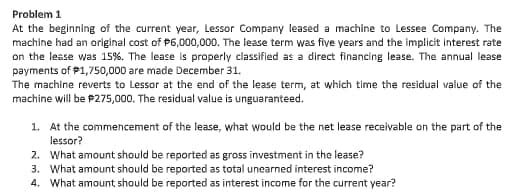

ne had an original co lease was 15%. Th nts of P1,750,000 are achine reverts to Le

Q: At December 31, 2022, the trial balance of Skysong Company contained the following amounts before…

A: Allowance Method - Under Allowance method provision needs to be made on the basis of uncollectible…

Q: What is the VAT amount that will be recorded in the applicable journal of Africa Traders?

A: VAT is calculated on price before VAT. So, that amount is assumed to be X. And 15% VAT is…

Q: You discovered the following errors in connection with your examination of the financial statements…

A: Non-Counterbalancing errors are those errors that do not get adjusted with the next year's figures…

Q: (LO 8) BE5-14 Yorkis Perez Corporation engaged in the following cash transactions during 2007. Sale…

A: Solution: The investing activities of statement cash flows are related with purchase and sale of…

Q: How did financial management influence your capsim simulation.

A: The planning, organizing, directing, and controlling of a company's financial activities, such as…

Q: 3. The following transactions involving marketable securities investments of KLM Co., occurred…

A: Investment in Marketable Securities Investment in marketable securities which is either it invested…

Q: to residency of corporations, which o

A: With the respect of residency of corporations, We must see Corporation POEM ( place of Effective…

Q: The manager of a division that produces add-on products for the automobile industry has just been…

A: Answer - First three subparts are solved here. Part 1 - Computation of the ROI for each…

Q: below: Cash P96,000 Accounts Payable P178,000 Accounts Receivable 184,000 Annie Capital 266,000…

A: When a new partner is admitted to a partnership firm, the firm gets reconstituted. For this purpose…

Q: In the coming year, Kalling Company expects to sell 28,700 units at $32 each. Kalling’s controller…

A: Answer 3) Kalling Company Absorption Costing Income Statement Sales (28,700 units X $ 32 per…

Q: e books of K. Mullings, a trader, via th cord the daily transactions via the bod of May 2010

A: Closing Stock = Opening Stock + Purchases - Sales. By using the above formula we are going to…

Q: 2 Project: Company Accour X DEL 7-1 Problem Set: Module Sev X CengageNOWv2 | Online tea X * Cengage…

A: Einsworth Corporation Vertical Analysis of Income Statement Amount Percentage Sales $…

Q: A company makes a single product and incurs fixed costs of £30,000 per annum. Variable cost per unit…

A: Fixed cost = £30,000 Selling price per unit = £15 Variable cost per unit = £5

Q: How can Golden Ltd lessen its exposure in the case?

A: Hedging is the method or more precisely about is the strategy which is followed by the company so…

Q: Problem 5 At the beginning of the current year, Wayv Company leased building to NCT U under an…

A: After all of a company's costs have been deducted, net income is the remaining revenue. Simply put,…

Q: The management of Marigold Industries estimates that credit sales for August, September, October,…

A: The cash collection is done as per the collection schedule. Collection for October include 25% of…

Q: Africa Traders, NOT a registered VAT vendor, manufactures and sells tables and chairs. The VAT rate…

A: Ans. b Debit the Bank account with R6 900, and credit the Sales account with R6 900.

Q: Granite Company purchased a machine with cost of $90,000 and salvage value of $6,000. The life of…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: During 2022, ABC Company introduced a new product carrying a two-year warranty against defects. The…

A: Warranty Liability: When a firm incurs warranty liabilities, it records the amount of repair or…

Q: From page 10-3 of the VLN, when the company sells 100 shares of the treasury stock for $11 per…

A: When the company sells 100 shares of treasury stock at $11 per share which were purchased at The $12…

Q: Exercise 13-34 (Algo) Estimate Cash Disbursements (LO 13-5) Cascade, Ltd., a merchandising firm,…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Unit IV question 9

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: On December 22, Travis Company purchased merchandise on account from a supplier for $7,500, terms…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The management accountant at Genus Manufacturing Company, Karen Cranston, is in the process of…

A: The question is related to Budgetary control. The details are given.

Q: 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated…

A: Term of lease 7 years Cost of machinery $ 507,000 Guaranteed Residual Value $…

Q: Salaries and wages payable $1,700 Notes payable (long-term) $1,700 Salaries and wages expense 51,800…

A: Formula: Net income = Total revenues - Total expenses.

Q: ANGEL Company has purchased raw materials amounting to P800,000 from its major supplier on February…

A: The suppliers provide supplies like raw materials and inputs to the corporation on the account. The…

Q: Which of the following best describes the auditors’ approach to auditing property, plant and…

A: As per the guidelines, only one question is allowed to be solved. Please resubmit the question…

Q: Garcon Inc. manufactures electronic products, with two operating divisions, Consumer and Com-…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Assume that Carla Vista Company will continue to use this copyright in the future. As of December…

A: Amortization expense is the write-off of an intangible asset over its anticipated useful life, which…

Q: Quail Company had an investment in bonds purchased at par for P8,000,000. On December 31, 2018, the…

A: Bondholders: Bond holders are the investors who acquires various bond of a company and after lapse…

Q: A milling machine has an initial cost is Php 370,000 and a service life of 10 years. Determine the…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: The Geurtz Company uses standard costing. The company makes and sells a single product called a…

A: GIVEN Actual cost of direct material purchased and used: £65,560Material price variance: £5,960…

Q: Grocery Corporation received $330,653 for 9.50 percent bonds issued on January 1, 2021, at a market…

A: No Date General Journal Debit Credit 1 Jan'1 Cash $ 330,653 Premium on Bonds…

Q: A relatively low P/E ratio illustrates

A: The PE ratio is calculated by dividing the share price by the earnings per share of the company. The…

Q: Mr. J, Capital Office Equipment Accounts Payable 85 000.00 Notes Receivable 1 200.00 12 000.00 Notes…

A: The income statement is an essential part of the financial statements of the company. It is prepared…

Q: Which statement is false concerning a comparison of a parent's books and the consolidated financial…

A: Consolidation is the process of combining the assets, liabilities, and other financial elements of…

Q: Dunne Corporation had the following stockholders’ equity amounts on January 1, 2021: Preferred…

A: In the context of the given question, we should journalize those transactions and compute the basic…

Q: bank at 12%.

A: Note:- Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: On July 31, 202O, Teal Company engaged Minsk Tooling Company to construct a special-purpose piece of…

A: The question is based on the concept of Financial Accounting.

Q: 15. Use the following information for questions 15 to 17 Rodel's Car Repair Shop started the year…

A: A partnership is a legally binding contract between two or more persons to manage and operate a…

Q: On January 1, 2021, ABC Company acquired an equipment from DEF Company in lieu of cash payment, ABC…

A: Interest expense is the amount which is paid along with the principal amount of a debt security like…

Q: Internal balances Multiple Choice Represent activity between the governmental funds and enterprise…

A: Here describe the details of internal balance which is described as the activity in between the…

Q: which of the following instances would a liability that would otherwise be presented as current is…

A: Liability is an obligation that has to be paid by the company by sacrificing the assets. It is…

Q: A and B form a partnership on January 1 of Year 1. Each makes a cash contribution to the partnership…

A: A and B form a partnership on January 1 of Year 1. Each makes a cash contribution to the…

Q: A condominium unit is being amortized with a quarterly payment of P56,000 for 5 years at 3%…

A: Solution: When quarterly payments are made, amortization schedule will consist of nos of quarterly…

Q: (c)Plug in the given in the formula if there is a derivation of the formul

A: The given information: Annual salary = 60,000increasing =5,000 yearInterest rate=10%Time period=8…

Q: -the book value at the end of (4th ) year using sum of year digits method. -If the vehicle sold…

A: Answer:

Q: From page 10-1 of the VLN, when a company sells shares of stock, those shares of stock are said to…

A: When the company sells the shares, those stock is said to be Issued shared and outstanding shares.…

Q: promissory note for the balance plus 10% intereat On January 1, 2021, West Company acquired a tract…

A: The correct answer for the above mentioned question is given in the following steps for your…

Step by step

Solved in 2 steps

- Leased Assets Koffman and Sons signed a four-year lease for a forklift on January 1, 2016. Annual lease payments of $1,510, based on an interest rate of 8%, are to be made every December 31, beginning with December 31, 2016. Required Assume that the lease is treated as an operating lease. Will the value of the forklift appear on Koffmans balance sheet? What account will indicate that lease payments have been made? Assume that the lease is treated as a capital lease. Prepare any journal entries needed when the lease is signed. Explain why the value of the leased asset is not recorded at $6,040 (1,5104). Prepare the journal entry to record the first lease payment on December 31, 2016. Calculate the amount of depreciation expense for the year 2016. At what amount would the lease obligation be presented on the balance sheet as of December 31, 2016?FISH CHIPS INC, PART I LEASE ANALYSIS Martha Millon, financial manager for Fish it Chips Inc., has been asked to perform a lease-versus-buy analysis on a new computer system. The Computer costs 1,200,000, and if it is purchased. Fish Chips could obtain a term loan for the full amount at a 10% cost. The loan would be amortized over the 4-year life of the computer, with payments made at the end of each year The computer is classified as special purpose; hence, it falls into the MACRS 3-year class. The applicable MACRS rates are 33%. 45%. 15%, and 7%. If the computer is purchased, a maintenance contract must be obtained at a cost of 25,000, payable at the beginning of each year. After 4 years, the computer will be sold. Millons best estimate of its residual value at that time is 125,000. Because technology is changing rapidly however, the residual value is uncertain. As an alternative. National Leasing is willing to write a 4-year lease on the computer, including maintenance, for payments of 340,000 at the beginning of each year. Fish 4c Chipss marginal federal-plus-state tax rate is 40%. Help Millon conduct her analysis by answering the following questions. a. 1. Why is leasing sometimes referred to as "off-balance-sheet" financing? 2. What is the difference between a capital lease and an operating lease? 3. What effect does leasing have on a firms capital structure? b. 1. What is Fish Chips's present value cost of owning the computer? (Hint: Set up a table whose bottom line is a time line" that shows the cash flows over the period t = 0 to t = 4. Then find the PV of these cash flows, or the PV cost of owning.) 2. Explain the rationale for the discount rate you used to find the PV. c. 1. What is Fish Chipss present value cost of leasing the computer? (Hint: Again, construct a time line.) 2. What is the net advantage to leasing? Does your analysis indicate that the firm should buy or lease the computer? Explain. d. Now assume that Millon believes that the computers residual value could be as low as 0 or as high as 250,000, but she stands by 125,000 as her expected value. She concludes that the residual value is riskier than the other cash flows in the analysis, and she wants to incorporate this differential risk into her analysis. Describe how this can be accomplished. What effect will it have on the lease decision? e. Millon knows that her firm has been considering moving its headquarters to a new location, and she is concerned that these plans may come to fruition prior to the expiration of the lease. If the move occurs, the company would obtain new computers; hence, Millon would like to include a cancellation clause in the lease contract. What effect would a cancellation clause have on the risk of the lease?Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)

- Problem 10- 10 Troy Company prepared the following amortization schedule for the lease of a machine from another entity. The machine has an economic life of six years. The lease agreement requires four annual payments of P330,000, including executory costs of P30,000, and the machine will be retured to the lessor at the end of the lease term. Minimum lease Interest Reduction Balance of payment Expense Liability Liablity 1/1/2020 985,150 12/31/2020 300,000 98,515 201,485 783,665 12/31/2021 300,000 78,366 221,634 562,031 12/31/2022…PROBLEM 4: Lease arrangement with Guaranteed Residual Value and annual fixed lease payment is paid at the beginning of each year, with DIRECT COST and LEASE INCENTIVE Lazy Company leased an equipment with useful life of 6 years on January 1, 2020 for period of 5 years with fixed annual rental of P600,000 which is to be paid in advance at the beginning of each year. The lease contract provides that the lessee has guaranteed a P100,000 residual value of the leased asset and a lease incentive P80,000. Initial direct cost incurred and paid by the lessee amounted to P200,000. The implicit interest rate in the lease is 10%. REQUIRED: Prepare table of amortization and journal entries for the entire lease term.QUESTION 1: A construction company agreed to lease payments of $452.56 on construction equipment to be made at the end of every month for 9.5 years. Financing is at 11% compounded monthly. (a) What is the value of the original lease contract? (b) If, due to delays, the first 9 payments were deferred, how much money would be needed after 10 payments to bring the lease payments up to date? (c) How much money would be required to pay off the lease after 10 payments? (d) If the lease were paid off after 10 payments, what would the total interest be? (e) How much of the total interest would be due to deferring the first 9 payments? Give typing answer with explanation and conclusion

- PROBLEM 3: Lease arrangement with GUARANTEED Residual ValueLazy Company leased an equipment with useful life of 6 years on January 1, 2020 for period of 5 years with fixed annual rental ofP600,000 which is to be paid at the end of each year. The lease contract provides that the lessee has guaranteed a P100,000 residualvalue of the leased asset. The implicit interest rate in the lease is 10%. REQUIRED: Prepare table of amortization and journal entriesfor the entire lease term.Problem 10-5 On January 1, 2020, Lessee Company entered into a lease with Lessor Company for a new equipment. The lease stipulates that annual payments of P1,000,000 will be made for five years startingbDecember 31,2020. Lessee Company guaranteed a residual value of P474,060 at the end of the 5 year period. Th equipment will revert to the lessor at the lease expiration. The omplicit interest rate for the lease is 16% after considering the guaranteed residual value. The economic life of the equipment is 10 years. The present value factors at 16% for five periods are: Present value of 1 0.4761 Present value of an ordinary annuity of 1 3.2743 Required: Prepare a schedule of the annual payments showing reduction of liablity every year. Prepare a journal entries on the bools of Leese Company for 2020 and 2021. Prepare a journal entry on December 31,2024, end of lease term, to record the return…2...new.continue...c The following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Crane Company, a lessee. Commencement date January 1, Annual lease payment due at the beginning of each year, beginning with January 1, $104,218 Residual value of equipment at end of lease term, guaranteed by the lessee $51,000 Expected residual value of equipment at end of lease term $46,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, $540,000 Lessor’s implicit rate 9 % Lessee’s incremental borrowing rate 9 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Suppose Crane received a lease incentive of $5,000 from Faldo Leasing to enter the lease. How would the initial measurement of the lease liability and right-of-use asset be affected? Right-of-use asset $enter a…

- Question 3 On 30 June 2022, Happy Ltd purchased machinery for its fair value of $41 600 and then leased it to Laugh Ltd. Laugh Ltd incurred $220, and Happy Ltd incurred $797, in costs to negotiate the lease agreement. The machine is expected to have an economic life of 5 years, after which time it will have a residual value of $2500. The lease agreement details are as follows. Length of lease 4 years Commencement date 30 June 2022 Annual lease payment, payable 30 June each year commencing 30 June 2022 $12 000 Residual value at the end of the lease term $10 000 Residual value guarantee by lessee $8 000 Interest rate implicit in the lease 9% All insurance and maintenance costs are paid by Happy Ltd and amount to $2 000 per year and will be reimbursed by Laugh Ltd by being included in the annual lease payment of $12 000. The lease has been classified as a finance lease by Happy Ltd. The machinery will be depreciated on a straight-line basis. It is…H 22 A finance lease for 6 years has an annual payment in arrears of R24,000. The fair value of the lease at inception was R106,000. Using the sum of digits method, the liability for the lease at the end of year 2 is: Select one: a. R3 221 b. R3 700 c. R3 551 d. R3 461Question 5 Telephone Limited signed a contract with Machinery Leasing Company at 1st January 2020 to lease a machine. The agreement consists in 10 equal annual payments of $300,000 at the beginning of each year with an interest rate of 15%. The yearly rental payment includes $30,000 of executory costs related to insurance on the machine. The executory costs of $30,000 are paid to the lessor each year. There is an option to purchase the machine at the end of the lease term for $50,000. The machine has an estimated useful life of 14 years and a guaranteed residual value of $20,000. Both companies adopt straight-line depreciation method for all items of PPE. Consider a PVIF (n=10, i=15%) of 0.2472 and PVIFA (n=10, i=15%) of 5.0188. The balance day for Telephone Limited and Machinery Leasing Company is 31 of December. Required (Round all numbers to the nearest dollar) a) Discuss the nature of this lease to Telephone Limited. b) Discuss the nature of this lease to Machinery Leasing…