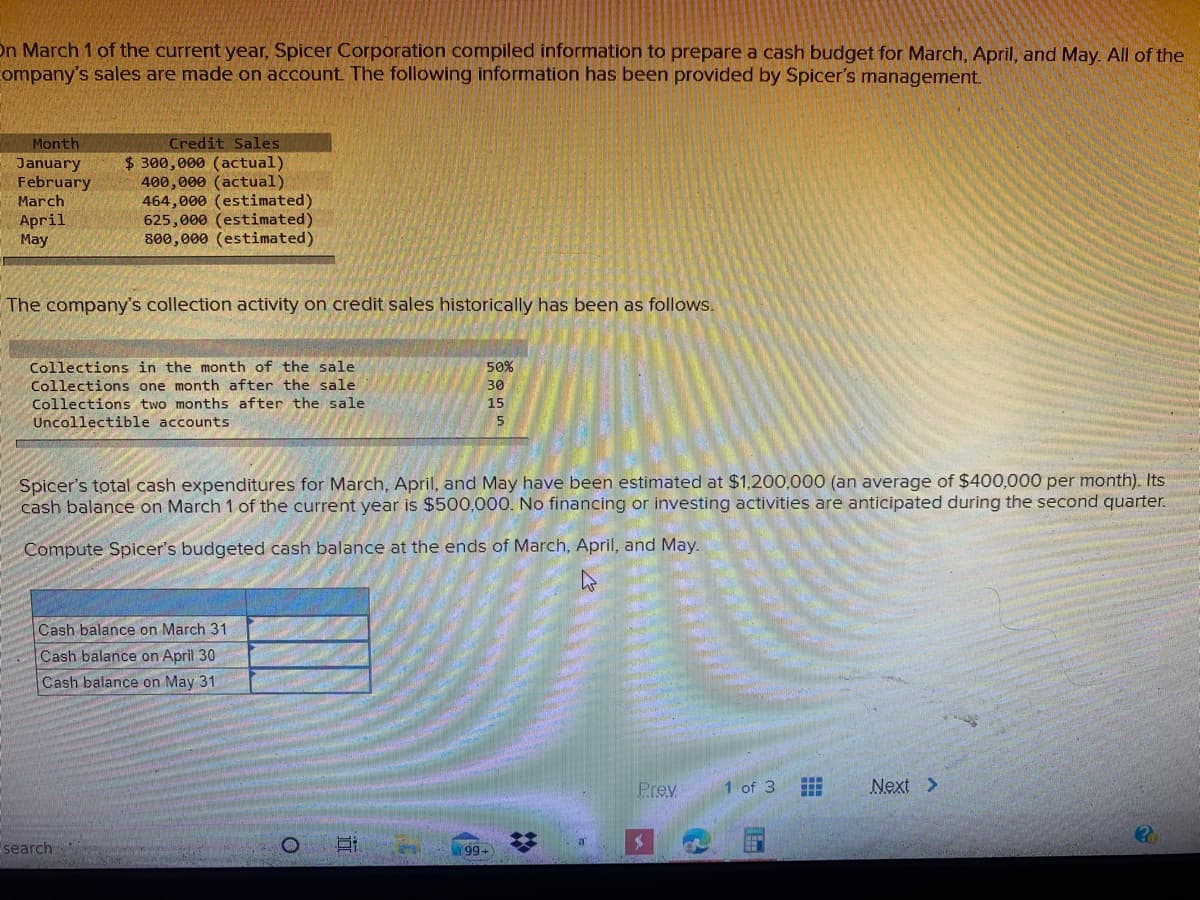

n March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the ompany's sales are made on account The following information has been provided by Spicer's management. Month Credit Sales January February March $ 300,000 (actual) 400,000 (actual) 464,000 (estimated) 625,000 (estimated) 800,000 (estimated) April May The company's collection activity on credit sales historically has been as follows. Collections in the month of the sale Collections one month after the sale 50% 30 Collections two months after the sale Uncollectible accounts 15 5. Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400,000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash balance at the ends of March, April, and May. Cash balance on March 31 Cash balance on April 30 Cash balance on May 31

n March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the ompany's sales are made on account The following information has been provided by Spicer's management. Month Credit Sales January February March $ 300,000 (actual) 400,000 (actual) 464,000 (estimated) 625,000 (estimated) 800,000 (estimated) April May The company's collection activity on credit sales historically has been as follows. Collections in the month of the sale Collections one month after the sale 50% 30 Collections two months after the sale Uncollectible accounts 15 5. Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400,000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash balance at the ends of March, April, and May. Cash balance on March 31 Cash balance on April 30 Cash balance on May 31

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 4P

Related questions

Question

100%

Budget balance help!

Transcribed Image Text:On March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the

company's sales are made on account The following information has been provided by Spicer's management.

Credit Sales

$ 300,000 (actual)

400,000 (actual)

464,000 (estimated)

625,000 (estimated)

800,000 (estimated)

Month

January

February

March

April

Мay

The company's collection activity on credit sales historically has been as follows.

Collections in the month of the sale

50%

Collections one month after the sale

Collections two months after the sale

30

15

Uncollectible accounts

Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400,000 per month). Its

cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter.

Compute Spicer's budgeted cash balance at the ends of March, April, and May.

Cash balance on March 31

Cash balance on April 30

Cash balance on May 31

Prev

1 of 3

Next >

a

search

99+

%2:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning