Notes RO '000 RO *000 Revenue Operating costs Gross profit 15 16 17,658 (11,102) 6,556 18,017 (11,385) 6,632 General and administrative expenses Finance costs - net 17 (646) (3,136) 21 2,795 (964) (3,438) 998 3,228 18 Other income Profit before tax Тах еxpense Profit and total comprehensive income for the year 20 _(460) 2,335 (591) 2,637 Basic and diluted profit per share for the year 23 0.033 0.037

Notes RO '000 RO *000 Revenue Operating costs Gross profit 15 16 17,658 (11,102) 6,556 18,017 (11,385) 6,632 General and administrative expenses Finance costs - net 17 (646) (3,136) 21 2,795 (964) (3,438) 998 3,228 18 Other income Profit before tax Тах еxpense Profit and total comprehensive income for the year 20 _(460) 2,335 (591) 2,637 Basic and diluted profit per share for the year 23 0.033 0.037

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

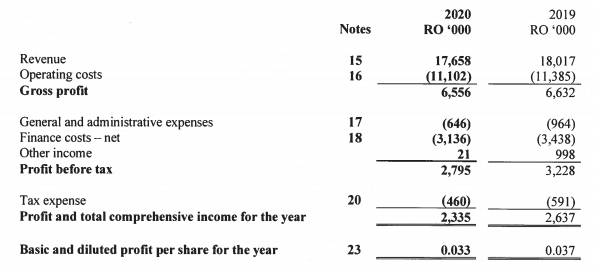

Calculate the following Ratio:

Gross profit Ratio

Net profit Ratio

Transcribed Image Text:2020

2019

Notes

RO '000

RO '000

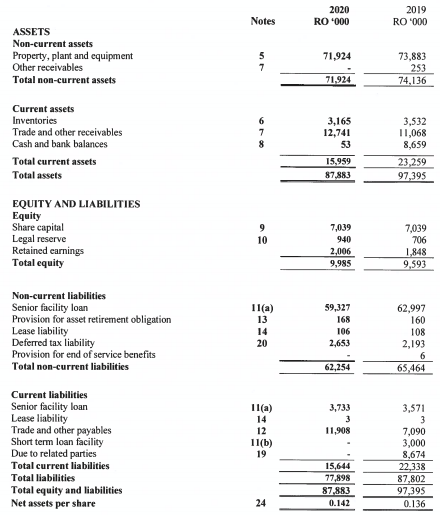

ASSETS

Non-current assets

Property, plant and equipment

Other receivables

5

71,924

73,883

253

74,136

Total non-current assets

71,924

Current assets

Inventories

Trade and other receivables

Cash and bank balances

3,165

12,741

3,532

I1,068

8,659

53

Total current assets

23,259

97,395

15,959

Total assets

87,883

EQUITY AND LIABILITIES

Equity

Share capital

Legal reserve

Retained earnings

Total equity

9

7,039

7,039

706

10

940

1,848

9,593

2,006

9,985

Non-current liabilities

Senior facility loan

Provision for asset retirement obligation

Lease liability

Deferred tax liability

Provision for end of service benefits

62,997

160

108

2,193

11(a)

59,327

13

168

14

106

20

2,653

Total non-current liabilities

62,254

65,464

Current liabilities

Senior facility loan

Lease liability

Trade and other payables

Short term loan facility

Due to related parties

1l(a)

3,733

3,571

14

3

3

12

11,908

7,090

3,000

8,674

22,338

87,802

97,395

0.136

11(b)

19

Total current liabilities

15,644

77,898

87,883

0.142

Total liabilities

Total equity and liabilities

Net assets per share

24

Transcribed Image Text:2020

2019

Notes

RO *000

RO *000

17,658

(11,102)

6,556

Revenue

15

Operating costs

Gross profit

18,017

(11,385)

6,632

16

General and administrative expenses

Finance costs – net

17

(646)

(3,136)

21

2,795

(964)

(3,438)

998

18

Other income

Profit before tax

3,228

Тах еxpense

Profit and total comprehensive income for the year

(460)

2,335

20

(591)

2,637

Basic and diluted profit per share for the year

23

0.033

0.037

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education