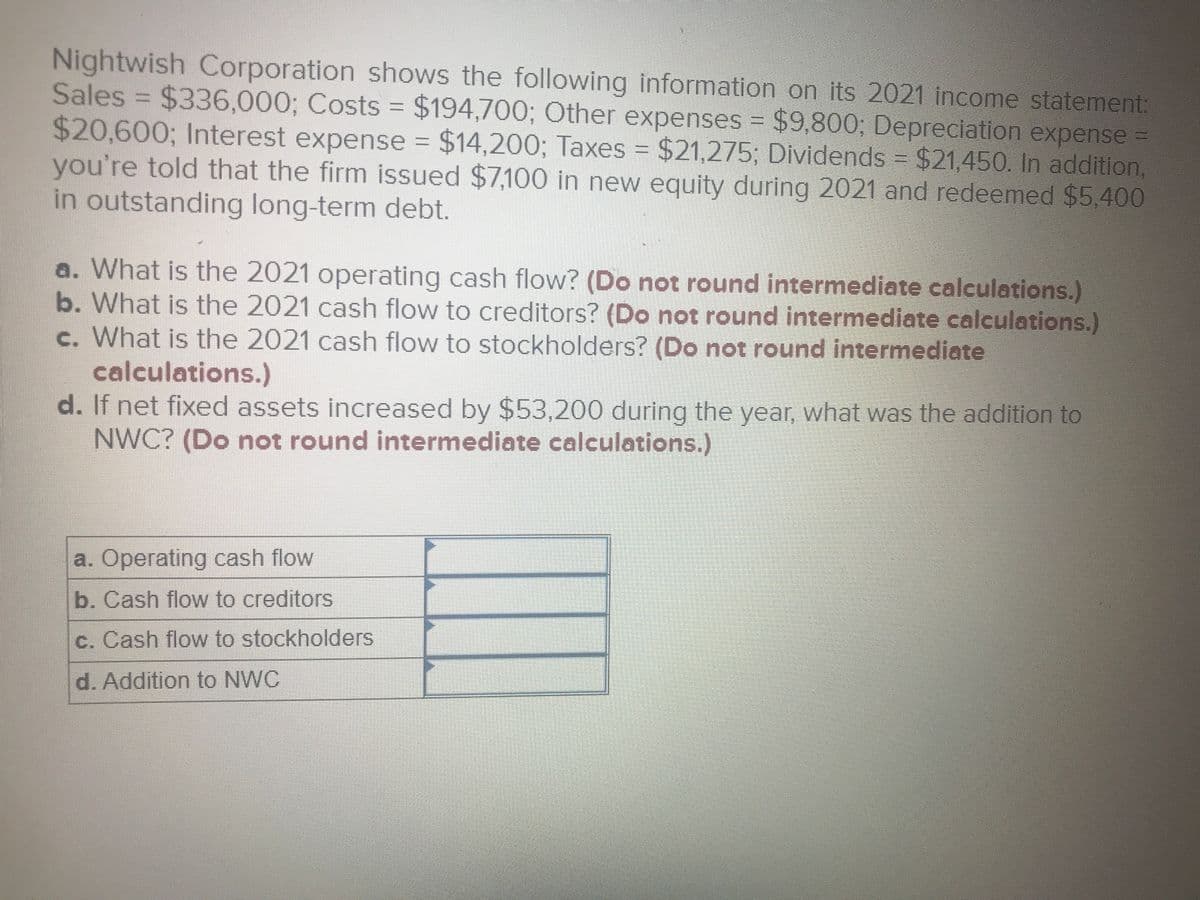

Nightwish Corporation shows the following information on its 2021 income statement: Sales = $336,000; Costs $194,700; Other expenses = $9,800; Depreciation expense $20,600; Interest expense = $14,200; Taxes $21,275; Dividends = $21,450. In addition, you're told that the firm issued $7,100 in new equity during 2021 and redeemed $5.400 in outstanding long-term debt. %3D %3D a. What is the 2021 operating cash flow? (Do not round intermediate calculations.) b. What is the 2021 cash flow to creditors? (Do not round intermediate calculations.) c. What is the 2021 cash flow to stockholders? (Do not round intermediate calculations.) d. If net fixed assets increased by $53,200 during the year, what was the addition to NWC? (Do not round intermediate calculations.)

Nightwish Corporation shows the following information on its 2021 income statement: Sales = $336,000; Costs $194,700; Other expenses = $9,800; Depreciation expense $20,600; Interest expense = $14,200; Taxes $21,275; Dividends = $21,450. In addition, you're told that the firm issued $7,100 in new equity during 2021 and redeemed $5.400 in outstanding long-term debt. %3D %3D a. What is the 2021 operating cash flow? (Do not round intermediate calculations.) b. What is the 2021 cash flow to creditors? (Do not round intermediate calculations.) c. What is the 2021 cash flow to stockholders? (Do not round intermediate calculations.) d. If net fixed assets increased by $53,200 during the year, what was the addition to NWC? (Do not round intermediate calculations.)

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

100%

Transcribed Image Text:Nightwish Corporation shows the following information on its 2021 income statement:

Sales $336,000; Costs =

$20,600; Interest expense = $14,200; Taxes = $21,275; Dividends = $21,450. In addition,

you're told that the firm issued $7,100 in new equity during 2021 and redeemed $5,400

in outstanding long-term debt.

$194,700; Other expenses = $9,800; Depreciation expense =

%3D

a. What is the 2021 operating cash flow? (Do not round intermediate calculations.)

b. What is the 2021 cash flow to creditors? (Do not round intermediate calculations.)

c. What is the 2021 cash flow to stockholders? (Do not round intermediate

calculations.)

d. If net fixed assets increased by $53,200 during the year, what was the addition to

NWC? (Do not round intermediate calculations.)

a. Operating cash flow

b. Cash flow to creditors

c. Cash flow to stockholders

d. Addition to NWC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning