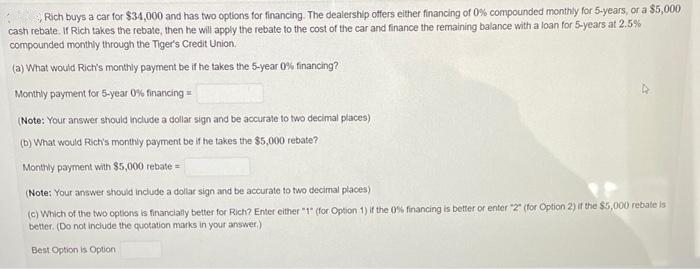

Rich buys a car for $34,000 and has two options for financing. The dealership offers either financing of 0% compounded monthly for 5-years, or a $5,000 cash rebate. If Rich takes the rebate, then he will apply the rebate to the cost of the car and finance the remaining balance with a loan for 5-years at 2.5% compounded monthly through the Tiger's Credit Union. (a) What would Rich's monthly payment be if he takes the 5-year 0% financing? Monthly payment for 5-year 0% financing= (Note: Your answer should include a dollar sign and be accurate to two decimal places) (b) What would Rich's monthly payment be if he takes the $5,000 rebate? Monthly payment with $5,000 rebate= (Note: Your answer should include a dollar sign and be accurate to two decimal places) (c) Which of the two options is financially better for Rich? Enter either "1" (for Option 1) if the 0% financing is better or enter "2" (for Option 2) if the $5,000 rebate is better. (Do not include the quotation marks in your answer.) Best Option is Option

Rich buys a car for $34,000 and has two options for financing. The dealership offers either financing of 0% compounded monthly for 5-years, or a $5,000 cash rebate. If Rich takes the rebate, then he will apply the rebate to the cost of the car and finance the remaining balance with a loan for 5-years at 2.5% compounded monthly through the Tiger's Credit Union. (a) What would Rich's monthly payment be if he takes the 5-year 0% financing? Monthly payment for 5-year 0% financing= (Note: Your answer should include a dollar sign and be accurate to two decimal places) (b) What would Rich's monthly payment be if he takes the $5,000 rebate? Monthly payment with $5,000 rebate= (Note: Your answer should include a dollar sign and be accurate to two decimal places) (c) Which of the two options is financially better for Rich? Enter either "1" (for Option 1) if the 0% financing is better or enter "2" (for Option 2) if the $5,000 rebate is better. (Do not include the quotation marks in your answer.) Best Option is Option

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 27M

Related questions

Question

Transcribed Image Text:Rich buys a car for $34,000 and has two options for financing. The dealership offers either financing of 0 % compounded monthly for 5-years, or a $5,000

cash rebate. If Rich takes the rebate, then he will apply the rebate to the cost of the car and finance the remaining balance with a loan for 5-years at 2.5%

compounded monthly through the Tiger's Credit Union.

(a) What would Rich's monthly payment be if he takes the 5-year 0% financing?

Monthly payment for 5-year 0% financing=

(Note: Your answer should include a dollar sign and be accurate to two decimal places)

(b) What would Rich's monthly payment be if he takes the $5,000 rebate?

Monthly payment with $5,000 rebate =

(Note: Your answer should include a dollar sign and be accurate to two decimal places)

(c) Which of the two options is financially better for Rich? Enter either "1" (for Option 1) if the 0% financing is better or enter "2" (for Option 2) if the $5,000 rebate is

better. (Do not include the quotation marks in your answer.)

Best Option is Option

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT