable. Compare the regression equation to the equation based on the high-low method. Which is a better fit? Why? 4. Use the regression results to calculate the expected purchase costs for October, November, and De- cember. Compare the expected purchase costs to the expected purchase costs calculated using the high-low method in requirement 2. Comment on your results.

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

High-low, regression. May Blackwell is the new manager of the materials storeroom for Clayton Manufacturing. May has been asked to estimate future monthly purchase costs for part #696, used in two of Clayton’s products. May has purchase cost and quantity data for the past 9 months as follows:

Trending now

This is a popular solution!

Step by step

Solved in 10 steps with 10 images