Mrs Jones took out a mortgage of £450,000 on 1st April 2007. According to the initial contrac he mortgage was to be cleared fully by a level annuity payable quarterly in arrears for 1 ears. The repayments were calculated on the basis of a nominal rate of interest of 6% per annu onvertible quarterly. (i) Showing your full workout, calculate the amount of the quarterly repayments. (ii) Calculate the amount of capital which was repaid in the first instalment on 1st July 2007. C:\

Mrs Jones took out a mortgage of £450,000 on 1st April 2007. According to the initial contrac he mortgage was to be cleared fully by a level annuity payable quarterly in arrears for 1 ears. The repayments were calculated on the basis of a nominal rate of interest of 6% per annu onvertible quarterly. (i) Showing your full workout, calculate the amount of the quarterly repayments. (ii) Calculate the amount of capital which was repaid in the first instalment on 1st July 2007. C:\

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

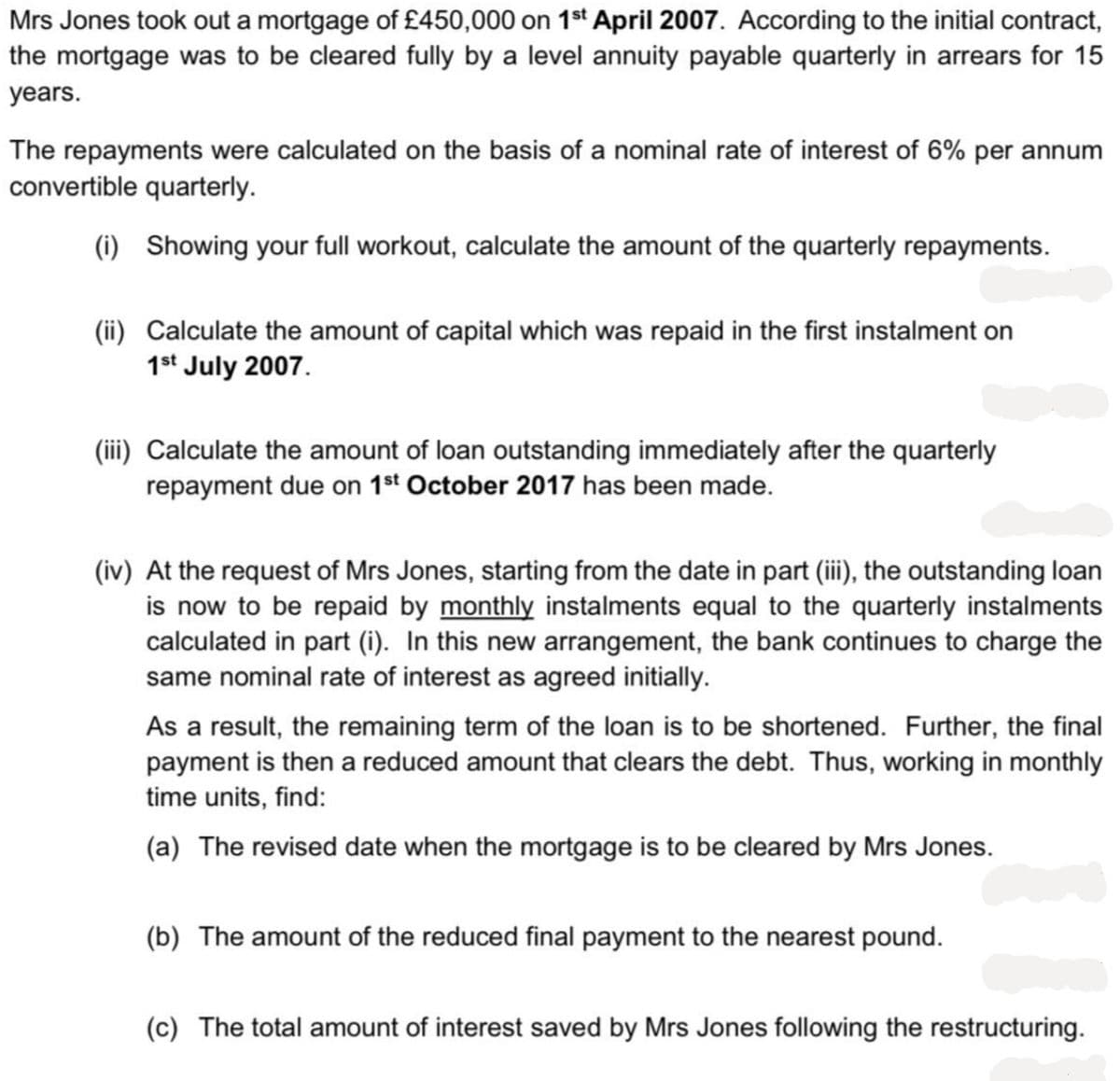

Transcribed Image Text:Mrs Jones took out a mortgage of £450,000 on 1st April 2007. According to the initial contract,

the mortgage was to be cleared fully by a level annuity payable quarterly in arrears for 15

years.

The repayments were calculated on the basis of a nominal rate of interest of 6% per annum

convertible quarterly.

(i) Showing your full workout, calculate the amount of the quarterly repayments.

(ii) Calculate the amount of capital which was repaid in the first instalment on

1st July 2007.

(iii) Calculate the amount of loan outstanding immediately after the quarterly

repayment due on 1st October 2017 has been made.

(iv) At the request of Mrs Jones, starting from the date in part (iii), the outstanding loan

is now to be repaid by monthly instalments equal to the quarterly instalments

calculated in part (i). In this new arrangement, the bank continues to charge the

same nominal rate of interest as agreed initially.

As a result, the remaining term of the loan is to be shortened. Further, the final

payment is then a reduced amount that clears the debt. Thus, working in monthly

time units, find:

(a) The revised date when the mortgage is to be cleared by Mrs Jones.

(b) The amount of the reduced final payment to the nearest pound.

(c) The total amount of interest saved by Mrs Jones following the restructuring.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT