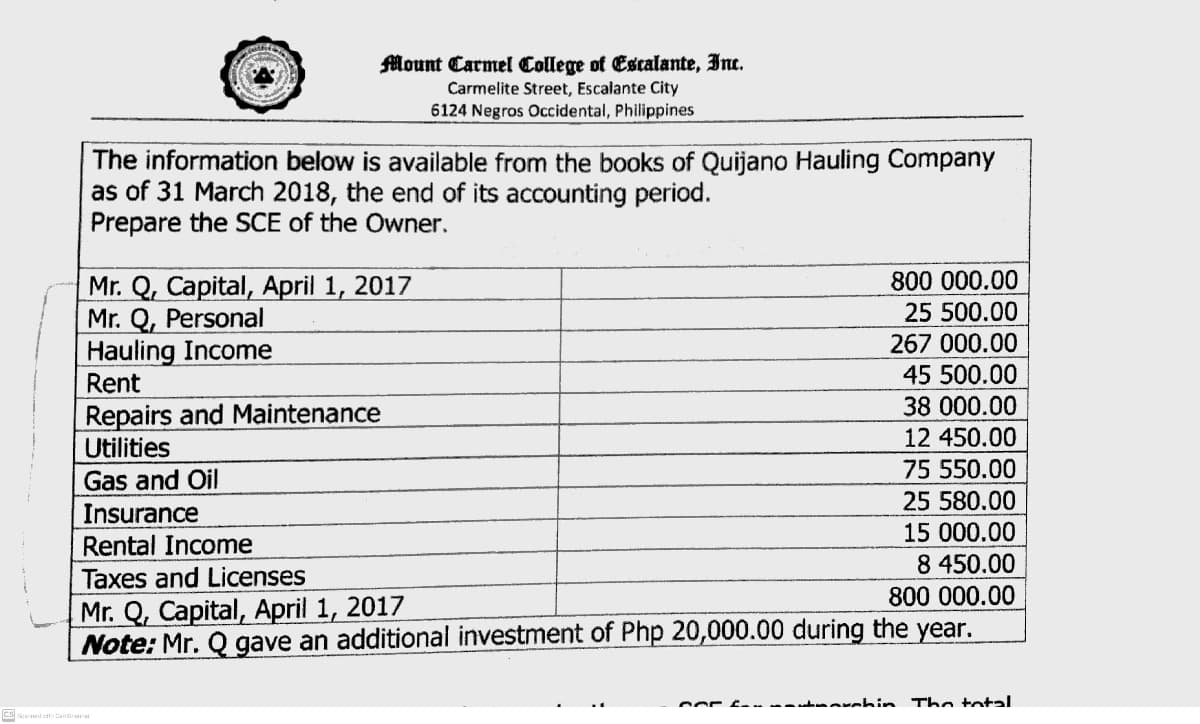

Mount Carmel College of Escalante, Inc. Carmelite Street, Escalante City 6124 Negros Occidental, Philippines The information below is available from the books of Quijano Hauling Company as of 31 March 2018, the end of its accounting period. Prepare the SCE of the Owner. 800 000.00 Mr. Q, Capital, April 1, 2017 Mr. Q, Personal Hauling Income Rent Repairs and Maintenance Utilities Gas and Oil 25 500.00 267 000.00 45 500.00 38 000.00 12 450.00 75 550.00 25 580.00 Insurance 15 000.00 8 450.00 Rental Income Taxes and Licenses Mr. Q, Capital, April 1, 2017 Note: Mr. Q gave an additional investment of Php 20,000.00 during the year. 800 000.00

Mount Carmel College of Escalante, Inc. Carmelite Street, Escalante City 6124 Negros Occidental, Philippines The information below is available from the books of Quijano Hauling Company as of 31 March 2018, the end of its accounting period. Prepare the SCE of the Owner. 800 000.00 Mr. Q, Capital, April 1, 2017 Mr. Q, Personal Hauling Income Rent Repairs and Maintenance Utilities Gas and Oil 25 500.00 267 000.00 45 500.00 38 000.00 12 450.00 75 550.00 25 580.00 Insurance 15 000.00 8 450.00 Rental Income Taxes and Licenses Mr. Q, Capital, April 1, 2017 Note: Mr. Q gave an additional investment of Php 20,000.00 during the year. 800 000.00

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter2: Analyzing Transactions: The Accounting Equation

Section: Chapter Questions

Problem 4SEB: EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first...

Related questions

Question

100%

Prepare the Statement of Changes in Equity for both businesses. Thank you!

Transcribed Image Text:Mount Carmel College of Escalante, Inc.

Carmelite Street, Escalante City

6124 Negros Occidental, Philippines

The information below is available from the books of Quijano Hauling Company

as of 31 March 2018, the end of its accounting period.

Prepare the SCE of the Owner.

800 000.00

Mr. Q, Capital, April 1, 2017

Mr. Q, Personal

Hauling Income

Rent

25 500.00

267 000.00

45 500.00

38 000.00

Repairs and Maintenance

Utilities

12 450.00

75 550.00

Gas and Oil

25 580.00

Insurance

15 000.00

Rental Income

8 450.00

Taxes and Licenses

800 000.00

Mr. Q, Capital, April 1, 2017

Note: Mr. Q gave an additional investment of Php 20,000.00 during the year.

cor f-. -- erahin

The total

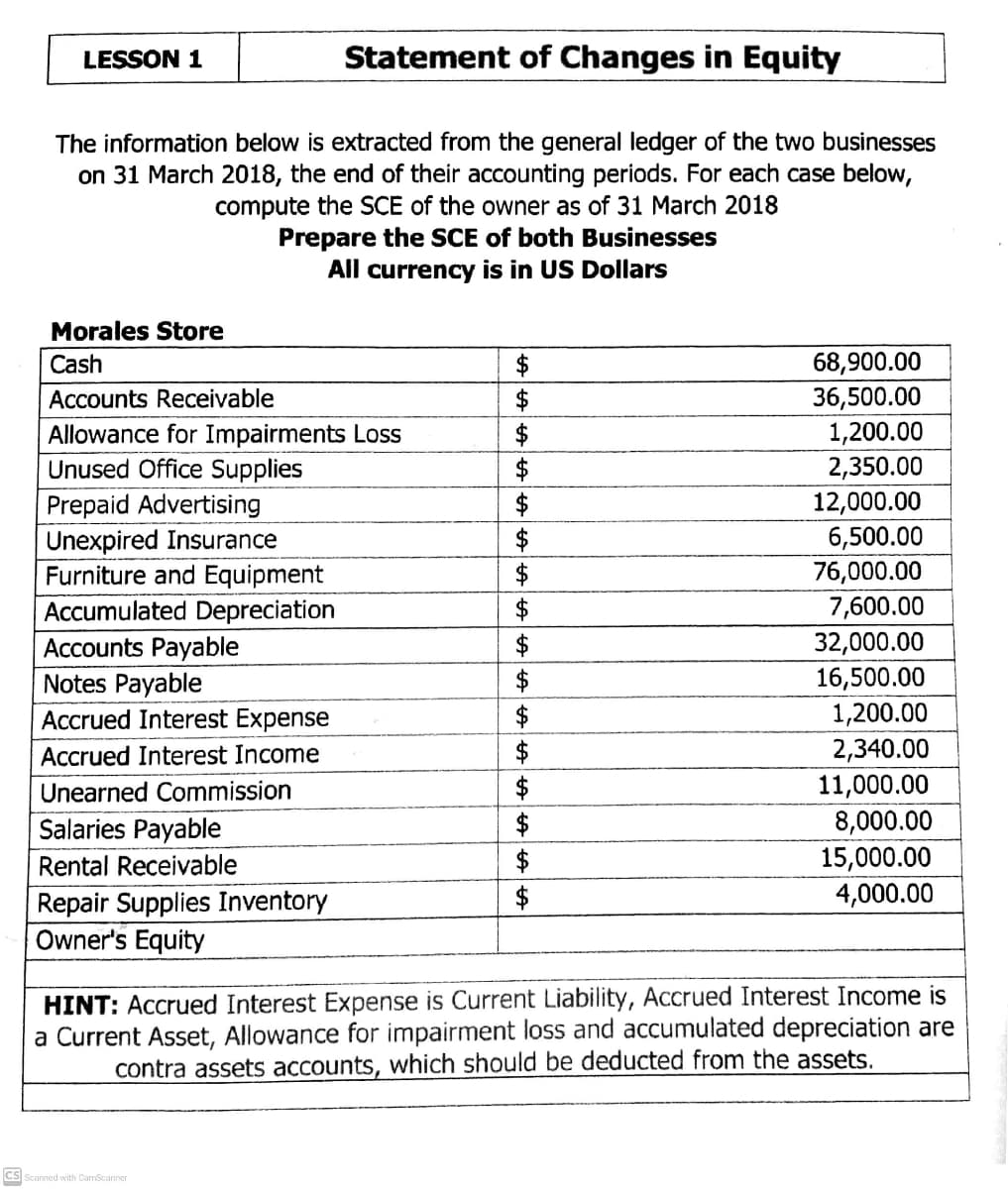

Transcribed Image Text:LESSON 1

Statement of Changes in Equity

The information below is extracted from the general ledger of the two businesses

on 31 March 2018, the end of their accounting periods. For each case below,

compute the SCE of the owner as of 31 March 2018

Prepare the SCE of both Businesses

All currency is in US Dollars

Morales Store

$

$

68,900.00

36,500.00

Cash

Accounts Receivable

Allowance for Impairments Loss

Unused Office Supplies

1,200.00

$

$

$

2,350.00

12,000.00

6,500.00

Prepaid Advertising

Unexpired Insurance

Furniture and Equipment

Accumulated Depreciation

Accounts Payable

Notes Payable

76,000.00

7,600.00

$

$

$

$

$

$

32,000.00

16,500.00

1,200.00

2,340.00

Accrued Interest Expense

Accrued Interest Income

11,000.00

8,000.00

15,000.00

4,000.00

Unearned Commission

Salaries Payable

$

Rental Receivable

$

$

Repair Supplies Inventory

Owner's Equity

HINT: Accrued Interest Expense is Current Liability, Accrued Interest Income is

a Current Asset, Allowance for impairment loss and accumulated depreciation are

contra assets accounts, which should be deducted from the assets.

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning