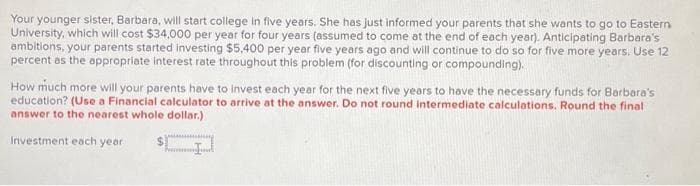

Your younger sister, Barbara, will start college in five years. She has just informed your parents that she wants to go to Eastern University, which will cost $34,000 per year for four years (assumed to come at the end of each year). Anticipating Barbara's ambitions, your parents started investing $5,400 per year five years ago and will continue to do so for five more years. Use 12 percent as the appropriate interest rate throughout this problem (for discounting or compounding). How much more will your parents have to invest each year for the next five years to have the necessary funds for Barbara's education? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Investment each year

Your younger sister, Barbara, will start college in five years. She has just informed your parents that she wants to go to Eastern University, which will cost $34,000 per year for four years (assumed to come at the end of each year). Anticipating Barbara's ambitions, your parents started investing $5,400 per year five years ago and will continue to do so for five more years. Use 12 percent as the appropriate interest rate throughout this problem (for discounting or compounding). How much more will your parents have to invest each year for the next five years to have the necessary funds for Barbara's education? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Investment each year

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Vd

Subject: acounting

Transcribed Image Text:Your younger sister, Barbara, will start college in five years. She has just informed your parents that she wants to go to Eastern

University, which will cost $34,000 per year for four years (assumed to come at the end of each year). Anticipating Barbara's

ambitions, your parents started investing $5,400 per year five years ago and will continue to do so for five more years. Use 12

percent as the appropriate interest rate throughout this problem (for discounting or compounding).

How much more will your parents have to invest each year for the next five years to have the necessary funds for Barbara's

education? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final

answer to the nearest whole dollar.)

gy

Investment each year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning