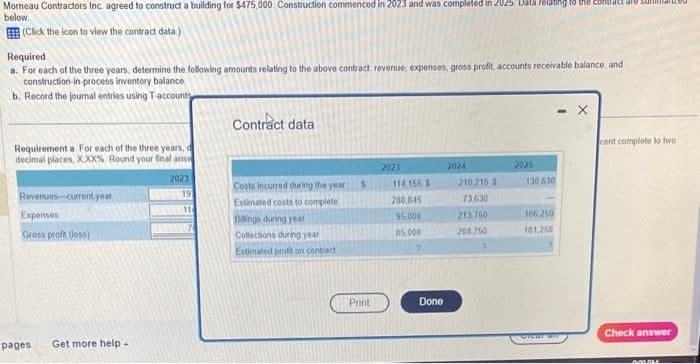

Morneau Contractors Inc. agreed to construct a building for $475,000 Construction commenced in 2023 and was completed in below. (Click the icon to view the contract data) Required a. For each of the three years, determine the following amounts relating to the above contract revenue, expenses, gross profit accounts receivable balance, and construction in process inventory balance b. Record the journal entries using T-accounts Requirement a For each of the three years, d decimal places, XXX% Round your final answ Revenues-current year Expenses Gross profit (loss) 2023 19 Contract data Costs incurred during the year Estimated costs to complete Billings during year Collections during year Estimated profit on contract $ Print 2023 114,155 280.045 95,000 85.000 Done 2024 210 215 73.630 213.750 200.750 2 2025 130.630 156.250 181.250 X cent complete to two

Morneau Contractors Inc. agreed to construct a building for $475,000 Construction commenced in 2023 and was completed in below. (Click the icon to view the contract data) Required a. For each of the three years, determine the following amounts relating to the above contract revenue, expenses, gross profit accounts receivable balance, and construction in process inventory balance b. Record the journal entries using T-accounts Requirement a For each of the three years, d decimal places, XXX% Round your final answ Revenues-current year Expenses Gross profit (loss) 2023 19 Contract data Costs incurred during the year Estimated costs to complete Billings during year Collections during year Estimated profit on contract $ Print 2023 114,155 280.045 95,000 85.000 Done 2024 210 215 73.630 213.750 200.750 2 2025 130.630 156.250 181.250 X cent complete to two

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:Morneau Contractors Inc. agreed to construct a building for $475,000 Construction commenced in 2023 and was completed in 2025 Data Pelating to the

below.

(Click the icon to view the contract data.)

Required

a. For each of the three years, determine the following amounts relating to the above contract revenue, expenses, gross profit, accounts receivable balance, and

construction-in-process inventory balance

b. Record the journal entries using T-accounts

Requirement a For each of the three years, d

decimal places, XXX% Round your final answ

2023

Revenues-current year

Expenses

Gross profit (loss)

pages Get more help -

19

7

Contract data

Costs incurred during the year

Estimated costs to complete

Billings during year

Collections during year

Estimated profit on contract

S

Print

2023

114,155 S

280,045

95,000

85.000

Done

2024

210 215 5

73,630

213,760

208.750

2025

130 630

166 250

181.250

DICHT UM

fact are summarize

X

cent complete to two

Check answer

BOLDLE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT