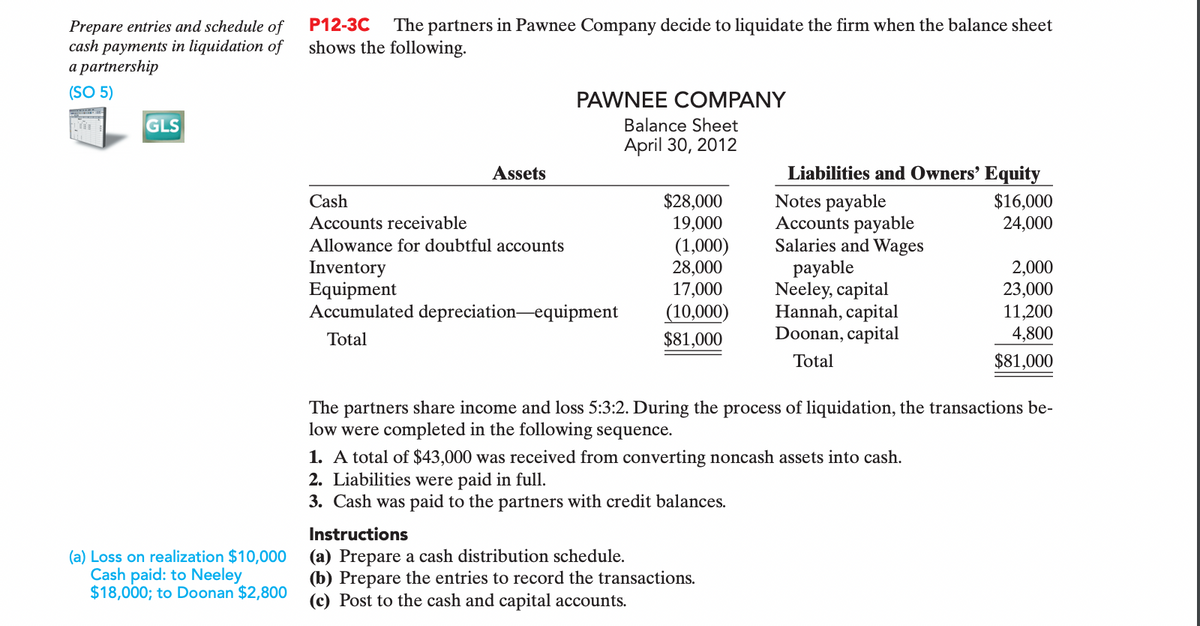

P12-3C The partners in Pawnee Company decide to liquidate the firm when the balance sheet shows the following. PAWNEE COMPANY Balance Sheet April 30, 2012 Assets Liabilities and Owners' Equity $16,000 24,000 Cash $28,000 19,000 (1,000) 28,000 17,000 (10,000) $81,000 Notes payable Accounts payable Salaries and Wages payable Neeley, capital Hannah, capital Doonan, capital Accounts receivable Allowance for doubtful accounts Inventory Equipment Accumulated depreciation-equipment 2,000 23,000 11,200 4,800 $81,000 Total Total The partners share income and loss 5:3:2. During the process of liquidation, the transactions be- low were completed in the following sequence. 1. A total of $43,000 was received from converting noncash assets into cash. 2. Liabilities were paid in full. 3. Cash was paid to the partners with credit balances. Instructions (a) Prepare a cash distribution schedule. (b) Prepare the entries to record the transactions. (c) Post to the cash and capital accounts.

P12-3C The partners in Pawnee Company decide to liquidate the firm when the balance sheet shows the following. PAWNEE COMPANY Balance Sheet April 30, 2012 Assets Liabilities and Owners' Equity $16,000 24,000 Cash $28,000 19,000 (1,000) 28,000 17,000 (10,000) $81,000 Notes payable Accounts payable Salaries and Wages payable Neeley, capital Hannah, capital Doonan, capital Accounts receivable Allowance for doubtful accounts Inventory Equipment Accumulated depreciation-equipment 2,000 23,000 11,200 4,800 $81,000 Total Total The partners share income and loss 5:3:2. During the process of liquidation, the transactions be- low were completed in the following sequence. 1. A total of $43,000 was received from converting noncash assets into cash. 2. Liabilities were paid in full. 3. Cash was paid to the partners with credit balances. Instructions (a) Prepare a cash distribution schedule. (b) Prepare the entries to record the transactions. (c) Post to the cash and capital accounts.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 5CE

Related questions

Topic Video

Question

Transcribed Image Text:P12-3C

Prepare entries and schedule of

cash payments in liquidation of

a partnership

The partners in Pawnee Company decide to liquidate the firm when the balance sheet

shows the following.

(SO 5)

PAWNEE COMPANY

GLS

Balance Sheet

April 30, 2012

Assets

Liabilities and Owners’ Equity

$28,000

19,000

(1,000)

28,000

17,000

(10,000)

$81,000

Notes payable

Accounts payable

Salaries and Wages

рayable

Neeley, capital

Hannah, capital

Doonan, capital

$16,000

24,000

Cash

Accounts receivable

Allowance for doubtful accounts

Inventory

Equipment

Accumulated depreciation-equipment

2,000

23,000

11,200

4,800

Total

Total

$81,000

The partners share income and loss 5:3:2. During the process of liquidation, the transactions be-

low were completed in the following sequence.

1. A total of $43,000 was received from converting noncash assets into cash.

2. Liabilities were paid in full.

3. Cash was paid to the partners with credit balances.

Instructions

(a) Loss on realization $10,000

Cash paid: to Neeley

$18,000; to Doonan $2,800

(a) Prepare a cash distribution schedule.

(b) Prepare the entries to record the transactions.

(c) Post to the cash and capital accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning