Leverage Calculations Calculate: FAREnterprises ter. Income Statements 2010 The DOL The DFL 2019 2020 Total Revenue 717 74,178 The DCL With both the interval method Years 2019 and 2020 and the Point method Years 2018, 2019, and 2020 75,387 Cost of Goods Sold Gross Profit Veriable GA Fied G&A Fised Depreciation S7.117 16,54 17,061 17,3 1,4 1,9 2,019 7,000 7,000 7,000 1500 1,500 1,500 Point Method 2018 2019 2020 Fid Rent 650 650 11,014 5500 2,000 A500 Operating Expenses 11,148 11.160 DOL EBIT 5913 G170 Interest Expense 2,000 2,000 famings Before Taes 3,013 4170 2020 1545 2.348 terval Method 168 2,502 Income Tax Espense 1,400 2019 DEL Net income 2,100 40% DOL Tax Rate OCL Share Data 10000 0.25 Besic Sheres 10000 10000 021 023

Leverage Calculations Calculate: FAREnterprises ter. Income Statements 2010 The DOL The DFL 2019 2020 Total Revenue 717 74,178 The DCL With both the interval method Years 2019 and 2020 and the Point method Years 2018, 2019, and 2020 75,387 Cost of Goods Sold Gross Profit Veriable GA Fied G&A Fised Depreciation S7.117 16,54 17,061 17,3 1,4 1,9 2,019 7,000 7,000 7,000 1500 1,500 1,500 Point Method 2018 2019 2020 Fid Rent 650 650 11,014 5500 2,000 A500 Operating Expenses 11,148 11.160 DOL EBIT 5913 G170 Interest Expense 2,000 2,000 famings Before Taes 3,013 4170 2020 1545 2.348 terval Method 168 2,502 Income Tax Espense 1,400 2019 DEL Net income 2,100 40% DOL Tax Rate OCL Share Data 10000 0.25 Besic Sheres 10000 10000 021 023

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 6P: Retail Inventory Method Turner Corporation uses the retail inventory method. The following...

Related questions

Question

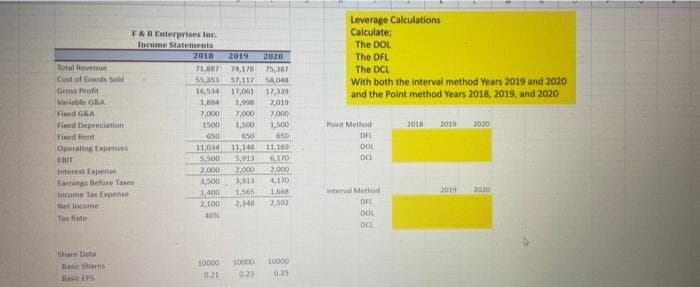

Transcribed Image Text:FAREnterprises Inc.

Income Statements

2016

Leverage Calculations

Calculate;

The DOL

2019

2020

The DFL

The DCL

With both the interval method Years 2019 and 2020

and the Point method Years 2018, 2019, and 2020

Total Reverue

Cost of Goods Sold

71,887 74,178

75, 387

55,a53

57.117

17,061

Gross Profit

16,534

17,339

Variable G&A

1,884

1,98

2,019

Fixed G&A

7,000

7,000

7,000

2020

1,500

650

Fined Depreciation

1500

1,500

Point Method

2018

2019

Fied Hent

650

650

DAL

Operating Expenses

11,034

11.169

DOL

11,148

5,500

2,000

EBIT

5,913

6,170

DCL

interest Espense

2,000

2,000

famings llefore Taxes

3,500

3,913

4,170

2020

1,668

2,500

Interval Method

2019

1,400

2,100

Income Tax Expense

1,565

2.348

DFL

Net income

DOL

Tax late

40%

DCL

Share Data

10000

10000

10000

Basic Shares

0.21

0.23

0.25

Basic EPS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning