My friend, Ahmad, is trying to determine which of two opportunities he should invest in (only one of them). His options are Bitcoin and S&P 500. If he invests in Bitcoin, he believes that he has a 10% chance of making 15% profit, a 25% chance of only 8% profit, 15% of losing 10% c his investment capital (-10%), and a 50% chance of no change in his investment capital (0%). If Ahmad invests in S&P500, he has a 70% chance for the 8% profit, a 25% chance for no change (0%), 3% chance for losing -10%, and 2 for a 15% profit. Ahmad is indifferent between the following lotteries. L₁ 0% and L₂ also indifferent between 15% -10%

My friend, Ahmad, is trying to determine which of two opportunities he should invest in (only one of them). His options are Bitcoin and S&P 500. If he invests in Bitcoin, he believes that he has a 10% chance of making 15% profit, a 25% chance of only 8% profit, 15% of losing 10% c his investment capital (-10%), and a 50% chance of no change in his investment capital (0%). If Ahmad invests in S&P500, he has a 70% chance for the 8% profit, a 25% chance for no change (0%), 3% chance for losing -10%, and 2 for a 15% profit. Ahmad is indifferent between the following lotteries. L₁ 0% and L₂ also indifferent between 15% -10%

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 3FPE

Related questions

Question

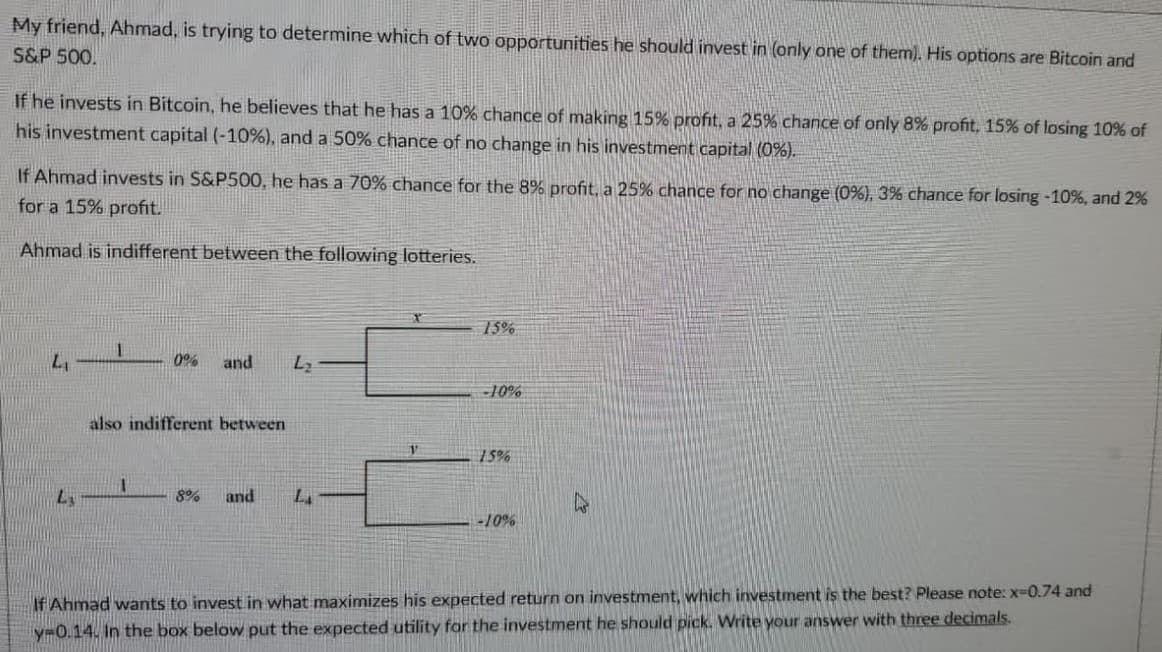

Transcribed Image Text:My friend, Ahmad, is trying to determine which of two opportunities he should invest in (only one of them). His options are Bitcoin and

S&P 500.

If he invests in Bitcoin, he believes that he has a 10% chance of making 15% profit, a 25% chance of only 8% profit, 15% of losing 10% of

his investment capital (-10%), and a 50% chance of no change in his investment capital (0%).

If Ahmad invests in S&P500, he has a 70% chance for the 8% profit, a 25% chance for no change (0%), 3% chance for losing -10%, and 2%

for a 15% profit.

Ahmad is indifferent between the following lotteries.

L₁

Ly

0% and L₂

also indifferent between

8% and LA

V

15%

-10%

15%

-10%

If Ahmad wants to invest in what maximizes his expected return on investment, which investment is the best? Please note: x-0.74 and

y-0.14. In the box below put the expected utility for the investment he should pick. Write your answer with three decimals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning