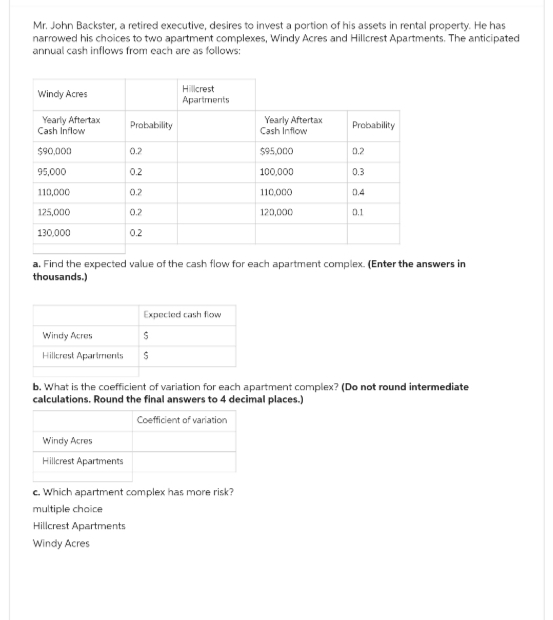

Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has narrowed his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated annual cash inflows from each are as follows: Windy Acres Yearly Aftertax Cash Inflow $90,000 95,000 110,000 125,000 130,000 Probability 0.2 0.2 0.2 0.2 0.2 Windy Acres Hillcrest Apartments Hillcrest Apartments Windy Acres S Hillcrest Apartments S Expected cash flow Yearly Aftertax Cash Inflow $95.000 100,000 110,000 120,000 a. Find the expected value of the cash flow for each apartment complex. (Enter the answers in thousands.) Probability c. Which apartment complex has more risk? multiple choice Hillcrest Apartments Windy Acres 0.2 0.3 04 0.1 b. What is the coefficient of variation for each apartment complex? (Do not round intermediate calculations. Round the final answers to 4 decimal places.) Coefficient of variation

Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has narrowed his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated annual cash inflows from each are as follows: Windy Acres Yearly Aftertax Cash Inflow $90,000 95,000 110,000 125,000 130,000 Probability 0.2 0.2 0.2 0.2 0.2 Windy Acres Hillcrest Apartments Hillcrest Apartments Windy Acres S Hillcrest Apartments S Expected cash flow Yearly Aftertax Cash Inflow $95.000 100,000 110,000 120,000 a. Find the expected value of the cash flow for each apartment complex. (Enter the answers in thousands.) Probability c. Which apartment complex has more risk? multiple choice Hillcrest Apartments Windy Acres 0.2 0.3 04 0.1 b. What is the coefficient of variation for each apartment complex? (Do not round intermediate calculations. Round the final answers to 4 decimal places.) Coefficient of variation

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 7E

Related questions

Question

Please Fast answer With Explanation And Do Not Give Solution In Image format

Transcribed Image Text:Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has

narrowed his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated

annual cash inflows from each are as follows:

Windy Acres

Yearly Aftertax

Cash Inflow

$90,000

95,000

110,000

125,000

130,000

Windy Acres

Hillcrest Apartments

Probability

0.2

0.2

0.2

0.2

0.2

Windy Acres

Hillcrest Apartments

Hillcrest

Apartments

Expected cash flow

S

$

a. Find the expected value of the cash flow for each apartment complex. (Enter the answers in

thousands.)

Yearly Aftertax

Cash Inflow

$95,000

100,000

110,000

120,000

Probability

c. Which apartment complex has more risk?

multiple choice

Hillcrest Apartments

Windy Acres

0.2

0.3

0.1

b. What is the coefficient of variation for each apartment complex? (Do not round intermediate

calculations. Round the final answers to 4 decimal places.)

Coefficient of variation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning