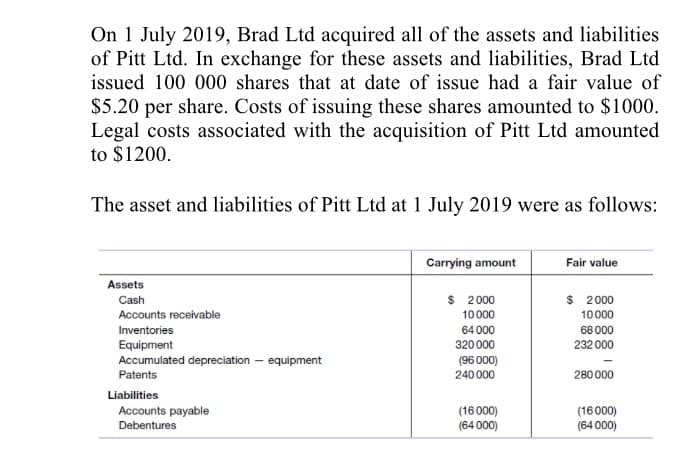

On 1 July 2019, Brad Ltd acquired all of the assets and liabilities of Pitt Ltd. In exchange for these assets and liabilities, Brad Ltd issued 100 000 shares that at date of issue had a fair value of $5.20 per share. Costs of issuing these shares amounted to $1000. Legal costs associated with the acquisition of Pitt Ltd amounted to $1200. The asset and liabilities of Pitt Ltd at 1 July 2019 were as follows: Carrying amount Fair value Assets $ 2000 $ 2000 10000 Cash Accounts receivable 10000 Inventories 64 000 68 000 Equipment Accumulated depreciation – equipment 320000 232 000 (96 000) 240000 Patents 280 000 Liabilities Accounts payable (16000) (64 000) (16000) (64 000) Debentures

On 1 July 2019, Brad Ltd acquired all of the assets and liabilities of Pitt Ltd. In exchange for these assets and liabilities, Brad Ltd issued 100 000 shares that at date of issue had a fair value of $5.20 per share. Costs of issuing these shares amounted to $1000. Legal costs associated with the acquisition of Pitt Ltd amounted to $1200. The asset and liabilities of Pitt Ltd at 1 July 2019 were as follows: Carrying amount Fair value Assets $ 2000 $ 2000 10000 Cash Accounts receivable 10000 Inventories 64 000 68 000 Equipment Accumulated depreciation – equipment 320000 232 000 (96 000) 240000 Patents 280 000 Liabilities Accounts payable (16000) (64 000) (16000) (64 000) Debentures

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 33CE

Related questions

Question

Prepare the

Transcribed Image Text:On 1 July 2019, Brad Ltd acquired all of the assets and liabilities

of Pitt Ltd. In exchange for these assets and liabilities, Brad Ltd

issued 100 000 shares that at date of issue had a fair value of

$5.20 per share. Costs of issuing these shares amounted to $1000.

Legal costs associated with the acquisition of Pitt Ltd amounted

to $1200.

The asset and liabilities of Pitt Ltd at 1 July 2019 were as follows:

Carrying amount

Fair value

Assets

$ 2000

$ 2000

Cash

Accounts receivable

10000

10000

Inventories

64 000

68 000

Equipment

320000

232 000

Accumulated depreciation – equipment

Patents

(96 000)

240 000

280 000

Liabilities

Accounts payable

(16000)

(64 000)

(16000)

(64 000)

Debentures

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning