O Cons i der Hhe following Coarnut medel. • The inverse femand function is given by p= 30-@ where Q = Et %3D Finm 1s marginal cest is $6(ci=6)- Fro 2 ases a ntw s. that it's margimal cost is $3 (6=3). fixed corf. Theve is no * The fwo fims chere thir quarti ties simultaneculy and Compete Jame). ' only (So its a one- shot simultamecus once Answer Hhe felloning puesfinns Derive Firm 1 nd Firm 2s veaitin functions. reupertivaly 5 Solve He Mash equilibivm (I", q) o What s He equilibrinm price and what is Hhe pafit level for eah fim. market for the te hulagy ured by price that Firm 1 is Suppou thare is a Iim 2. Wlhat is Hhe highest willing to paj for this new Now let's change the atup fan (omet Gapetiton to Bertrand (ampetitin, while maintaining all ether ayAamp tins. What iš He equilibium price? Suppon the Awo fims engaga in Batvand (ompetition What is the hijhest price that Frm 1 & for He new fechmly millng to pa

O Cons i der Hhe following Coarnut medel. • The inverse femand function is given by p= 30-@ where Q = Et %3D Finm 1s marginal cest is $6(ci=6)- Fro 2 ases a ntw s. that it's margimal cost is $3 (6=3). fixed corf. Theve is no * The fwo fims chere thir quarti ties simultaneculy and Compete Jame). ' only (So its a one- shot simultamecus once Answer Hhe felloning puesfinns Derive Firm 1 nd Firm 2s veaitin functions. reupertivaly 5 Solve He Mash equilibivm (I", q) o What s He equilibrinm price and what is Hhe pafit level for eah fim. market for the te hulagy ured by price that Firm 1 is Suppou thare is a Iim 2. Wlhat is Hhe highest willing to paj for this new Now let's change the atup fan (omet Gapetiton to Bertrand (ampetitin, while maintaining all ether ayAamp tins. What iš He equilibium price? Suppon the Awo fims engaga in Batvand (ompetition What is the hijhest price that Frm 1 & for He new fechmly millng to pa

Chapter11: The Firm: Production And Costs

Section: Chapter Questions

Problem 3P

Related questions

Question

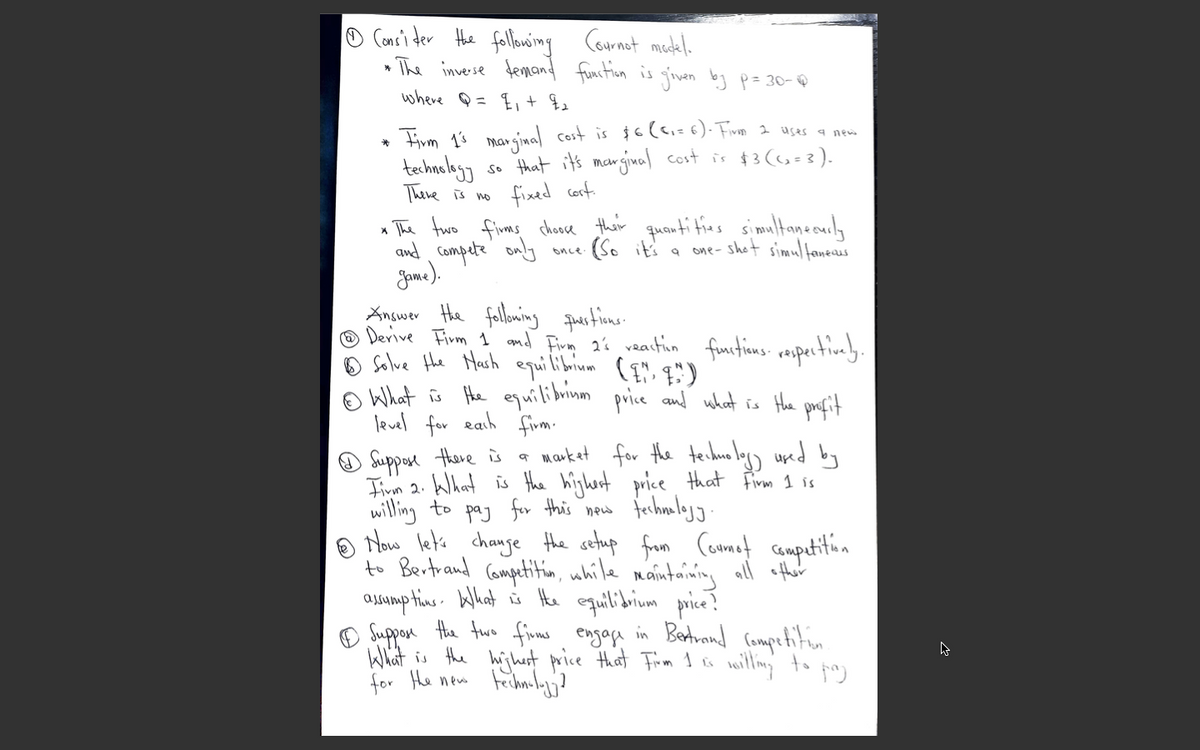

Kindly help explain part E and F only. Thanks a lot.

Transcribed Image Text:Consi der Hhe fallowing

» The inverse femand function is givan by p= 30-@

Cournet medel.

where Q = E,+

* Firm 13 marginal cost is $6lei=6). Fivm 2 uses a nem

techaulagy

There is no

that it's marginal cost is $3 (6=3).

fixed cort

So

The fwo fims chooce thair

and Compete only

Jame).

Answer the follming puestions.

O Derive Firm 1 amd Firm 2% vation furtions reupertivaly.

o Solve Hhe Harh equilibrium ( ", q")

O What is He equilibrinm

level for eah firm.

quenti tias simultaneculy

(So it's a

one- shot simultaneaus

once

price and what is Hhe profit

Suppore there is

Iim 2. Wlhat is the highert price that Firm I is

willing to paj for this new

o Mow let's chauge the setup from Coumet campetition

to Bertrand Competitin, while maintaining all efther

aJAump tins. What is He equilibium price?

O Suppon the fwe finms engage in Betrand (ompetition

What is the hijhut price that Fim 1 o milling

for He new feihnly?

* market for the teihue lagy uped by

to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax