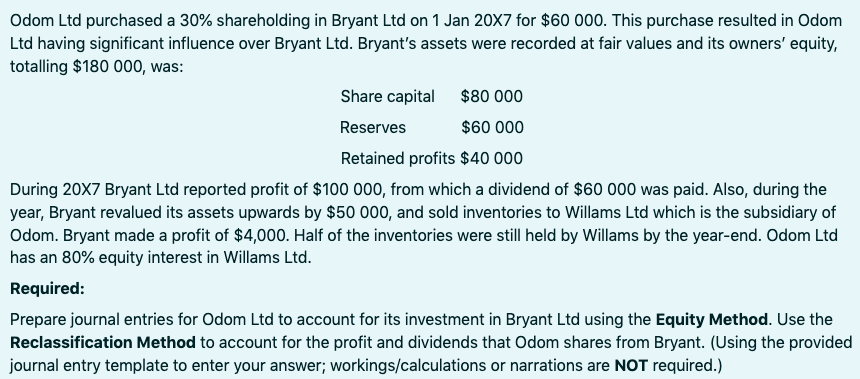

Odom Ltd purchased a 30% shareholding in Bryant Ltd on 1 Jan 20X7 for $60 000. This purchase resulted in Odom Ltd having significant influence over Bryant Ltd. Bryant's assets were recorded at fair values and its owners' equity, totalling $180 000, was: Share capital $80 000 Reserves $60 000 Retained profits $40 000 During 20X7 Bryant Ltd reported profit of $100 000, from which a dividend of $60 000 was paid. Also, during the year, Bryant revalued its assets upwards by $50 000, and sold inventories to Willams Ltd which is the subsidiary of Odom. Bryant made a profit of $4,000. Half of the inventories were still held by Willams by the year-end. Odom Ltd has an 80% equity interest in Willams Ltd.

Odom Ltd purchased a 30% shareholding in Bryant Ltd on 1 Jan 20X7 for $60 000. This purchase resulted in Odom Ltd having significant influence over Bryant Ltd. Bryant's assets were recorded at fair values and its owners' equity, totalling $180 000, was: Share capital $80 000 Reserves $60 000 Retained profits $40 000 During 20X7 Bryant Ltd reported profit of $100 000, from which a dividend of $60 000 was paid. Also, during the year, Bryant revalued its assets upwards by $50 000, and sold inventories to Willams Ltd which is the subsidiary of Odom. Bryant made a profit of $4,000. Half of the inventories were still held by Willams by the year-end. Odom Ltd has an 80% equity interest in Willams Ltd.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 6MCQ: Ames Corporation repurchases 10,000 shares of its common stock for $12 per share. The shares were...

Related questions

Question

Transcribed Image Text:Odom Ltd purchased a 30% shareholding in Bryant Ltd on 1 Jan 20X7 for $60 000. This purchase resulted in Odom

Ltd having significant influence over Bryant Ltd. Bryant's assets were recorded at fair values and its owners' equity,

totalling $180 000, was:

Share capital

$80 000

Reserves

$60 000

Retained profits $40 000

During 20X7 Bryant Ltd reported profit of $100 000, from which a dividend of $60 000 was paid. Also, during the

year, Bryant revalued its assets upwards by $50 000, and sold inventories to Willams Ltd which is the subsidiary of

Odom. Bryant made a profit of $4,000. Half of the inventories were still held by Willams by the year-end. Odom Ltd

has an 80% equity interest in Willams Ltd.

Required:

Prepare journal entries for Odom Ltd to account for its investment in Bryant Ltd using the Equity Method. Use the

Reclassification Method to account for the profit and dividends that Odom shares from Bryant. (Using the provided

journal entry template to enter your answer; workings/calculations or narrations are NOT required.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning