rge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin onds. (Use the U.S. tax rate schedule for married filing jointly). equired: . If Jorge and Anita earn an additional $100,000 of taxable income, what is their marginal tax rate on this income? . What is their marginal rate if, instead, they report an additional $100,000 in deductions? or all requirements, round your answers to 2 decimal places.) a. Marginal tax rate b. Marginal tax rate %

rge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin onds. (Use the U.S. tax rate schedule for married filing jointly). equired: . If Jorge and Anita earn an additional $100,000 of taxable income, what is their marginal tax rate on this income? . What is their marginal rate if, instead, they report an additional $100,000 in deductions? or all requirements, round your answers to 2 decimal places.) a. Marginal tax rate b. Marginal tax rate %

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 29P: Arthur and Cora are married and have 2 dependent children. They have a gross income of 95,000. Their...

Related questions

Question

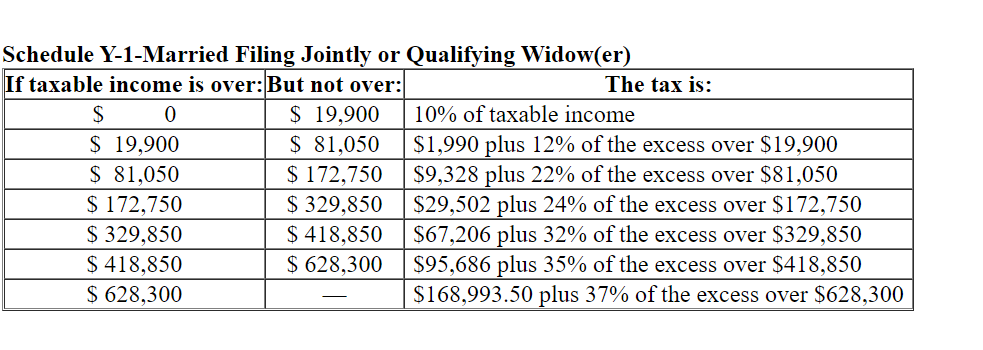

Transcribed Image Text:Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over:But not over:

The tax is:

$ 19,900

$ 81,050

$ 172,750

$ 329,850

$ 418,850

$ 628,300

$

10% of taxable income

$ 19,900

$ 81,050

$ 172,750

$ 329,850

$ 418,850

$ 628,300

$1,990 plus 12% of the excess over $19,900

$9,328 plus 22% of the excess over $81,050

$29,502 plus 24% of the excess over $172,750

$67,206 plus 32% of the excess over $329,850

$95,686 plus 35% of the excess over $418,850

$168,993.50 plus 37% of the excess over $628,300

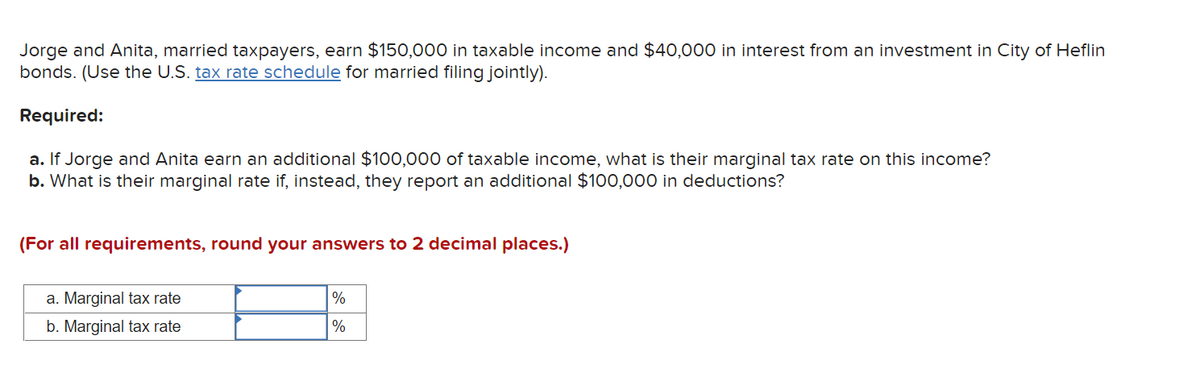

Transcribed Image Text:Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin

bonds. (Use the U.S. tax rate schedule for married filing jointly).

Required:

a. If Jorge and Anita earn an additional $100,000 of taxable income, what is their marginal tax rate on this income?

b. What is their marginal rate if, instead, they report an additional $100,000 in deductions?

(For all requirements, round your answers to 2 decimal places.)

a. Marginal tax rate

%

b. Marginal tax rate

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you