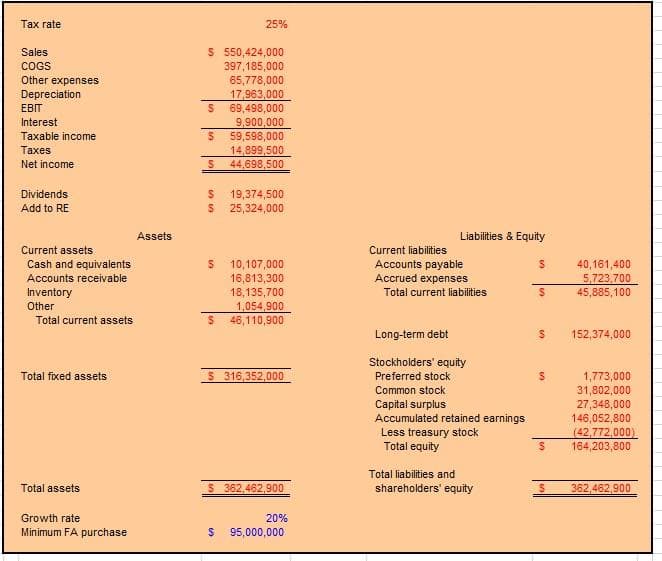

Tax rate 25% S 550,424,000 397,185,000 65,778,000 17,963,000 69,498,000 9,900,000 S 59,598,000 14,899,500 S 4,698,500 Sales COGS Other expenses Depreciation EBIT Interest Taxable income Тахes Net income $ 19,374,500 $ 25,324,000 Dividends Add to RE Assets Liabilities & Equity Current assets Current liabilities 10,107,000 16,813,300 18,135,700 1,054,900 $ 46,110,900 Cash and equivalents Accounts receivable Accounts payable Accrued expenses 40,161,400 5,723,700 45,885,100 Inventory Other Total current liabilities Total current assets Long-term debt 152,374,000 S 316,352,000 Stockholders' equity Preferred stock Total fixed assets 1,773,000 31,802,000 27,348,000 146,052,800 (42,772,000) 164,203,800 Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity Total liabilties and Total assets S 362,462,900 shareholders' equity 362,462,900 Growth rate 20% Minimum FA purchase 95,000,000

Tax rate 25% S 550,424,000 397,185,000 65,778,000 17,963,000 69,498,000 9,900,000 S 59,598,000 14,899,500 S 4,698,500 Sales COGS Other expenses Depreciation EBIT Interest Taxable income Тахes Net income $ 19,374,500 $ 25,324,000 Dividends Add to RE Assets Liabilities & Equity Current assets Current liabilities 10,107,000 16,813,300 18,135,700 1,054,900 $ 46,110,900 Cash and equivalents Accounts receivable Accounts payable Accrued expenses 40,161,400 5,723,700 45,885,100 Inventory Other Total current liabilities Total current assets Long-term debt 152,374,000 S 316,352,000 Stockholders' equity Preferred stock Total fixed assets 1,773,000 31,802,000 27,348,000 146,052,800 (42,772,000) 164,203,800 Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity Total liabilties and Total assets S 362,462,900 shareholders' equity 362,462,900 Growth rate 20% Minimum FA purchase 95,000,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

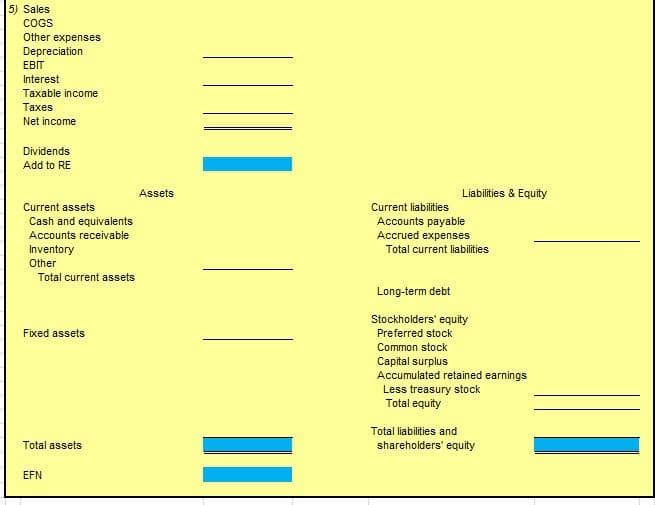

please fill yellow format column with help of ornge colour

Transcribed Image Text:Тах гate

25%

S 550,424,000

397,185,000

65,778,000

17,963,000

69,498,000

9,900,000

59,598,000

14,899,500

44,698,500

Sales

COGS

Other expenses

Depreciation

EBIT

Interest

Taxable income

Тахes

Net income

Dividends

19,374,500

25,324,000

Add to RE

Assets

Liabilities & Equity

Current assets

Current liabilities

Cash and equivalents

Accounts payable

Accrued expenses

10,107,000

16,813,300

18,135,700

1,054,900

46,110,900

40,161,400

5,723,700

45,885,100

Accounts receivable

Inventory

Total current liabilities

Other

Total current assets

Long-term debt

152,374,000

Stockholders' equity

Total fixed assets

5 316,352,000

Preferred stock

1,773,000

31,802,000

Common stock

Capital surplus

Accumulated retained earnings

Less treasury stock

Total equity

27,348,000

146,052,800

(42,772,000)

164,203,800

Total liabilities and

Total assets

S 362,462,900

shareholders' equity

362,462,900

Growth rate

20%

Minimum FA purchase

95,000,000

Transcribed Image Text:5) Sales

COGS

Other expenses

Depreciation

EBIT

Interest

Taxable income

Тахes

Net income

Dividends

Add to RE

Assets

Liabilities & Equity

Current assets

Current liabilities

Cash and equivalents

Accounts payable

Accrued expenses

Accounts receivable

Inventory

Total current liabilities

Other

Total current assets

Long-term debt

Stockholders' equity

Fixed assets

Preferred stock

Common stock

Capital surplus

Accumulated retained earnings

Less treasury stock

Total equity

Total liabilities and

Total assets

shareholders' equity

EFN

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education