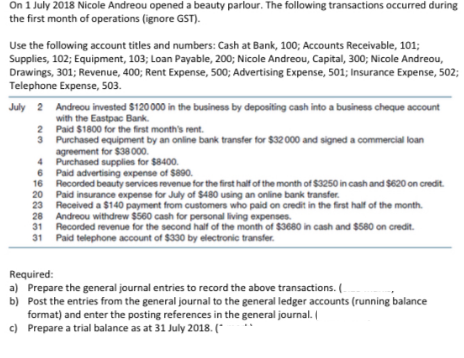

On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations (ignore GST). Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101; Supplies, 102; Equipment, 103; Loan Payable, 200; Nicole Andreou, Capital, 300; Nicole Andreou, Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502; Telephone Expense, 503. July 2 Andreou invested $120000 in the business by depositing cash into a business cheque account with the Eastpac Bank. 2 Paid $1800 for the first month's rent. 3 Purchased equipment by an online bank transfer for $32 000 and signed a commercial loan agreement for $38 000. 4 Purchased supplies for $8400. 6 Paid advertising expense of $890. 16 Recorded beauty services revenue for the first half of the month of $3250 in cash and $620 on credit. 20 Paid insurance expense for July of $480 using an online bank transfer. 23 Received a $140 payment from customers who paid on credit in the first half of the month. 28 Andreou withdrew $560 cash for personal living expenses. 31 Recorded revenue for the second half of the month of $3680 in cash and $580 on credit. 31 Paid telephone account of $330 by electronic transfer. Required: a) Prepare the general journal entries to record the above transactions. ( b) Post the entries from the general journal to the general ledger accounts (running balance format) and enter the posting references in the general journal. c) Prepare a trial balance as at 31 July 2018. (*

On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations (ignore GST). Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101; Supplies, 102; Equipment, 103; Loan Payable, 200; Nicole Andreou, Capital, 300; Nicole Andreou, Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502; Telephone Expense, 503. July 2 Andreou invested $120000 in the business by depositing cash into a business cheque account with the Eastpac Bank. 2 Paid $1800 for the first month's rent. 3 Purchased equipment by an online bank transfer for $32 000 and signed a commercial loan agreement for $38 000. 4 Purchased supplies for $8400. 6 Paid advertising expense of $890. 16 Recorded beauty services revenue for the first half of the month of $3250 in cash and $620 on credit. 20 Paid insurance expense for July of $480 using an online bank transfer. 23 Received a $140 payment from customers who paid on credit in the first half of the month. 28 Andreou withdrew $560 cash for personal living expenses. 31 Recorded revenue for the second half of the month of $3680 in cash and $580 on credit. 31 Paid telephone account of $330 by electronic transfer. Required: a) Prepare the general journal entries to record the above transactions. ( b) Post the entries from the general journal to the general ledger accounts (running balance format) and enter the posting references in the general journal. c) Prepare a trial balance as at 31 July 2018. (*

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 1PB: During February of this year, H. Rose established Rose Shoe Hospital. The following asset,...

Related questions

Question

Transcribed Image Text:On 1 July 2018 Nicole Andreou opened a beauty parlour. The following transactions occurred during

the first month of operations (ignore GST).

Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101;

Supplies, 102; Equipment, 103; Loan Payable, 200; Nicole Andreou, Capital, 300; Nicole Andreou,

Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502;

Telephone Expense, 503.

July 2 Andreou invested $120000 in the business by depositing cash into a business cheque account

with the Eastpac Bank.

2 Paid $1800 for the first month's rent.

3 Purchased equipment by an online bank transfer for $32 000 and signed a commercial loan

agreement for $38 000.

4 Purchased supplies for $8400.

6 Paid advertising expense of $890.

16 Recorded beauty services revenue for the first half of the month of $3250 in cash and $620 on credit.

20 Paid insurance expense for July of $480 using an online bank transfer.

23 Received a $140 payment from customers who paid on credit in the first half of the month.

28 Andreou withdrew $560 cash for personal living expenses.

31 Recorded revenue for the second half of the month of $3680 in cash and $580 on credit.

31 Paid telephone account of $330 by electronic transfer.

Required:

a) Prepare the general journal entries to record the above transactions. (

b) Post the entries from the general journal to the general ledger accounts (running balance

format) and enter the posting references in the general journal.

c) Prepare a trial balance as at 31 July 2018. (*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning