It is usually associated with employee compensation that is based on the number of hours worked multiplied by an hourly rate of pay.

It is usually associated with employee compensation that is based on the number of hours worked multiplied by an hourly rate of pay.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 2EB: Identify whether each of the following transactions, which are related to expense recognition, are...

Related questions

Question

i'm confused with this terms

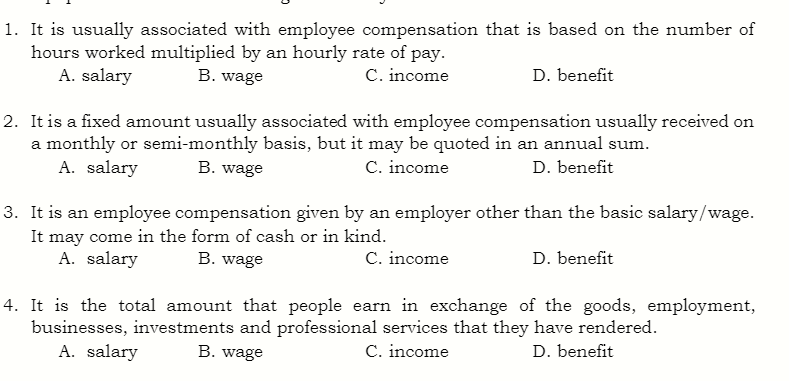

Transcribed Image Text:1. It is usually associated with employee compensation that is based on the number of

hours worked multiplied by an hourly rate of pay.

B. wage

C. income

D. benefit

A. salary

2. It is a fixed amount usually associated with employee compensation usually received on

a monthly or semi-monthly basis, but it may be quoted in an annual sum.

A. salary

B. wage

C. income

D. benefit

3. It is an employee compensation given by an employer other than the basic salary/wage.

It may come in the form of cash or in kind.

A. salary

B. wage

C. income

D. benefit

4. It is the total amount that people earn in exchange of the goods, employment,

businesses, investments and professional services that they have rendered.

D. benefit

A. salary

B. wage

C. income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning