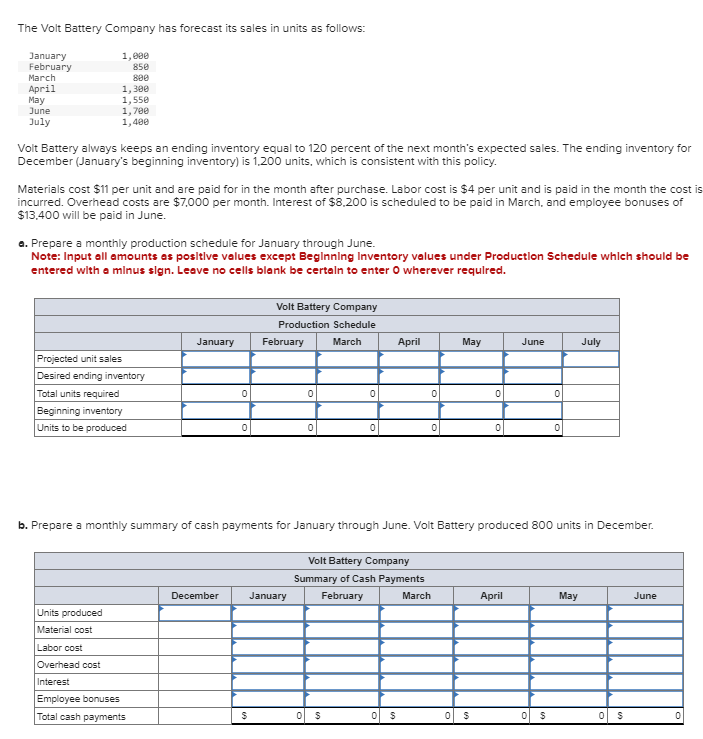

The Volt Battery Company has forecast its sales in units as follows: January February March April May June July 1,000 850 888 1,300 1,550 1,700 1,480 Volt Battery always keeps an ending inventory equal to 120 percent of the next month's expected sales. The ending inventory for December (January's beginning inventory) is 1,200 units, which is consistent with this policy. Materials cost $11 per unit and are paid for in the month after purchase. Labor cost is $4 per unit and is paid in the month the cost incurred. Overhead costs are $7,000 per month. Interest of $8,200 is scheduled to be paid in March, and employee bonuses of $13,400 will be paid in June. a. Prepare a monthly production schedule for January through June. Note: Input all amounts as positive values except Beginning Inventory values under Production Schedule which should be entered with a minus sign. Leave no cells blank be certain to enter O wherever required. Projected unit sales Desired ending inventory Total units required Beginning inventory Units to be produced January Units produced Material cost Labor cost Overhead cost Interest Employee bonuses Total cash payments 0 December 0 Volt Battery Company Production Schedule March February S January 0 0 0 S April Volt Battery Company Summary of Cash Payments February March 0 S 0 0 b. Prepare a monthly summary of cash payments for January through June. Volt Battery produced 800 units in December. May 0 0 S June April 0 0 S 0 July May S June

The Volt Battery Company has forecast its sales in units as follows: January February March April May June July 1,000 850 888 1,300 1,550 1,700 1,480 Volt Battery always keeps an ending inventory equal to 120 percent of the next month's expected sales. The ending inventory for December (January's beginning inventory) is 1,200 units, which is consistent with this policy. Materials cost $11 per unit and are paid for in the month after purchase. Labor cost is $4 per unit and is paid in the month the cost incurred. Overhead costs are $7,000 per month. Interest of $8,200 is scheduled to be paid in March, and employee bonuses of $13,400 will be paid in June. a. Prepare a monthly production schedule for January through June. Note: Input all amounts as positive values except Beginning Inventory values under Production Schedule which should be entered with a minus sign. Leave no cells blank be certain to enter O wherever required. Projected unit sales Desired ending inventory Total units required Beginning inventory Units to be produced January Units produced Material cost Labor cost Overhead cost Interest Employee bonuses Total cash payments 0 December 0 Volt Battery Company Production Schedule March February S January 0 0 0 S April Volt Battery Company Summary of Cash Payments February March 0 S 0 0 b. Prepare a monthly summary of cash payments for January through June. Volt Battery produced 800 units in December. May 0 0 S June April 0 0 S 0 July May S June

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter22: Master Budget (master)

Section: Chapter Questions

Problem 1R: Ranger Industries has provided the following information at June 30: Other information: Average...

Related questions

Question

Transcribed Image Text:The Volt Battery Company has forecast its sales in units as follows:

January

February

March

April

May

June

July

1,000

850

800

1,300

1,550

1,700

1,400

Volt Battery always keeps an ending inventory equal to 120 percent of the next month's expected sales. The ending inventory for

December (January's beginning inventory) is 1,200 units, which is consistent with this policy.

Materials cost $11 per unit and are paid for in the month after purchase. Labor cost is $4 per unit and is paid in the month the cost is

incurred. Overhead costs are $7,000 per month. Interest of $8,200 is scheduled to be paid in March, and employee bonuses of

$13,400 will be paid in June.

a. Prepare a monthly production schedule for January through June.

Note: Input all amounts as positive values except Beginning Inventory values under Production Schedule which should be

entered with a minus sign. Leave no cells blank be certain to enter O wherever required.

Projected unit sales

Desired ending inventory

Total units required

Beginning inventory

Units to be produced

January

Units produced

Material cost

Labor cost

Overhead cost

Interest

Employee bonuses

Total cash payments

0

December

0

Volt Battery Company

Production Schedule

March

$

February

0

January

0

0

0

0 $

April

Volt Battery Company

Summary of Cash Payments

February

March

$

0

0

May

b. Prepare a monthly summary of cash payments for January through June. Volt Battery produced 800 units in December.

0

0 $

0

June

April

0

$

0

July

May

0

S

June

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

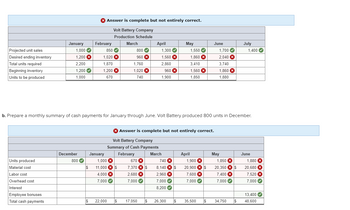

It said these were wrong.

Transcribed Image Text:Projected unit sales

Desired ending inventory

Total units required

Beginning inventory

Units to be produced

January

Units produced

Material cost

Labor cost

Overhead cost

Interest

Employee bonuses

Total cash payments

1,000✔

1,200 x

2,200

1,200✔

1,000

December

800✔

$

> Answer is complete but not entirely correct.

Volt Battery Company

Production Schedule

$

February

850✔

1,020 X

1,870

1,200 X

670

January

1,000 X

11,000 $

4,000 X

7,000 ✓

22,000

March

800✔

960 x

1,760

1,020 X

740

$

670 X

7,370 × $

2,680 X

7,000 ✓

April

b. Prepare a monthly summary of cash payments for January through June. Volt Battery produced 800 units in December.

17,050

1,300✔

$

1,560 x

2,860

960 x

1,900

›×

X Answer is complete but not entirely correct.

Volt Battery Company

Summary of Cash Payments

February

March

740 X

8,140 x $

2,960 x

7,000✔

8,200✔

26,300

May

$

1,550 ✔

1,860 X

3,410

1,560 X

1,850

April

June

1,900 X

20,900 × $

7,600 X

7,000✔

35.500 $

1,700✔

2,040 X

3,740

1,860 X

1,880

May

1,850 X

20,350 × $

7,400 X

7,000 ✓

34,750

July

1,400

I$

June

1,880 X

20,680 X

7,520 X

7,000✔

13,400✔

48,600

Solution

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning