nsurance buyers have more information about whether they are high-risk or low-risk than the insurance company does. This creates an asymmetric information problem for the insurance company because buyers who are high-risk tend to want to buy more insurance, without letting th insurance company know about their higher risk. How might this problem impact an insurance company? O The company will not be impacted. O The insurance buyers, not the company, will be impacted. As high risk buyers submit claims, they will use up the company's funds for that year, and since the company did not adjust for these high risk claims, once that money is used up, remaining claimants won't receive any coverage.

nsurance buyers have more information about whether they are high-risk or low-risk than the insurance company does. This creates an asymmetric information problem for the insurance company because buyers who are high-risk tend to want to buy more insurance, without letting th insurance company know about their higher risk. How might this problem impact an insurance company? O The company will not be impacted. O The insurance buyers, not the company, will be impacted. As high risk buyers submit claims, they will use up the company's funds for that year, and since the company did not adjust for these high risk claims, once that money is used up, remaining claimants won't receive any coverage.

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.4P

Related questions

Question

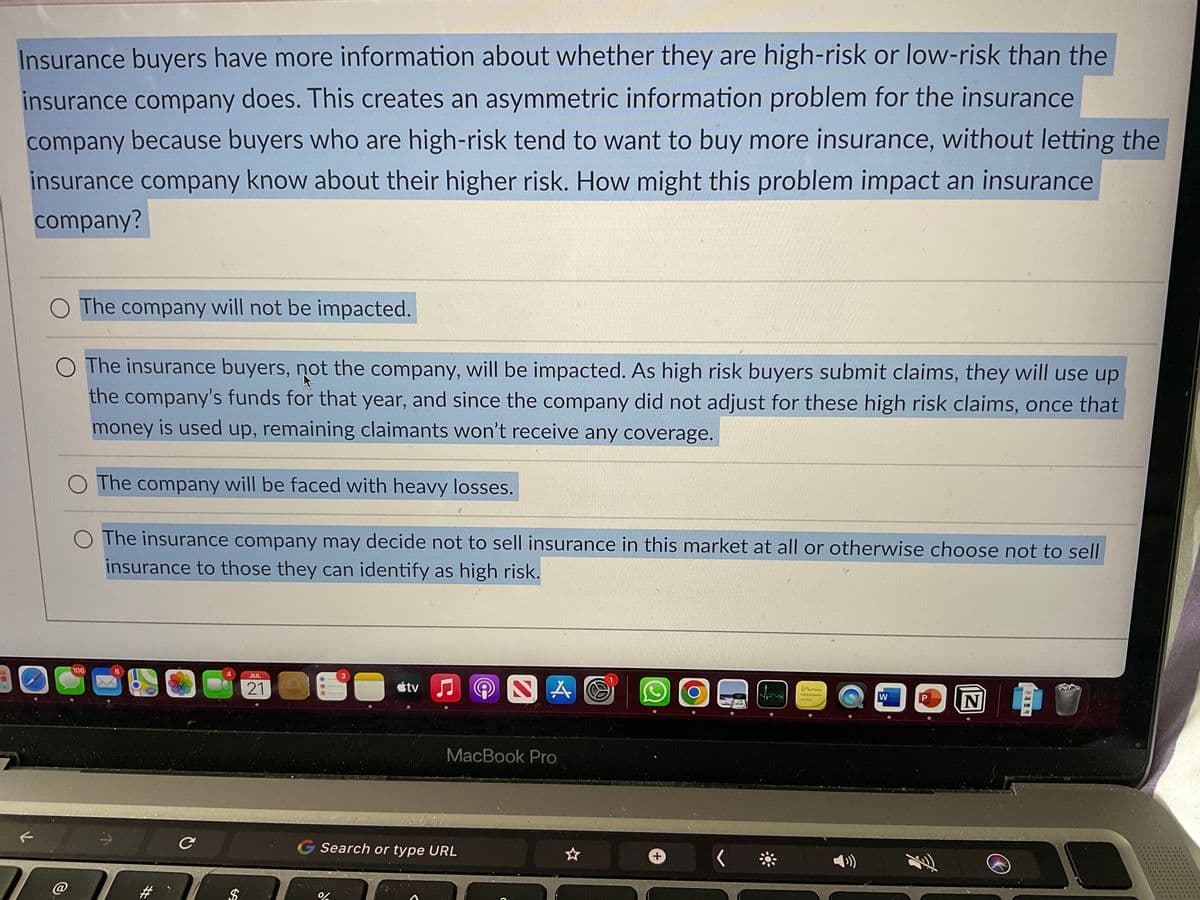

Transcribed Image Text:Insurance buyers have more information about whether they are high-risk or low-risk than the

insurance company does. This creates an asymmetric information problem for the insurance

company because buyers who are high-risk tend to want to buy more insurance, without letting the

insurance company know about their higher risk. How might this problem impact an insurance

company?

F

T

O The company will not be impacted.

O The insurance buyers, not the company, will be impacted. As high risk buyers submit claims, they will use up

the company's funds for that year, and since the company did not adjust for these high risk claims, once that

money is used up, remaining claimants won't receive any coverage.

The company will be faced with heavy losses.

The insurance company may decide not to sell insurance in this market at all or otherwise choose not to sell

insurance to those they can identify as high risk.

106

#

C

4

$

JUL

21

tv♫♬

%

MacBook Pro

Search or type URL

+

W

D

P

N

Ⓒ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax