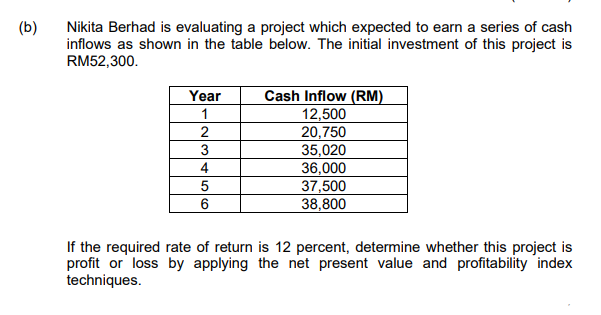

Nikita Berhad is evaluating a project which expected to earn a series of cash inflows as shown in the table below. The initial investment of this project is RM52,300. Year Cash Inflow (RM) 12,500 20,750 35,020 36,000 37,500 38,800 1 2 3 4 If the required rate of return is 12 percent, determine whether this project is profit or loss by applying the net present value and profitability index techniques.

Nikita Berhad is evaluating a project which expected to earn a series of cash inflows as shown in the table below. The initial investment of this project is RM52,300. Year Cash Inflow (RM) 12,500 20,750 35,020 36,000 37,500 38,800 1 2 3 4 If the required rate of return is 12 percent, determine whether this project is profit or loss by applying the net present value and profitability index techniques.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 3CMA

Related questions

Question

Transcribed Image Text:(b)

Nikita Berhad is evaluating a project which expected to earn a series of cash

inflows as shown in the table below. The initial investment of this project is

RM52,300.

Cash Inflow (RM)

12,500

20,750

35,020

36,000

37,500

38,800

Year

2

3

4

5

6

If the required rate of return is 12 percent, determine whether this project is

profit or loss by applying the net present value and profitability index

techniques.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College