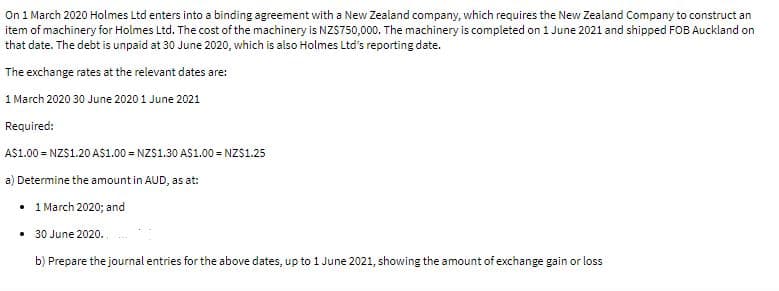

On 1 March 2020 Holmes Ltd enters into a binding agreement with a New Zealand company, which requires the New Zealand Company to construct an item of machinery for Holmes Ltd. The cost of the machinery is NZS750,000. The machinery is completed on 1 June 2021 and shipped FOB Auckland on that date. The debt is unpaid at 30 June 2020, which is also Holmes Ltd's reporting date. The exchange rates at the relevant dates are: 1 March 2020 30 June 2020 1 June 2021 Required: A$1.00 = NZS1.20 AS1.00 = NZS1.30 AS1.00 = NZS1.25 a) Determine the amount in AUD, as at: • 1 March 2020; and 30 June 2020. b) Prepare the journal entries for the above dates, up to 1 June 2021, showing the amount of exchange gain or loss

On 1 March 2020 Holmes Ltd enters into a binding agreement with a New Zealand company, which requires the New Zealand Company to construct an item of machinery for Holmes Ltd. The cost of the machinery is NZS750,000. The machinery is completed on 1 June 2021 and shipped FOB Auckland on that date. The debt is unpaid at 30 June 2020, which is also Holmes Ltd's reporting date. The exchange rates at the relevant dates are: 1 March 2020 30 June 2020 1 June 2021 Required: A$1.00 = NZS1.20 AS1.00 = NZS1.30 AS1.00 = NZS1.25 a) Determine the amount in AUD, as at: • 1 March 2020; and 30 June 2020. b) Prepare the journal entries for the above dates, up to 1 June 2021, showing the amount of exchange gain or loss

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 22PC

Related questions

Question

Transcribed Image Text:On 1 March 2020 Holmes Ltd enters into a binding agreement with a New Zealand company, which requires the New Zealand Company to construct an

item of machinery for Holmes Ltd. The cost of the machinery is NZS750,000. The machinery is completed on 1 June 2021 and shipped FOB Auckland on

that date. The debt is unpaid at 30 June 2020, which is also Holmes Ltd's reporting date.

The exchange rates at the relevant dates are:

1 March 2020 30 June 2020 1 June 2021

Required:

A$1.00 = NZS1.20 AS1.00 = NZS1.30 AS1.00 = NZS1.25

a) Determine the amount in AUD, as at:

• 1 March 2020; and

30 June 2020.

b) Prepare the journal entries for the above dates, up to 1 June 2021, showing the amount of exchange gain or loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning