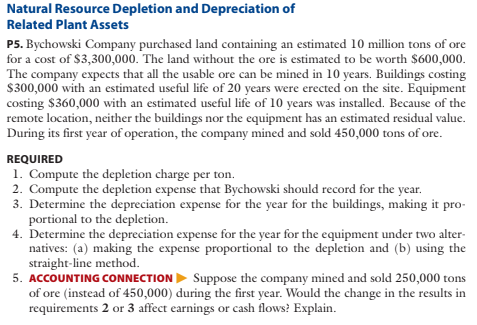

Natural Resource Depletion and Depreciation of Related Plant Assets P5. Bychowski Company purchased land containing an estimated 10 million tons of ore for a cost of $3,300,000. The land without the ore is estimated to be worth $600,000. The company expects that all the usable ore can be mined in 10 years. Buildings costing $300,000 with an estimated useful life of 20 years were erected on the site. Equipment costing $360,000 with an estimated useful life of 10 years was installed. Because of the remote location, neither the buildings nor the equipment has an estimated residual value. During its first year of operation, the company mined and sold 450,000 tons of ore. REQUIRED 1. Compute the depletion charge per ton. 2. Compute the depletion expense that Bychowski should record for the year. 3. Determine the depreciation expense for the year for the buildings, making it pro- portional to the depletion. 4. Determine the depreciation expense for the year for the equipment under two alter- natives: (a) making the expense proportional to the depletion and (b) using the straight-line method. 5. ACCOUNTING CONNECTION Suppose the company mined and sold 250,000 tons of ore (instead of 450,000) during the first year. Would the change in the results in requirements 2 or 3 affect earnings or cash flows? Explain.

Natural Resource Depletion and Depreciation of Related Plant Assets P5. Bychowski Company purchased land containing an estimated 10 million tons of ore for a cost of $3,300,000. The land without the ore is estimated to be worth $600,000. The company expects that all the usable ore can be mined in 10 years. Buildings costing $300,000 with an estimated useful life of 20 years were erected on the site. Equipment costing $360,000 with an estimated useful life of 10 years was installed. Because of the remote location, neither the buildings nor the equipment has an estimated residual value. During its first year of operation, the company mined and sold 450,000 tons of ore. REQUIRED 1. Compute the depletion charge per ton. 2. Compute the depletion expense that Bychowski should record for the year. 3. Determine the depreciation expense for the year for the buildings, making it pro- portional to the depletion. 4. Determine the depreciation expense for the year for the equipment under two alter- natives: (a) making the expense proportional to the depletion and (b) using the straight-line method. 5. ACCOUNTING CONNECTION Suppose the company mined and sold 250,000 tons of ore (instead of 450,000) during the first year. Would the change in the results in requirements 2 or 3 affect earnings or cash flows? Explain.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

Transcribed Image Text:Natural Resource Depletion and Depreciation of

Related Plant Assets

P5. Bychowski Company purchased land containing an estimated 10 million tons of ore

for a cost of $3,300,000. The land without the ore is estimated to be worth $600,000.

The company expects that all the usable ore can be mined in 10 years. Buildings costing

$300,000 with an estimated useful life of 20 years were erected on the site. Equipment

costing $360,000 with an estimated useful life of 10 years was installed. Because of the

remote location, neither the buildings nor the equipment has an estimated residual value.

During its first year of operation, the company mined and sold 450,000 tons of ore.

REQUIRED

1. Compute the depletion charge per ton.

2. Compute the depletion expense that Bychowski should record for the year.

3. Determine the depreciation expense for the year for the buildings, making it pro-

portional to the depletion.

4. Determine the depreciation expense for the year for the equipment under two alter-

natives: (a) making the expense proportional to the depletion and (b) using the

straight-line method.

5. ACCOUNTING CONNECTION Suppose the company mined and sold 250,000 tons

of ore (instead of 450,000) during the first year. Would the change in the results in

requirements 2 or 3 affect earnings or cash flows? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning