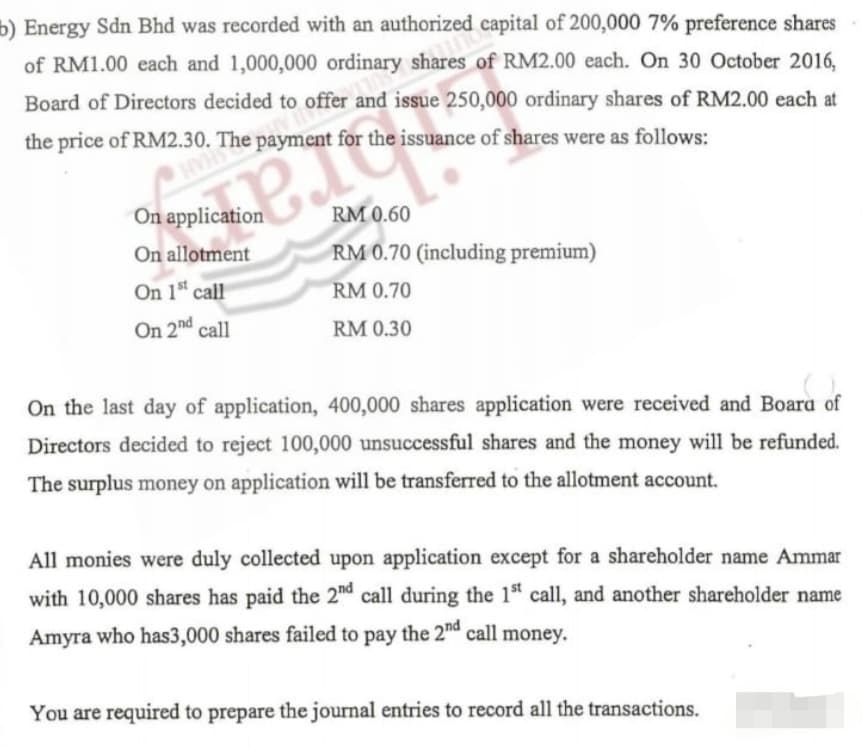

of RM1.00 each and 1,000,000 ordinary shar Energy Sdn Bhd was recorded with an authorized capital of 200,000 7% preference shares of RM1.00 each and 1,000,000 ordinary shares of RM2.00 each. On 30 October 2016, Board of Directors decided to offer and issue 250,000 ordinary shares of RM2.00 each at the price of RM2.30. The payment for the issuance of shares were as follows: On application RM 0.60 On allotment RM 0.70 (including premium) On 1" call RM 0.70 On 2nd call RM 0.30

Q: Patterson, Inc. wishes to evaluate, in summary fashion, its financial performance for the most rec p...

A: The question is based on the concept of Cost Accounting. As per the Bartleby guidelines we are allow...

Q: TK Co. manufactures a single product that goes through two processes, mixing and cooking. The data p...

A: 8) Equivalent units of X Beginning WIP 27000 Add: units added durin...

Q: 29. The Global Products Corporation has three subsidiaries. Heavy Machinery Electronics Medical Supp...

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for yo...

Q: Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporatio...

A: Preferred stock Preferred stock, are shares of a corporation's stock with dividends that are paid ou...

Q: If a gain of $8,077 is realized in selling (for cash) office equipment having a book value of $59,04...

A: The cash flow statement includes the amount of cash received or paid.

Q: 1. Answer the following questions for Steve. 2. Explain the corporate characteristic termed “no m

A: A corporation is a legal entity that is separated from its owners and has the same rights and respon...

Q: EyeGuard Equipment Incorporated (EEI) manufactures protective eyewear for use in commercial and home...

A: Calculation of Activity Rates Activity Centre Cost Driver Manufacturing overheads (In $) Activity...

Q: NO HANDWRITING OR PICTURE FORMAT PLEASE - If possible Steve Osbourne is considering opening a bu...

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued i...

Q: At the beginning of the year, Lopez Company had the following standard cost sheet for one of its che...

A: Solution 1: Actual rate of variable overhead = $125,000 / 170000 = $0.735294 per DLH Standard rate o...

Q: DEBIT CREDIT 1.Equipment Capital 1. The owner invests equipment in the business. 2. The company rece...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: On January 1, year 1, ABC Company purchased 80% of the stock of XYZ for P4,000,000 cash. Prior to th...

A: GIVEN On January 1, year 1, ABC Company purchased 80% of the stock of XYZ for P4,000,000 cash. Pri...

Q: • June wants to sell her car which was purchased for RM 120,000 after using it for 4 years. The resi...

A: offer by Go Car agency Depreciation under declining balance method depreciation rate =1/8 x100 =12.5...

Q: bonds.

A: The correct answer is Option (d) accounting supervisor.

Q: Ive tried asking this twice and neither time has the answer been accepted. Please, assist me! Ch...

A: Blue Circle Corporation Cash Flow Statement (Indirect Method) For the year ended December 31, 20...

Q: Depreciation and Rate of Return Burrell Company purchased a machine for $47,000 on January 2, 2019. ...

A: Solution Depreciation represents the reduction in the value of asset and indicate how much of asset ...

Q: The company is desirous of comparing serval financial transactions and possible outcomes to assist i...

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: 2. Management felt that because the data revealed some customers require a disproportionate share of...

A: Activity based costing is the allocation of overhead cost on the basis of the most appropriate cost ...

Q: The following information is taken from a company's records. Cost Market value per Unit per Unit Inv...

A: As per IAS 2 inventory is to be measured at cost or Net realizable value whichever is lower. Here in...

Q: A provision may be the equivalent of an estimated liability or a loss contingency that is accrued be...

A: In this question we will understand that how a provision may be equivalent of an estimated liability...

Q: Steve Osbourne is considering opening a business, but the major decision faced is how to organize th...

A: Journal entries are prepared for each and every transaction entered by the organization. It is the f...

Q: Land costing $138,463 was sold for $175,514 cash. The gain on the sale was reported on the income st...

A: Cash flow includes only the cash amount that is received or paid in the cash transaction.

Q: On January 1, 2017. Bonobo Co. issued S20,000,000 of 10% bonds due in 10 years. Each $1,000 bond is ...

A: Under the Straight-line method of amortization the coupon payment i.e. cash interest of 2000000 will...

Q: Steve Osbourne is considering opening a business, but the major decision faced is how to organize th...

A: Introduction A public Corporation have a option to raise capital by issuing stock to shareholder's. ...

Q: Steve Osbourne is considering opening a business, but the major decision faced is how to organize th...

A: Share refers to the smallest unit of the total capital of an entity.

Q: Answer the follow: Explain the corporate characteristic termed “no mutual agency" Explain the corpo...

A: The question is related to Characteristics of Comapnies. A company is an artificial person created b...

Q: Calculate the days in inventory for 2020, 2021, and 2022. (Round days in inventory to 1 decimal plac...

A: Days in inventory are also known as days inventory outstanding. It measures the number of days that ...

Q: Quantitative Problem: You own a security with the cash flows shown below. 2 3 620 365 240 290 If you...

A: Present value = Cash flows*Discounting factor Discounting factor =1/1.121,1/1.122,1/1.123,1/1.1241/1...

Q: It would be the owner's responsibility in the management agreement to: Require the manager to keep i...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: Which of the following statements is true regarding minimum corporate income tax? Minimum corporate ...

A: minimum corporate income tax in Philippines, 2 % of gross profit is imposed on domestic and residen...

Q: Instructions On January 1, the first day of the fiscal year, Shiller Company borrowed $79,000 by giv...

A: Notes Payable - Notes Payable is amount owed by the company. Which is repayable at fixed period and ...

Q: During the measurement period, which of the following may affect the amount of goodwill from busines...

A: Measurement period is the period after the acquisition date in which acquirer can adjust the provisi...

Q: Culver Corporation uses a periodic inventory system and reports the following for the month of June....

A: In this question, the data is given about Culver corporation uses a periodic inventory system and we...

Q: 17. Complete the following balance sheet. Cash $30,000 Accounts Receivable $2,000 Inventory $5,000 F...

A: Answer:- step2 in the solution.

Q: 2022 VR

A: Given:

Q: Unit Cost Total Cost Information on Entity A's Units P19.55 P 58,650 3,000 Balance at Jan. 1 21.50 2...

A: Solution: Under weighted average method of periodic inventory system, average cost per unit is deter...

Q: On January 1, year 1, ABC Company purchased 80% of the stock of XYZ for P4,000,000 cash. Prior to th...

A: GIVEN On January 1, year 1, ABC Company purchased 80% of the stock of XYZ for P4,000,000 cash. Pri...

Q: The following balances are taken from the trial balance of Mike as on 31-03-2015. Debtors Bad Debt r...

A: Bad debt reserve is the balance of provision which is made for doubtful debts. Bad debts is the amou...

Q: Entries for Bonds Payable and Installment Note Transactions The following transactions were complet...

A: A journal entry is the first step—and an essential function—of the accounting process. Journal entri...

Q: 1. The company is desirous of comparing several financial transactions and possible outcomes to assi...

A: The journal entries are prepared to record day to day transactions of the business. The shareholders...

Q: Symbol HD LOW Independent Audit Firm KPMG LLP DELOITTE & TOUCHE LLP Year end...

A: Liquidity ratios 1) Current ratio = Current assets/ Current liabilities Quick ratio = (cash + accou...

Q: Nrangler Incorporated uses the percentage of credit sales method to estimate Bad Debt Expense. At th...

A: As per percentage of credit sales method Bad debt expense = Net credit sales × % of bad debt

Q: The Changing Role of Accounting. Explain the following: 1. New technology in accounting 2. Diversi...

A: Accounting is a process that starts by recording of financial transactions. It includes the recordin...

Q: T/F. A major contentious issue with Internal Service Fund is the distribution of losses to various c...

A: Internal Service Fund is the reserve created with the motive to provide the goods, services or benef...

Q: In its first year of operations, the partnership of Li, Kwan, and Yu earned a profit of P 300,000 be...

A: The Profit after deducting all the expenses are distributed among the partners in the profit sharing...

Q: Preble Company manufactures one product. Its variable manufacturing overhead is applied to productio...

A: Labor spending variance = Actual labor cost - Standard labor cost Variable overhead rate variance= (...

Q: Leaky Black sells cars for $30,000 (cost to Leaky of 15,000) that come with a 2 year assurance-type ...

A: A written contract between the seller and buyer to repair or replace the item for a specified period...

Q: Is it true or false that corporations muse issue common stock, but may or may not decide to issue pr...

A: Steve Osbourne- Opening a business Massive profit during 1st year and following year relatively pro...

Q: The company is desirous of comparing serval financial transactions and possible outcomes to assist i...

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued i...

Q: Adger Corporation is a service company that measures its output based on the number of customers ser...

A: Fixed cost remains same i.e. it doesn't changes with the changing level of production or sales where...

Q: Common shares, 600,000 authorized, 60,000 shares issued $500,000 Contributed surplus (from a 2010 ...

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued i...

Step by step

Solved in 2 steps

- Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Vishnu Company is authorized to issue 500,000 shares of $2 par value common stock. In conjunction with its incorporation process and the IPO, the company has the following transaction: Apr. 10, issued 1,000 shares of stock for legal services valued at $15,000. Journalize the transaction.Juniper Company is authorized to issue 5,000,000 shares of $2 par value common stock. In conjunction with its incorporation process and the IPO, the company has the following transaction: Mar. 1, issued 4,000 shares of stock in exchange for equipment worth $250,000. Journalize the transaction.

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Effective May 1, the shareholders of Baltimore Corporation approved a 2-for-1 split of the companys common stock and an increase in authorized common shares from 100,000 shares (par value 20 per share) to 200,000 shares (par value 10 per share). Baltimores shareholders equity items immediately before issuance of the stock split shares were as follows: What should be the balances in Baltimores Additional Paid-in Capital and Retained Earnings accounts immediately after the stock split is effected?MacKenzie Mining Corporation is authorized to issue 50,000 shares of $500 par value 7% preferred stock. It is also authorized to issue 5,000,000 shares of $3 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.

- Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Comprehensive Young Corporation has been operating successfully for several years. It is authorized to issue 24,000 shares of no-par common stock and 6,000 shares of 8%, 100 par preferred stock. The Contributed Capital section of its January 1, 2019, balance sheet is as follows: Part a. A shareholder has raised the following questions: 1. What is the legal capital of the corporation? 2. At what average price per share has the preferred stock been issued? 3. How many shares of common stock have been issued (the common stock has been issued at an average price of 23 per share)? Part b. The company engaged in the following transactions in 2019: Required: 1. Answer the questions in Part a. 2. Prepare journal entries to record the transactions in Part b. 3. Prepare the Contributed Capital section of Youngs December 31, 2016, balance sheet.

- Alert Companys shareholders equity prior to any of the following events is as follows: The company is considering the following alternative items: 1. An 8% stock dividend on the common stock when it is selling for 30 per share. 2. A 30% stock dividend on the common stock when it is selling for 32 per share. 3. A special stock dividend to common shareholders consisting of 1 share of preferred stock for every 100 shares of common stock. The preferred stock and common stock are selling for 123 and 31 per share, respectively. 4. A 2-for-1 stock split on the common stock, reducing the par value to 5 per share (assume the same date for declaration and issuance). The market price is 30 per share on the common stock. 5. A property dividend to common shareholders consisting of 100 bonds issued by West Company. These bonds are carried on the Alert Company books as an available-for sale investment at a fair value of 48,000 (which is also its cost); it has a current value of 54,000. 6. A cash dividend, consisting of a normal dividend and a liquidating dividend, on both the preferred and the common stock. The 10% preferred dividend includes a 2% liquidating dividend, and the 2.30 per share common dividend includes a 0.30 per share liquidating dividend (separate liquidating dividend contra accounts should be used). Required: For each of the preceding alternative items: 1. Record (a) the journal entry at the date of declaration and (b) the journal entry at the date of issuance. 2. Compute the balances in the shareholders equity accounts immediately after the issuance (any gains or losses are to be reflected in the retained earnings balance; ignore income taxes).Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)