Concept explainers

Activity-based department rate product costing and product cost distortions

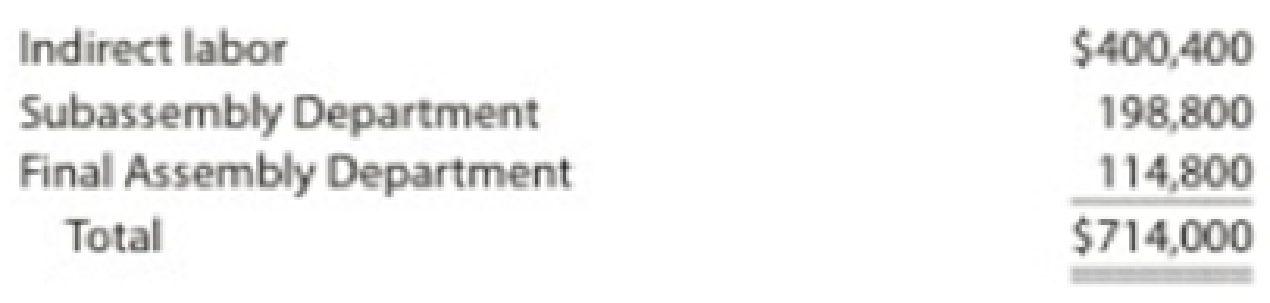

Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory

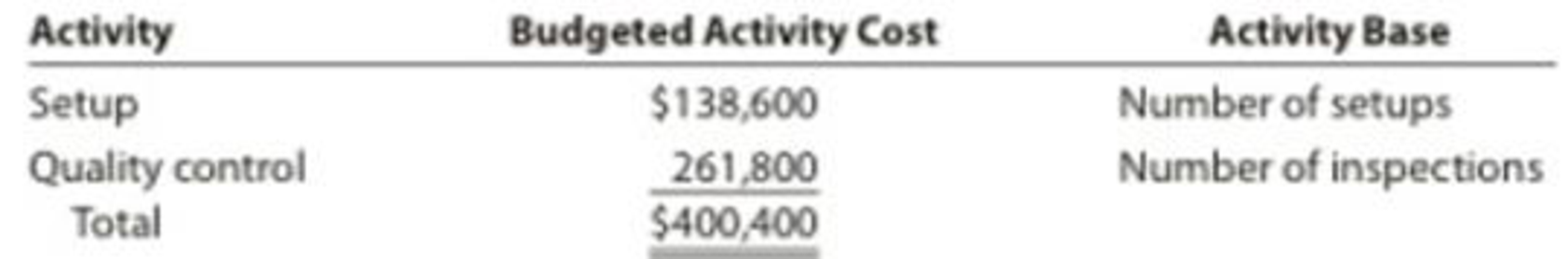

The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows:

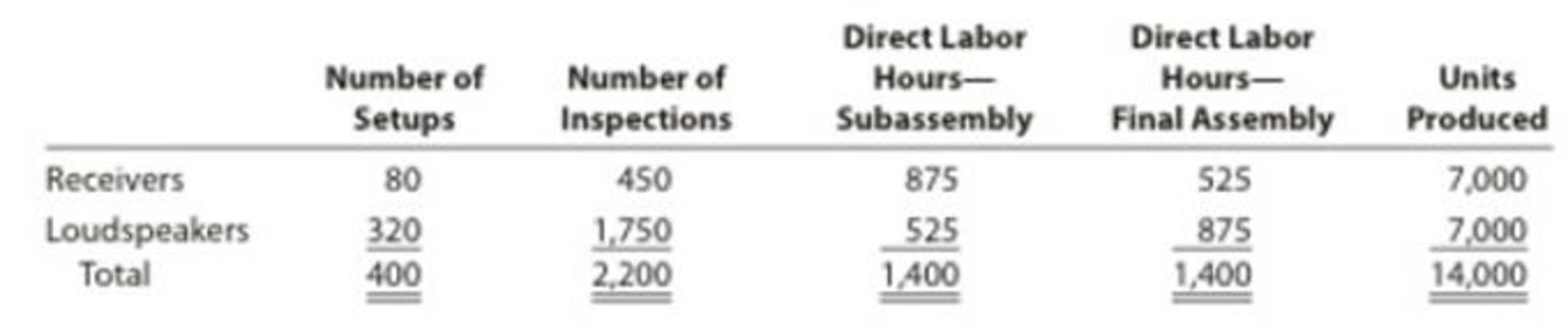

The activity-base usage quantities and units produced for the two products follow:

Instructions

Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $420,000 and $294,000 for the Subassembly and Final Assembly departments, respectively.

Determine the total and per-unit

Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments.

Determine the total and per-unit cost assigned to each product under activity-based costing.

Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods. production department factory overhead rate and activity-based costing methods.

1.

Compute the multiple production department overhead rates for both departments.

Explanation of Solution

Multiple production department factory overhead rates: This allocation method identifies different departments in the process of production. The factory overheads are allocated to products based on the overhead rate for each of the production departments.

Formula to compute multiple production department overhead rates:

Activity-based costing (ABC) method: The costing method which allocates overheads to the products based on factory overhead rate for each activity or cost object, according to the cost pooled for the cost drivers (allocation base).

Formula to compute activity-based overhead rate:

Compute multiple production department overhead rates for subassembly department.

Compute multiple production department overhead rates for final assembly department.

2.

Compute the factory overhead allocated to total and per unit of each product

Explanation of Solution

Compute total factory overhead and per unit overhead allocated for receivers.

| Production Department | Multiple Production Department Overhead Rate | × | Total Number of Budgeted DLH | = | Factory Overhead |

| Subassembly | $300 per DLH | × | 875 DLH | = | $262,500 |

| Final assembly | $210 per DLH | × | 525 DLH | = | 110,250 |

| Total factory overhead costs allocated for receivers | $372,750 | ||||

| Number of units of receivers | ÷ 7,000 units | ||||

| Factory overhead cost per unit of receivers | $53.25 | ||||

Table (1)

Note: Refer to part (A) for value and computation of multiple production department overhead rate.

Compute total factory overhead and per unit overhead allocated for loudspeakers.

| Production Department | Multiple Production Department Overhead Rate | × | Total Number of Budgeted DLH | = | Factory Overhead |

| Subassembly | $300 per DLH | × | 525 DLH | = | $157,500 |

| Final assembly | $210 per DLH | × | 875 DLH | = | 183,750 |

| Total factory overhead costs allocated for loudspeakers | $341,250 | ||||

| Number of units of loudspeakers | ÷ 7,000 units | ||||

| Factory overhead cost per unit of loudspeakers | $48.75 | ||||

Table (2)

Note: Refer to part (A) for value and computation of multiple production department overhead rate.

3.

Compute the activity-based overhead rate for each of the given activities

Explanation of Solution

Compute activity-based overhead rates.

| Computation of Activity-Based Overhead Rates | |||||

| Activity | Activity Cost | ÷ | Total Activity-Base Usage | = | Activity-Based Overhead Rates |

| Setup | $138,600 | ÷ | 400 setups | = | $346.50 per setup |

| Quality control | 261,800 | ÷ | 2,200 inspections | = | $119 per inspection |

| Subassembly | 198,800 | ÷ | 1,400 DLH | = | $142 per DLH |

| Final assembly | 114,800 | ÷ | 1,400 DLH | = | $82 per DLH |

Table (3)

4.

Compute the activity-cost per unit of the products

Explanation of Solution

Compute activity cost allocated per unit of receivers.

| Activity | Activity-Based Overhead Rates | × | Actual Use of Activity-Base (Cost Driver) | = | Activity Cost Allocated |

| Setup | $346.50 per setup | × | 80 setups | = | $27,720 |

| Quality control | $119 per inspection | × | 450 inspections | = | 53,550 |

| Subassembly | $142 per DLH | × | 875 DLH | = | 124,250 |

| Final assembly | $82 per DLH | × | 525 DLH | = | 43,050 |

| Total activity costs allocated to receivers | $248,570 | ||||

| Number of units of receivers | ÷ 7,000 units | ||||

| Activity-based overhead cost per unit of receivers | $35.51 | ||||

Table (4)

Note: Refer to Table (3) for the value and computation of activity allocation rates.

Compute activity cost allocated per unit of loudspeakers.

| Activity | Activity-Based Overhead Rates | × | Actual Use of Activity-Base (Cost Driver) | = | Activity Cost Allocated |

| Setup | $346.50 per setup | × | 320 setups | = | $110,880 |

| Quality control | $119 per inspection | × | 1,750 inspections | = | 208,250 |

| Subassembly | $142 per DLH | × | 525 DLH | = | 74,550 |

| Final assembly | $82 per DLH | × | 875 DLH | = | 71,750 |

| Total activity costs allocated to loudspeakers | $465,430 | ||||

| Number of units of loudspeakers | ÷ 7,000 units | ||||

| Activity-based overhead cost per unit of loudspeakers | $66.49 | ||||

Table (5)

Note: Refer to Table (3) for the value and computation of activity allocation rates.

5.

Discuss the product cost distortion due to multiple production department overhead rate.

Explanation of Solution

The product cost under multiple production department overhead rate approach and ABC approach are different. The product cost is distorted in multiple production department overhead rate approach. Although the time spent for subassembly and final assembly departments for loudspeakers and receivers is in the same ratio, but the setup department and quality control department are not accounted for in multiple department overhead rate method.

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting

- Multiple production department factory overhead rates The management of Spotted Cow Dairy Company, described in Problem 1B, now plans to use the multiple production department factory overhead rate method. The total factory overhead associated with each department is as follows: Instructions Determine the multiple production department factory overhead rates, using machine hours for the Blending Department and direct labor hours for the Packing Department. Determine the product factory overhead costs, using the multiple production department rates in (1).arrow_forwardA CPA would recommend changing from plantwide overhead rate application to departmental rates under which of the following circumstances? a. The plant produces one product. b. The plant produces multiple products that may or may not pass through all producing departments. c. The plant produces multiple products that pass through all of the producing departments. d. The plant produces many different products that consume the same amount of resources in each producing department.arrow_forwardActivity cost pools, activity rates, and product costs using activity-based costing Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: The estimated activity-base usage and unit information for two product lines was determined as follows: A. Determine the activity rate for each activity cost pool. B. Determine the activity-based cost per unit of each product.arrow_forward

- Activity-based product costing Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 0.5 machine hour per unit. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forwardThe management of Gwinnett County Chrome Company, described in Problem 1A, now plans to use the multiple production department factory overhead rate method. The total factory overhead associated with each department is as follows: Instructions 1. Determine the multiple production department factory overhead rates, using direct labor hours for the Stamping Department and machine hours for the Plating Department. 2. Determine the product factory overhead costs, using the multiple production department rates in (1).arrow_forwardUnder what two conditions would the multiple production department factory overhead rate method provide more accurate product costs than the single plantwide factory overhead rate method?arrow_forward

- Use the following information for Brief Exercises 4-27 and 4-28: Quillen Company manufactures a product in a factory that has two producing departments, Cutting and Sewing, and two support departments, S1 and S2. The activity driver for S1 is number of employees, and the activity driver for S2 is number of maintenance hours. The following data pertain to Quillen: Brief Exercises 4-27 (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Refer to the information for Quillen Company above. Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratiosone for Cutting and the other for Sewing.) 2. Allocate the support department costs to the producing departments by using the direct method.arrow_forwardUse the following information for Brief Exercises 4-34 and 4-35: Sanjay Company manufactures a product in a factory that has two producing departments, Assembly and Painting, and two support departments, S1 and S2. The activity driver for S1 is square footage, and the activity driver for S2 is number of machine hours. The following data pertain to Sanjay: Brief Exercises 4-34 (Appendix 4B) Assigning Support Department Costs by Using the Direct Method Refer to the information for Sanjay Company above. Required: 1. Calculate the cost assignment ratios to be used under the direct method for Departments S1 and S2. (Note: Each support department will have two ratiosone for Assembly and the other for Painting.) 2. Allocate the support department costs to the producing departments by using the direct method.arrow_forwardPrimera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forward

- Activity-based costing and product cost distortion The management of Four Finger Appliance Company in Exercise 14 has asked you to use activity-based costing instead of direct labor hours to allocate factory overhead costs to the two products. You have determined that 81,000 of factory overhead from each of the production departments can be associated with setup activity (162,000 in total). Company records indicate that blenders required 135 setups, while the toaster ovens required only 45 setups. Each product has a production volume of 7,500 units. Determine the three activity rates (assembly, test and pack, and setup). Determine the total factory overhead and factory overhead per unit allocated to each product using the activity rates in (A).arrow_forwardReducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity. Other overhead activities, their costs, and drivers are listed below. Other production information concerning the two hydraulic cylinders is also provided: Required: 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost. 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios. 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification. 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning