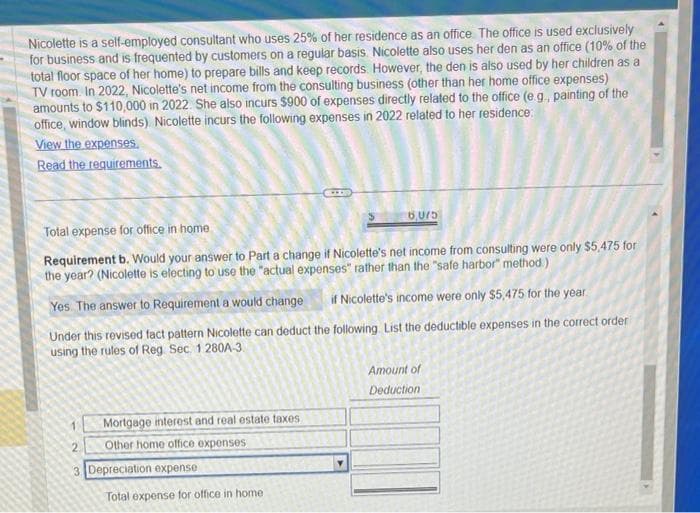

Nicolette is a self-employed consultant who uses 25% of her residence as an office. The office is used exclusively for business and is frequented by customers on a regular basis. Nicolette also uses her den as an office (10% of the total floor space of her home) to prepare bills and keep records. However, the den is also used by her children as a TV room. In 2022, Nicolette's net income from the consulting business (other than her home office expenses) amounts to $110,000 in 2022. She also incurs $900 of expenses directly related to the office (e.g., painting of the office, window blinds). Nicolette incurs the following expenses in 2022 related to her residence View the expenses. Read the requirements. Mortgage interest and real estate taxes Other home office expenses Total expense for office in home Requirement b. Would your answer to Part a change if Nicolette's net income from consulting were only $5,475 for the year? (Nicolette is electing to use the "actual expenses" rather than the "safe harbor" method.) Yes. The answer to Requirement a would change if Nicolette's income were only $5,475 for the year Under this revised fact pattern Nicolette can deduct the following List the deductible expenses in the correct order using the rules of Reg. Sec. 1280A-3 2 3 Depreciation expense SLLL Total expense for office in home 6,075 Amount of Deduction

Nicolette is a self-employed consultant who uses 25% of her residence as an office. The office is used exclusively for business and is frequented by customers on a regular basis. Nicolette also uses her den as an office (10% of the total floor space of her home) to prepare bills and keep records. However, the den is also used by her children as a TV room. In 2022, Nicolette's net income from the consulting business (other than her home office expenses) amounts to $110,000 in 2022. She also incurs $900 of expenses directly related to the office (e.g., painting of the office, window blinds). Nicolette incurs the following expenses in 2022 related to her residence View the expenses. Read the requirements. Mortgage interest and real estate taxes Other home office expenses Total expense for office in home Requirement b. Would your answer to Part a change if Nicolette's net income from consulting were only $5,475 for the year? (Nicolette is electing to use the "actual expenses" rather than the "safe harbor" method.) Yes. The answer to Requirement a would change if Nicolette's income were only $5,475 for the year Under this revised fact pattern Nicolette can deduct the following List the deductible expenses in the correct order using the rules of Reg. Sec. 1280A-3 2 3 Depreciation expense SLLL Total expense for office in home 6,075 Amount of Deduction

Chapter6: Business Expenses

Section: Chapter Questions

Problem 33P

Related questions

Question

N 1

Transcribed Image Text:Nicolette is a self-employed consultant who uses 25% of her residence as an office. The office is used exclusively

for business and is frequented by customers on a regular basis. Nicolette also uses her den as an office (10% of the

total floor space of her home) to prepare bills and keep records. However, the den is also used by her children as a

TV room. In 2022, Nicolette's net income from the consulting business (other than her home office expenses)

amounts to $110,000 in 2022. She also incurs $900 of expenses directly related to the office (e.g., painting of the

office, window blinds). Nicolette incurs the following expenses in 2022 related to her residence

View the expenses.

Read the requirements.

2

Total expense for office in home

Requirement b. Would your answer to Part a change if Nicolette's net income from consulting were only $5,475 for

the year? (Nicolette is electing to use the "actual expenses" rather than the "safe harbor" method.)

Yes. The answer to Requirement a would change

if Nicolette's income were only $5,475 for the year

Under this revised fact pattern Nicolette can deduct the following List the deductible expenses in the correct order

using the rules of Reg Sec. 1280A-3

3

Mortgage interest and real estate taxes

Other home office expenses

Depreciation expense

6LLL

Total expense for office in home

6,075

Amount of

Deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT