O Townhouse and rental income are Sam's separate property; condo becomes community property

O Townhouse and rental income are Sam's separate property; condo becomes community property

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 61TPC

Related questions

Question

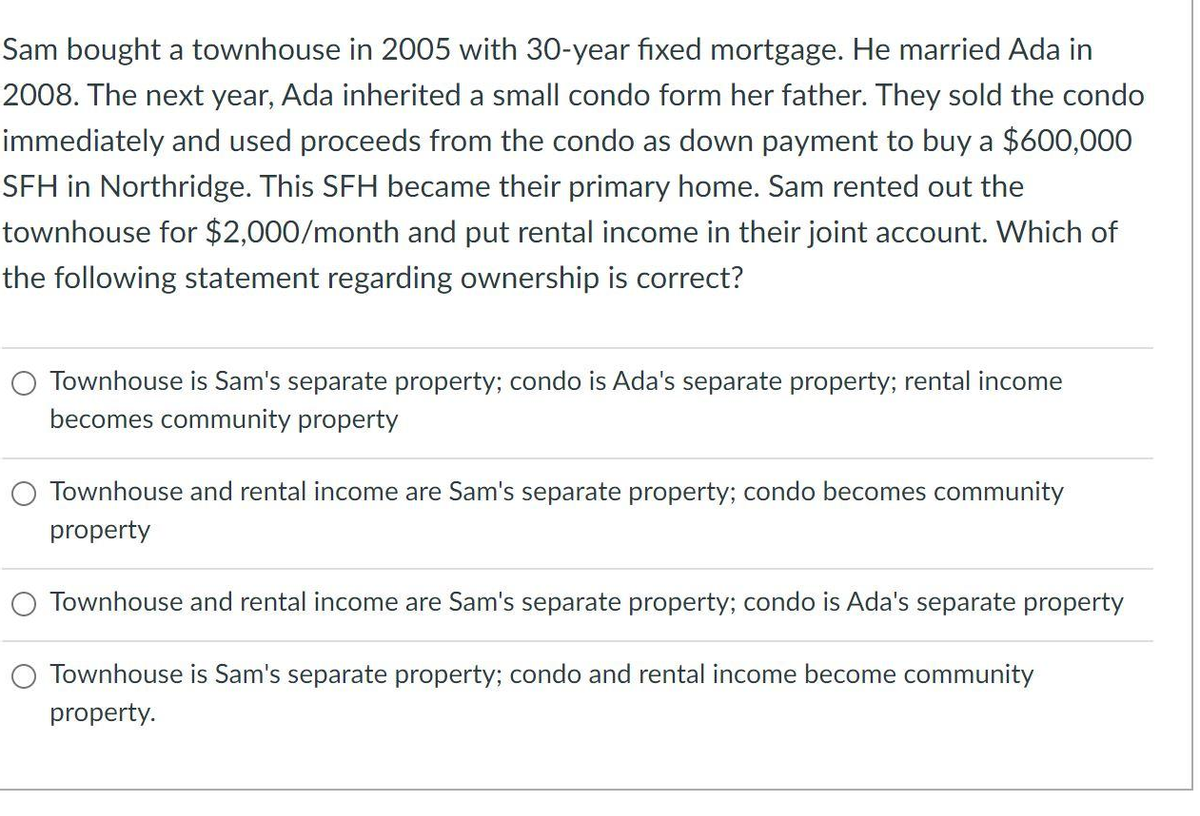

Transcribed Image Text:Sam bought a townhouse in 2005 with 30-year fixed mortgage. He married Ada in

2008. The next year, Ada inherited a small condo form her father. They sold the condo

immediately and used proceeds from the condo as down payment to buy a $600,000

SFH in Northridge. This SFH became their primary home. Sam rented out the

townhouse for $2,000/month and put rental income in their joint account. Which of

the following statement regarding ownership is correct?

Townhouse is Sam's separate property; condo is Ada's separate property; rental income

becomes community property

O Townhouse and rental income are Sam's separate property; condo becomes community

property

Townhouse and rental income are Sam's separate property; condo is Ada's separate property

O Townhouse is Sam's separate property; condo and rental income become community

property.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT