Multiple Choice Job cost sheets contain entries for actual direct material, actual direct labor, and actual manufacturing overhead cost incurred in completing a job. Using multiple predetermined overhead rates rather than a single predetermined plant-wide overhead rate improves the job cost accurancy. When estimated activity used for overheod application is less than the level of activity at capacity, the use of capacity-based overhead rate decreases net operating income due to the cost of idle capacity. If a job is not completed at the end of the period, then no manufacturing overhead cost would be applied to that job when a predetermined overhead rate is used. Using a plantwide overhead rate based on direct labor-hours will ensure that direct labor costs are correctly traced to Jobs,

Multiple Choice Job cost sheets contain entries for actual direct material, actual direct labor, and actual manufacturing overhead cost incurred in completing a job. Using multiple predetermined overhead rates rather than a single predetermined plant-wide overhead rate improves the job cost accurancy. When estimated activity used for overheod application is less than the level of activity at capacity, the use of capacity-based overhead rate decreases net operating income due to the cost of idle capacity. If a job is not completed at the end of the period, then no manufacturing overhead cost would be applied to that job when a predetermined overhead rate is used. Using a plantwide overhead rate based on direct labor-hours will ensure that direct labor costs are correctly traced to Jobs,

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 3MCQ: In a normal costing system, the cost of a job includes a. actual direct materials, actual direct...

Related questions

Question

1.

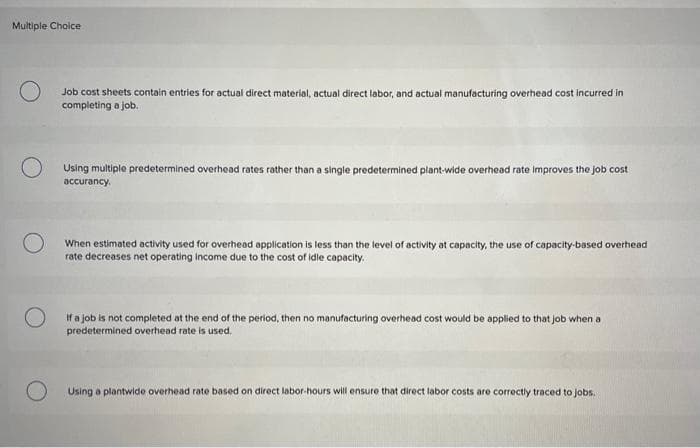

(First image ) Which is correct?

Transcribed Image Text:Multiple Cholce

Job cost sheets contain entries for actual direct material, actual direct labor, and actual manufacturing overhead cost incurred in

completing a job.

Using multiple predetermined overhead rates rather than a single predetermined plant-wide overhead rate Improves the job cost

accurancy.

When estimated activity used for overhead application is less than the level of activity at capacity, the use of capacity-based overhead

rate decreases net operating income due to the cost of idle capacity.

If a job is not completed at the end of the period, then no manufacturing overhead cost would be applied to that job when a

predetermined overhead rate is used.

Using a plantwide overhead rate based on direct labor-hours will ensure that direct labor costs are correctly traced to jobs.

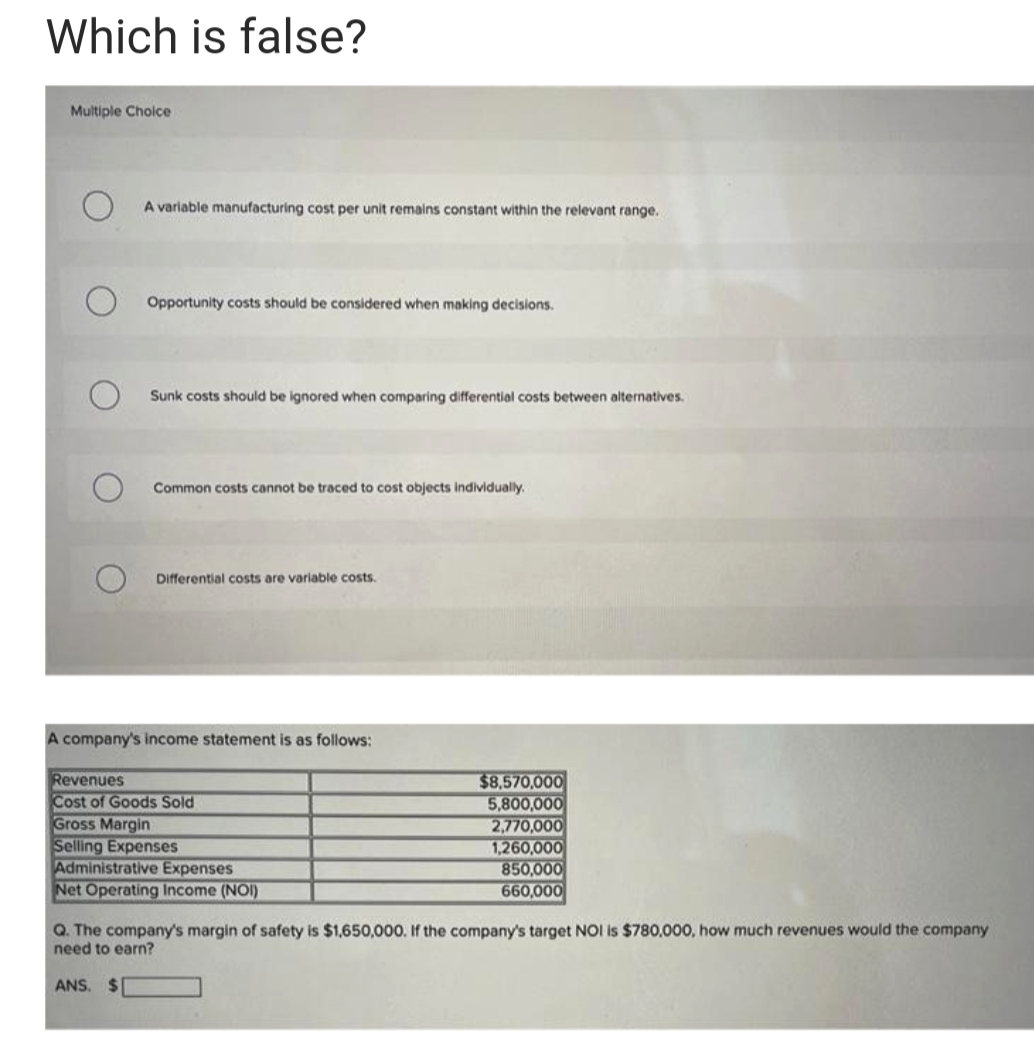

Transcribed Image Text:Which is false?

Multiple Cholce

A variable manufacturing cost per unit remains constant within the relevant range.

Opportunity costs should be considered when making decisions.

Sunk costs should be ignored when comparing differential costs between alternatives.

Common costs cannot be traced to cost objects individually.

Differential costs are variable costs.

A company's income statement is as follows:

Revenues

Cost of Goods Sold

Gross Margin

Selling Expenses

Administrative Expenses

Net Operating Income (NOI)

$8,570,000

5,800,000

2,770,000

1,260,000

850,000

660,000

Q. The company's margin of safety is $1,650,000. If the company's target NOI is $780,000, how much revenues would the company

need to earn?

ANS. $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning