Noah Yobs, age 55, who has $57,400 of AGI (solely from wages) before considering rental activities, has $51,660 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $28,700 of income. He has other passive activity income of $18,368. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year? $fill in the blank 3ed587f89fd0031_1 b. Compute Noah's AGI on Form 1040 [page 1; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss.

Noah Yobs, age 55, who has $57,400 of AGI (solely from wages) before considering rental activities, has $51,660 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $28,700 of income. He has other passive activity income of $18,368. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year? $fill in the blank 3ed587f89fd0031_1 b. Compute Noah's AGI on Form 1040 [page 1; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 28P

Related questions

Question

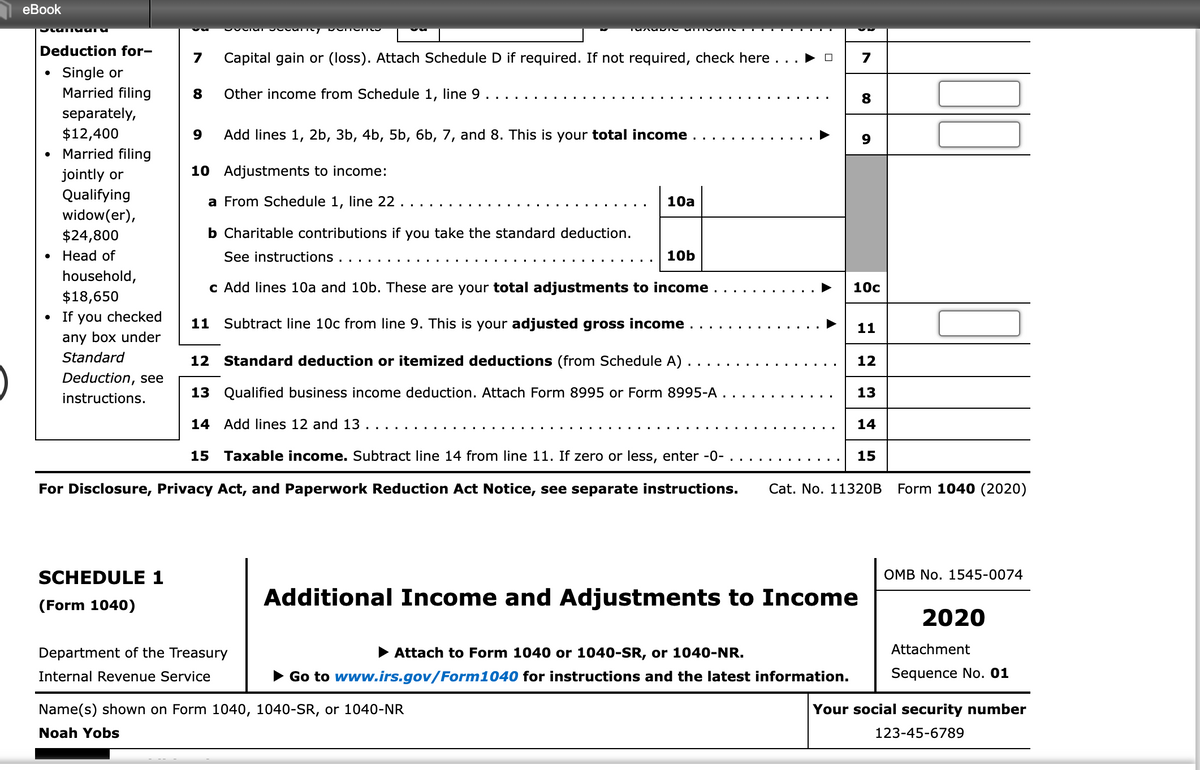

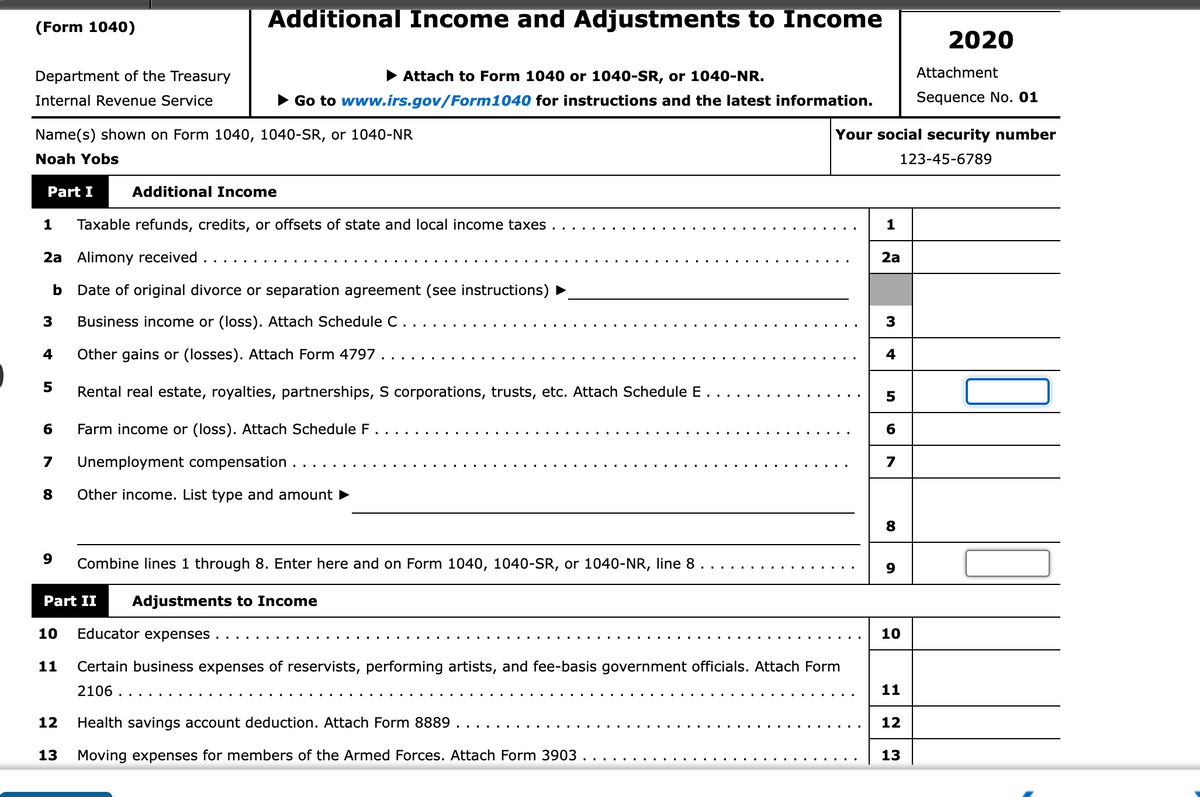

Noah Yobs, age 55, who has $57,400 of AGI (solely from wages) before considering rental activities, has $51,660 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $28,700 of income. He has other passive activity income of $18,368.

a. What amount of rental loss can Noah use to offset active or portfolio income in the current year?

$fill in the blank 3ed587f89fd0031_1

b. Compute Noah's AGI on Form 1040 [page 1; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss.

Transcribed Image Text:еBook

Deduction for-

7

Capital gain or (loss). Attach Schedule D if required. If not required, check here ..

7

Single or

Married filing

Other income from Schedule 1, line 9

8

separately,

$12,400

Married filing

Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income

10 Adjustments to income:

jointly or

Qualifying

a From Schedule 1, line 22.

10a

widow(er),

$24,800

b Charitable contributions if you take the standard deduction.

. Неad of

See instructions

10b

household,

c Add lines 10a and 10b. These are your total adjustments to income

10с

$18,650

• If you checked

11 Subtract line 10c from line 9. This is your adjusted gross income

11

any box under

Standard

12 Standard deduction or itemized deductions (from Schedule A) .

12

Deduction, see

instructions.

13 Qualified business income deduction. Attach Form 8995 or Form 8995-A ..

13

14 Add lines 12 and 13

14

15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- .

15

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 11320B

Form 1040 (2020)

SCHEDULE 1

OMB No. 1545-0074

Additional Income and Adjustments to Income

(Form 1040)

2020

Department of the Treasury

• Attach to Form 1040 or 1040-SR, or 1040-NR.

Attachment

Internal Revenue Service

• Go to www.irs.gov/Form1040 for instructions and the latest information.

Sequence No. 01

Name(s) shown on Form 1040, 1040-SR, or 1040-NR

Your social security number

Noah Yobs

123-45-6789

Transcribed Image Text:Additional Income and Adjustments to Income

(Form 1040)

2020

Department of the Treasury

• Attach to Form 1040 or 1040-SR, or 1040-NR.

Attachment

Internal Revenue Service

• Go to www.irs.gov/Form1040 for instructions and the latest information.

Sequence No. 01

Name(s) shown on Form 1040, 1040-SR, or 1040-NR

Your social security number

Noah Yobs

123-45-6789

Part I

Additional Income

Taxable refunds, credits, or offsets of state and local income taxes

1

2a Alimony received

2a

b

Date of original divorce or separation agreement (see instructions)

3

Business income or (loss). Attach Schedule C.

4

Other gains or (losses). Attach Form 4797.

5

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E.

6

Farm income or (loss). Attach Schedule F.

7

Unemployment compensation ..

7

Other income. List type and amount

8

Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 .

9

...

Part II

Adjustments to Income

10

Educator expenses

10

11

Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form

2106 .

11

12

Health savings account deduction. Attach Form 8889

12

13

Moving expenses for members of the Armed Forces. Attach Form 3903

13

4+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning