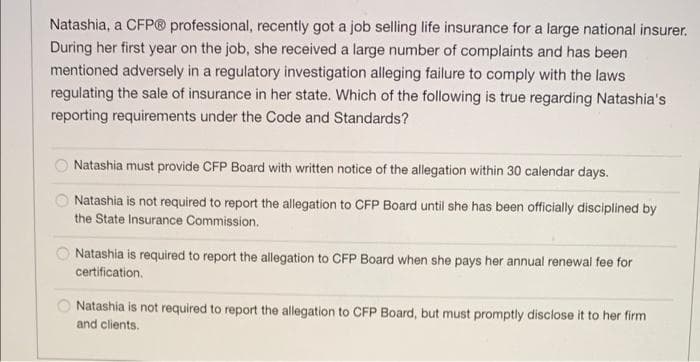

Natashia, a CFP® professional, recently got a job selling life insurance for a large national insurer. During her first year on the job, she received a large number of complaints and has been mentioned adversely in a regulatory investigation alleging failure to comply with the laws regulating the sale of insurance in her state. Which of the following is true regarding Natashia's reporting requirements under the Code and Standards? Natashia must provide CFP Board with written notice of the allegation within 30 calendar days. Natashia is not required to report the allegation to CFP Board until she has been officially disciplined by the State Insurance Commission.

Natashia, a CFP® professional, recently got a job selling life insurance for a large national insurer. During her first year on the job, she received a large number of complaints and has been mentioned adversely in a regulatory investigation alleging failure to comply with the laws regulating the sale of insurance in her state. Which of the following is true regarding Natashia's reporting requirements under the Code and Standards? Natashia must provide CFP Board with written notice of the allegation within 30 calendar days. Natashia is not required to report the allegation to CFP Board until she has been officially disciplined by the State Insurance Commission.

Business Its Legal Ethical & Global Environment

10th Edition

ISBN:9781305224414

Author:JENNINGS

Publisher:JENNINGS

Chapter18: Governance And Structure: Forms Of Doing Business

Section: Chapter Questions

Problem 8QAP

Related questions

Question

Transcribed Image Text:Natashia, a CFP® professional, recently got a job selling life insurance for a large national insurer.

During her first year on the job, she received a large number of complaints and has been

mentioned adversely in a regulatory investigation alleging failure to comply with the laws

regulating the sale of insurance in her state. Which of the following is true regarding Natashia's

reporting requirements under the Code and Standards?

Natashia must provide CFP Board with written notice of the allegation within 30 calendar days.

Natashia is not required to report the allegation to CFP Board until she has been officially disciplined by

the State Insurance Commission.

Natashia is required to report the allegation to CFP Board when she pays her annual renewal fee for

certification.

Natashia is not required to report the allegation to CFP Board, but must promptly disclose it to her firm

and clients.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT