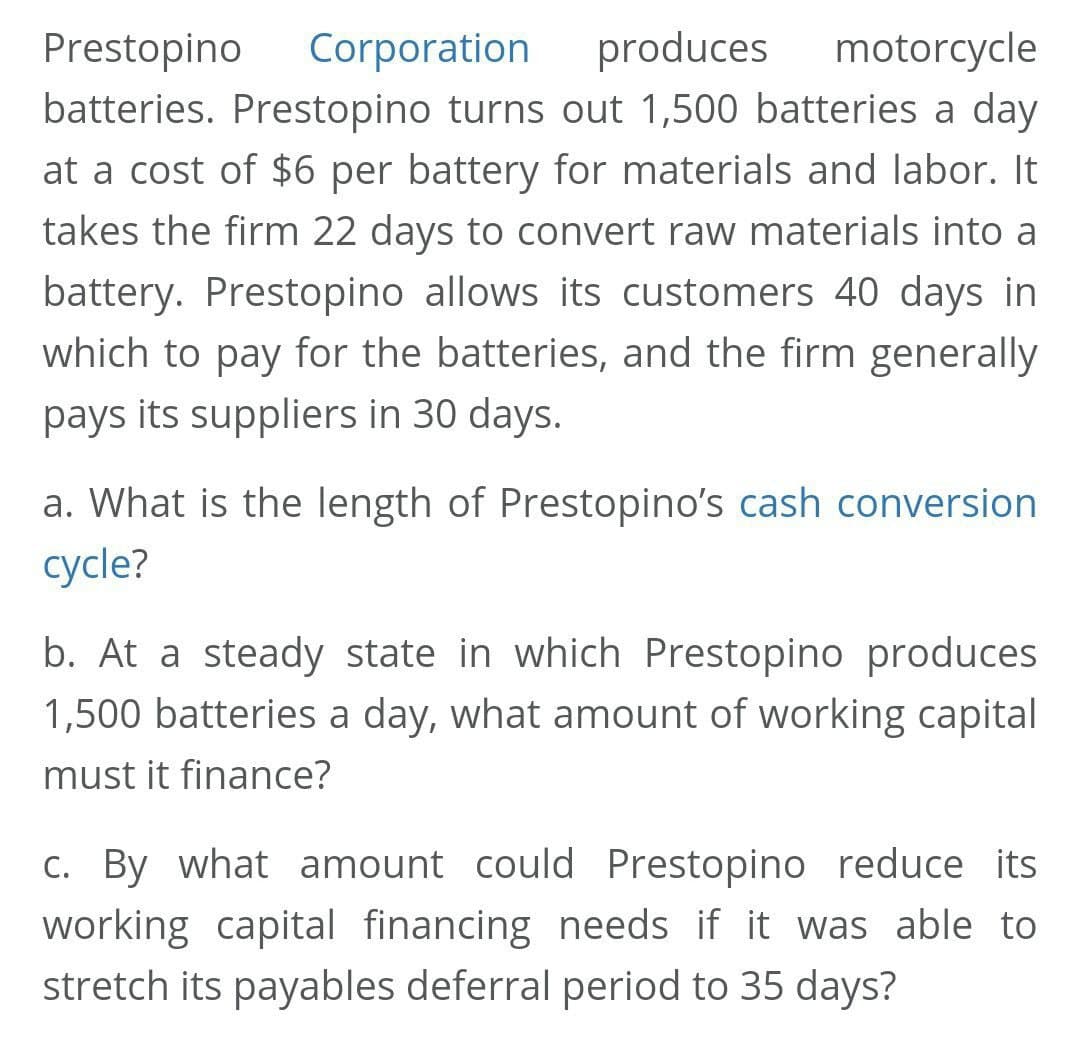

motorcycle Prestopino batteries. Prestopino turns out 1,500 batteries a day Corporation produces at a cost of $6 per battery for materials and labor. It takes the firm 22 days to convert raw materials into a battery. Prestopino allows its customers 40 days in which to pay for the batteries, and the firm generally pays its suppliers in 30 days. a. What is the length of Prestopino's cash conversion cycle? b. At a steady state in which Prestopino produces 1,500 batteries a day, what amount of working capital must it finance? c. By what amount could Prestopino reduce its working capital financing needs if it was able to stretch its payables deferral period to 35 days?

motorcycle Prestopino batteries. Prestopino turns out 1,500 batteries a day Corporation produces at a cost of $6 per battery for materials and labor. It takes the firm 22 days to convert raw materials into a battery. Prestopino allows its customers 40 days in which to pay for the batteries, and the firm generally pays its suppliers in 30 days. a. What is the length of Prestopino's cash conversion cycle? b. At a steady state in which Prestopino produces 1,500 batteries a day, what amount of working capital must it finance? c. By what amount could Prestopino reduce its working capital financing needs if it was able to stretch its payables deferral period to 35 days?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter13: The Balanced Scorecard: Strategic-based Control

Section: Chapter Questions

Problem 8E: Hatch Manufacturing produces multiple machine parts. The theoretical cycle time for one of its...

Related questions

Question

Help

Transcribed Image Text:Prestopino

Corporation

produces

motorcycle

batteries. Prestopino turns out 1,500 batteries a day

at a cost of $6 per battery for materials and labor. It

takes the firm 22 days to convert raw materials into a

battery. Prestopino allows its customers 40 days in

which to pay for the batteries, and the firm generally

pays its suppliers in 30 days.

a. What is the length of Prestopino's cash conversion

cycle?

b. At a steady state in which Prestopino produces

1,500 batteries a day, what amount of working capital

must it finance?

c. By what amount could Prestopino reduce its

working capital financing needs if it was able to

stretch its payables deferral period to 35 days?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub