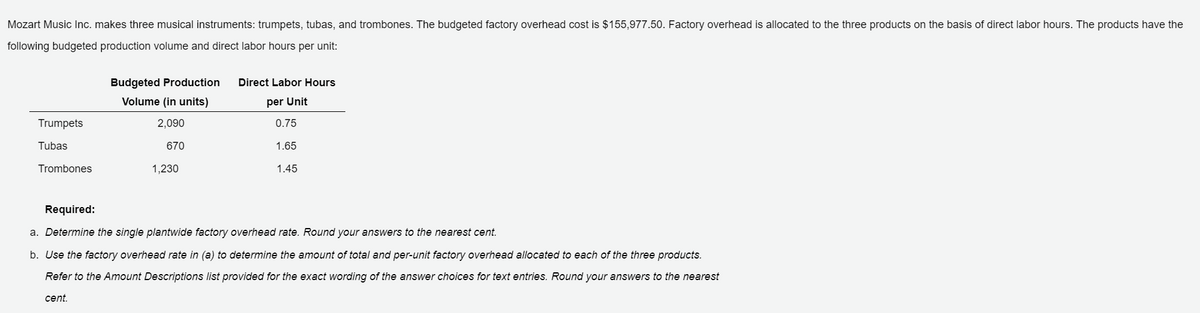

Mozart Music Inc. makes three musical instruments: trumpets, tubas, and trombones. The budgeted factory overhead cost is $155,977.50. Factory overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit: Budgeted Production Direct Labor Hours Volume (in units) per Unit Trumpets 2,090 0.75 Tubas 670 1.65 Trombones 1,230 1.45 Required: a. Determine the single plantwide factory overhead rate. Round your answers to the nearest cent. b. Use the factory overhead rate in (a) to determine the amount of total and per-unit factory overhead allocated to each of the three products. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Round your answers to the nearest cent.

Mozart Music Inc. makes three musical instruments: trumpets, tubas, and trombones. The budgeted factory overhead cost is $155,977.50. Factory overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volume and direct labor hours per unit: Budgeted Production Direct Labor Hours Volume (in units) per Unit Trumpets 2,090 0.75 Tubas 670 1.65 Trombones 1,230 1.45 Required: a. Determine the single plantwide factory overhead rate. Round your answers to the nearest cent. b. Use the factory overhead rate in (a) to determine the amount of total and per-unit factory overhead allocated to each of the three products. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Round your answers to the nearest cent.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 2E: Bach Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted...

Related questions

Question

100%

Mozart Music Inc. makes three musical instruments: trumpets, tubas, and trombones.

| Amount Descriptions | |

| Assembly | |

| Fabrication | |

| Trombones | |

| Trumpets | |

| Tubas | |

| Total |

Transcribed Image Text:Mozart Music Inc. makes three musical instruments: trumpets, tubas, and trombones. The budgeted factory overhead cost is $155,977.50. Factory overhead is allocated to the three products on the basis of direct labor hours. The products have the

following budgeted production volume and direct labor hours per unit:

Budgeted Production

Direct Labor Hours

Volume (in units)

per Unit

Trumpets

2,090

0.75

Tubas

670

1.65

Trombones

1,230

1.45

Required:

a. Determine the single plantwide factory overhead rate. Round your answers to the nearest cent.

b. Use the factory overhead rate in (a) to determine the amount of total and per-unit factory overhead allocated to each of the three products.

Refer to the Amount Descriptions list provided for the exact wording of the

wer

hoices for text entries. Round your answers to the nearest

cent.

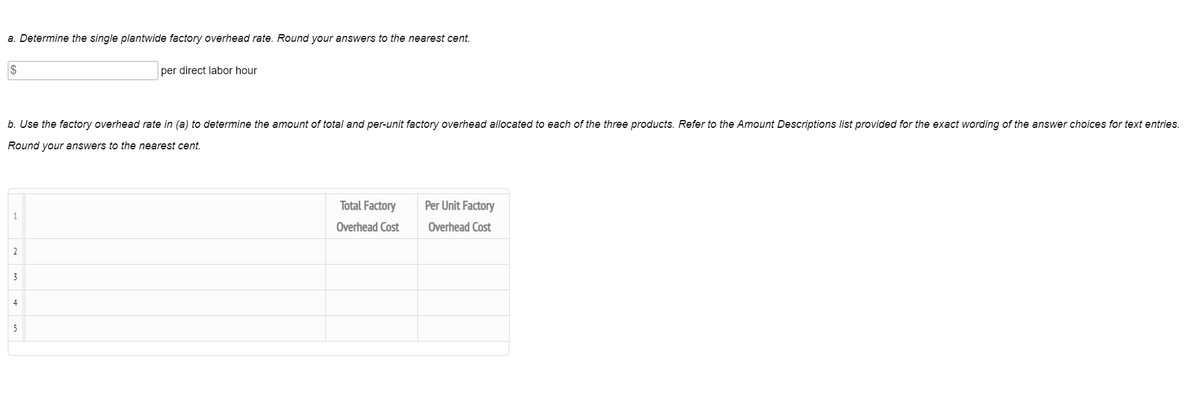

Transcribed Image Text:a. Determine the single plantwide factory overhead rate. Round your answers to the nearest cent.

$

per direct labor hour

b. Use the factory overhead rate in (a) to determine the amount of total and per-unit factory overhead allocated to each of the three products. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.

Round your answers to the nearest cent.

Total Factory

Per Unit Factory

1

Overhead Cost

Overhead Cost

2

3

4

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning