oghis Do It! Review 6-1 a, b1 Victoria Company reports the following operating results for the month of April. CALCULATOR PR VICTORIA COMPANY CVP Income Statement For the Month Ended April 30, 2020 Total Per Unit Sales (9,000 units) $450,000 $50 Variable costs 225,000 25.00 Contribution margin 225,000 $25.00 175,050 Fixed expenses $49,950 Management is considering the following course of action to increase net income: Reduce the selling price by 5%, with no changes to unit variable costs o Management is confident that this change will increase unit sales by 20%. Net income

oghis Do It! Review 6-1 a, b1 Victoria Company reports the following operating results for the month of April. CALCULATOR PR VICTORIA COMPANY CVP Income Statement For the Month Ended April 30, 2020 Total Per Unit Sales (9,000 units) $450,000 $50 Variable costs 225,000 25.00 Contribution margin 225,000 $25.00 175,050 Fixed expenses $49,950 Management is considering the following course of action to increase net income: Reduce the selling price by 5%, with no changes to unit variable costs o Management is confident that this change will increase unit sales by 20%. Net income

Chapter4: Operating Activities: Sales And Cash Receipts

Section: Chapter Questions

Problem 1.3C

Related questions

Question

Transcribed Image Text:ldoghis

Home -M

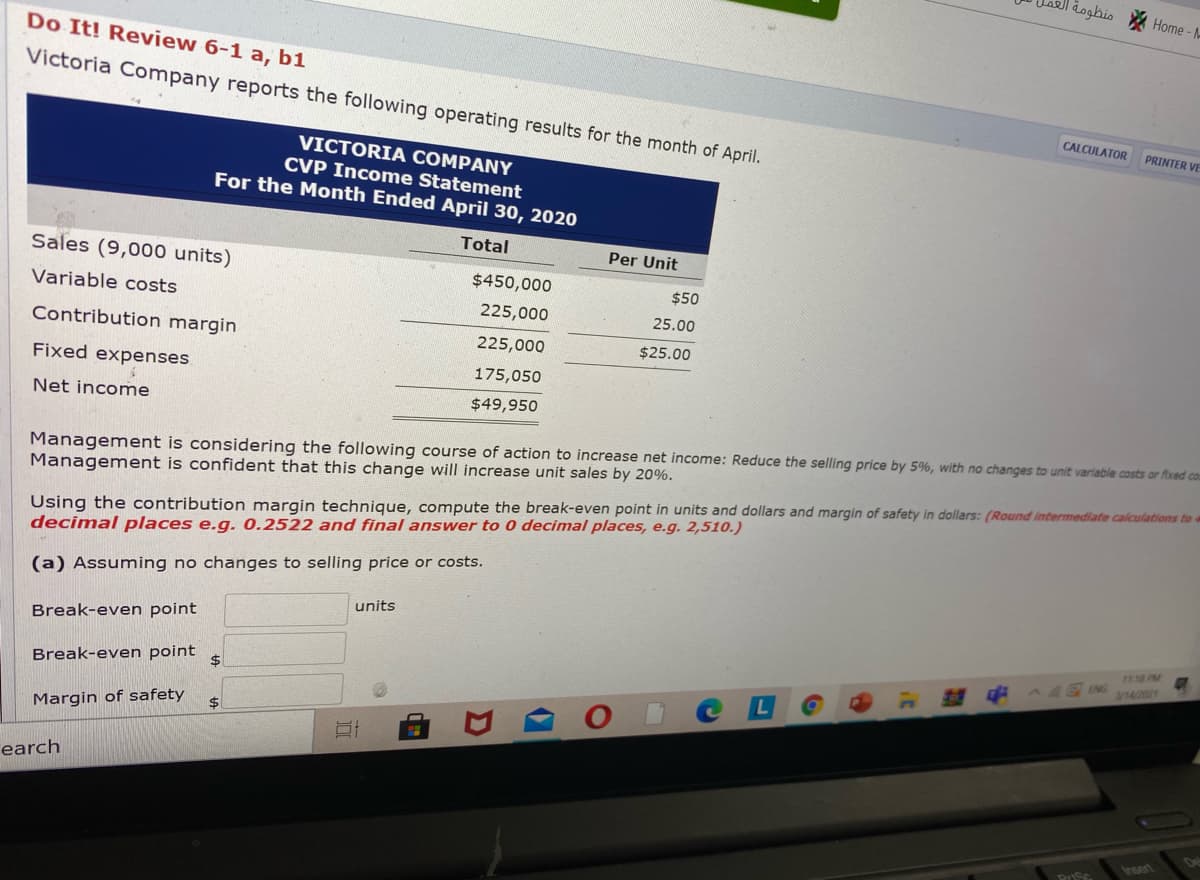

Do It! Review 6-1 a, b1

Victoria Company reports the following operating results for the month of April.

CALCULATOR

PRINTER VE

VICTORIA COMPANY

CVP Income Statement

For the Month Ended April 30, 2020

Total

Per Unit

Sales (9,000 units)

$450,000

$50

Variable costs

225,000

25.00

Contribution margin

225,000

$25.00

Fixed expenses

175,050

Net income

$49,950

Management is considering the following course of action to increase net income: Reduce

Management is confident that this change will increase unit sales by 20%.

selling price by 5%, with nơ changes to unit variable costs or fixed cou

Using the contribution margin technique, compute the break-even point in units and dollars and margin of safety in dollars: (Round intermediate calculations to a

decimal places e.g. 0.2522 and final answer to 0 decimal places, e.g. 2,510.)

(a) Assuming no changes to selling price or costs.

units

Break-even point

1118 PM

ENG

/14/2021

Break-even point

$

中

2$

Margin of safety

earch

Insert

1O

Transcribed Image Text:Hòme-MyADU

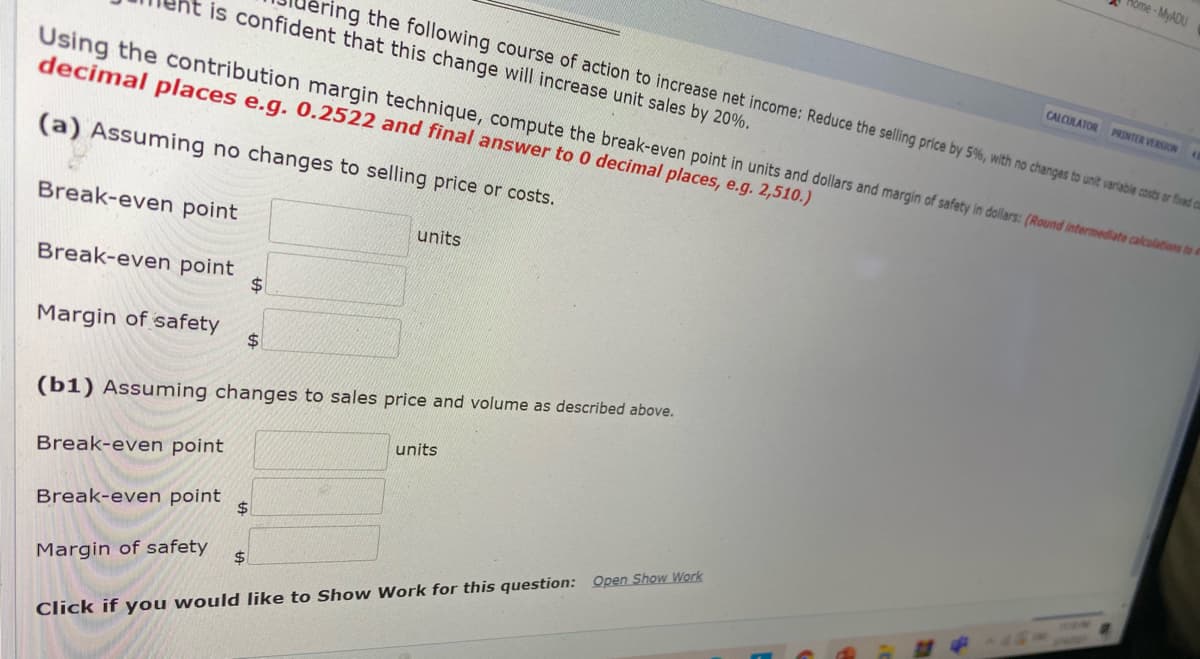

ring the following course of action to increase net income: Reduce the selling price by 5%, with no changes to unit variable costs or foed co

is confident that this change will increase unit sales by 20%.

CALCULATOR

PRINTER VERSION

Using the contribution margin technique, compute the break-even point in units and dollars and margin of safety in dollars: (Round intermediate calculations to

decimal places e.g. 0.2522 and final answer to 0 decimal places, e.g. 2,510.)

(a) Assuming no changes to selling price or costs.

Break-even point

units

Break-even point

$4

Margin of safety

%$4

(b1) Assuming changes to sales price and volume as described above.

units

Break-even point

Break-even point

$4

Margin of safety

$1

Click if you would like to Show Work for this question: Open Show Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you