ne financial records of Metlock Inc. were destroyed by fire at the end of 2025. Fortunately, the controller had kept certain statistical ata related to the income statement as follows. 1. 2. 3. 4. 5. 5. 6. 7. 8. The beginning merchandise inventory was $88,320 and decreased 20% during the current year. Sales discounts amount to $14,280. 18,852 shares of common stock were outstanding for the entire year. Interest expense was $17,200. The income tax rate is 30%. The income tax rate is 30%. Cost of goods sold amounts to $440,000. Administrative expenses are 20% of cost of goods sold but only 8 % of gross sales. Four-fifths of the operating expenses relate to sales activities. From the foregoing information prepare an income statement for the year 2025 in single-step form. (Round earnings per share to 2 decimal places, e.g. 1.48.)

ne financial records of Metlock Inc. were destroyed by fire at the end of 2025. Fortunately, the controller had kept certain statistical ata related to the income statement as follows. 1. 2. 3. 4. 5. 5. 6. 7. 8. The beginning merchandise inventory was $88,320 and decreased 20% during the current year. Sales discounts amount to $14,280. 18,852 shares of common stock were outstanding for the entire year. Interest expense was $17,200. The income tax rate is 30%. The income tax rate is 30%. Cost of goods sold amounts to $440,000. Administrative expenses are 20% of cost of goods sold but only 8 % of gross sales. Four-fifths of the operating expenses relate to sales activities. From the foregoing information prepare an income statement for the year 2025 in single-step form. (Round earnings per share to 2 decimal places, e.g. 1.48.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 47E: Bryce Company manufactures pet supplies. However, Bryces electronic accounting system recently...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:ne financial records of Metlock Inc. were destroyed by fire at the end of 2025. Fortunately, the controller had kept certain statistical

ata related to the income statement as follows.

1.

2.

3.

4.

5.

5.

The income tax rate is 30%.

Cost of goods sold amounts to $440,000.

7. Administrative expenses are 20% of cost of goods sold but only 8% of gross sales.

Four-fifths of the operating expenses relate to sales activities.

6.

The beginning merchandise inventory was $88,320 and decreased 20% during the current year.

Sales discounts amount to $14,280.

18,852 shares of common stock were outstanding for the entire year.

Interest expense was $17,200.

The income tax rate is 30%.

8.

From the foregoing information prepare an income statement for the year 2025 in single-step form. (Round earnings per share to 2

decimal places, e.g. 1.48.)

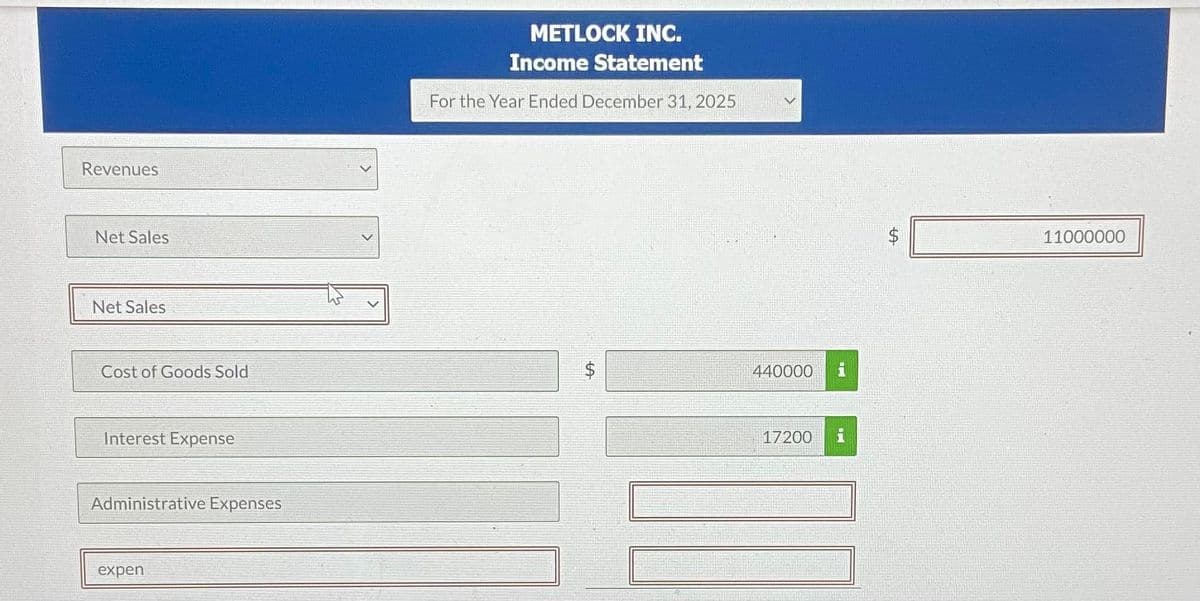

Transcribed Image Text:Revenues

Net Sales

Net Sales

Cost of Goods Sold

Interest Expense

Administrative Expenses

expen

METLOCK INC.

Income Statement

For the Year Ended December 31, 2025

$

LA

440000

17200

LA

11000000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning