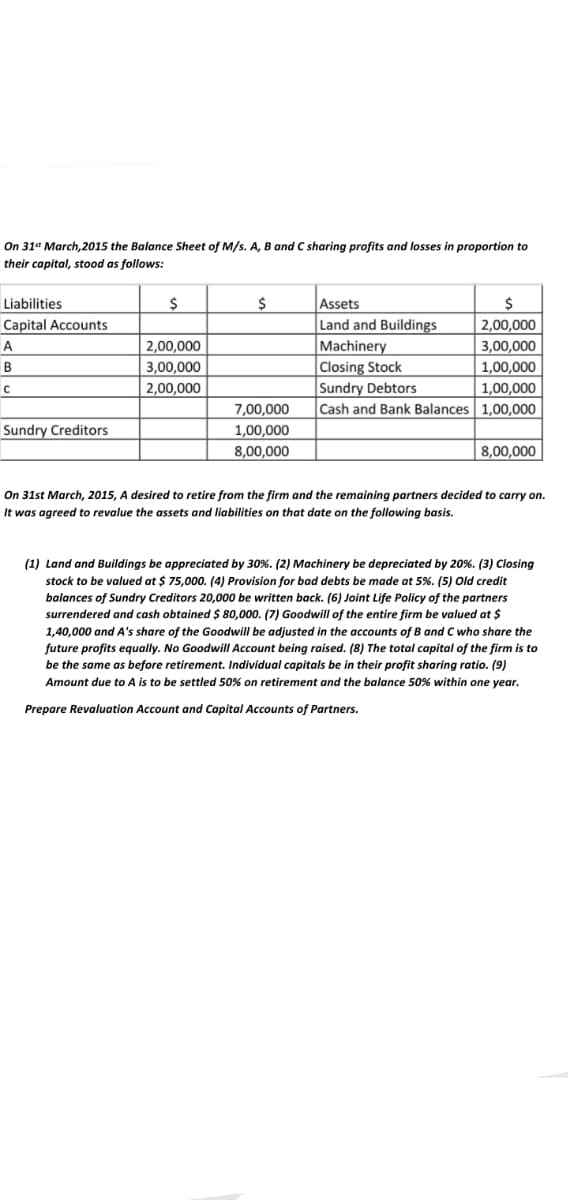

On 31" March, 2015 the Balance Sheet of M/s. A, B and C sharing profits and losses in proportion to their capital, stood as follows: Assets Land and Buildings Machinery |Closing Stock |Sundry Debtors Cash and Bank Balances 1,00,000 Liabilities Capital Accounts 2,00,000 3,00,000 1,00,000 1,00,000 |2,00,000 3,00,000 A B 2,00,000 7,00,000 1,00,000 8,00,000 Sundry Creditors 8,00,000 On 31st March, 2015, A desired to retire from the firm and the remaining partners decided to carry on. It was agreed to revalue the assets and liabilities on that date on the following basis. (1) Land and Buildings be appreciated by 30%. (2) Machinery be depreciated by 20%. (3) Closing stock to be valued at $ 75,000. (4) Provision for bad debts be made at 5%. (5) Old credit balances of Sundry Creditors 20,000 be written back. (6) Joint Life Policy of the partners surrendered and cash obtained $ 80,000. (7) Goodwill of the entire firm be valued at $ 1,40,000 and A's share of the Goodwill be adjusted in the accounts of B and C who share the future profits equally. No Goodwill Account being raised. (8) The total capital of the firm is to be the same as before retirement. Individual capitals be in their profit sharing ratio. (9) Amount due to A is to be settled 50% on retirement and the balance 50% within one year. Prepare Revaluation Account and Capital Accounts of Partners.

On 31" March, 2015 the Balance Sheet of M/s. A, B and C sharing profits and losses in proportion to their capital, stood as follows: Assets Land and Buildings Machinery |Closing Stock |Sundry Debtors Cash and Bank Balances 1,00,000 Liabilities Capital Accounts 2,00,000 3,00,000 1,00,000 1,00,000 |2,00,000 3,00,000 A B 2,00,000 7,00,000 1,00,000 8,00,000 Sundry Creditors 8,00,000 On 31st March, 2015, A desired to retire from the firm and the remaining partners decided to carry on. It was agreed to revalue the assets and liabilities on that date on the following basis. (1) Land and Buildings be appreciated by 30%. (2) Machinery be depreciated by 20%. (3) Closing stock to be valued at $ 75,000. (4) Provision for bad debts be made at 5%. (5) Old credit balances of Sundry Creditors 20,000 be written back. (6) Joint Life Policy of the partners surrendered and cash obtained $ 80,000. (7) Goodwill of the entire firm be valued at $ 1,40,000 and A's share of the Goodwill be adjusted in the accounts of B and C who share the future profits equally. No Goodwill Account being raised. (8) The total capital of the firm is to be the same as before retirement. Individual capitals be in their profit sharing ratio. (9) Amount due to A is to be settled 50% on retirement and the balance 50% within one year. Prepare Revaluation Account and Capital Accounts of Partners.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter2: Analyzing Transactions Into Debit And Credit Parts

Section: Chapter Questions

Problem 1ANFS

Related questions

Question

Transcribed Image Text:On 31* March, 2015 the Balance Sheet of M/s. A, B and C sharing profits and losses in proportion to

their capital, stood as follows:

Liabilities

Assets

Land and Buildings

Machinery

|Closing Stock

Sundry Debtors

Cash and Bank Balances 1,00,000

Capital Accounts

2.00.000

A

2,00,000

3,00,000

3,00,000

2,00,000

1,00,000

1,00,000

B

7,00,000

1,00,000

Sundry Creditors

8,00,000

8,00,000

On 31st March, 2015, A desired to retire from the firm and the remaining partners decided to carry on.

It was agreed to revalue the assets and liabilities on that date on the following basis.

(1) Land and Buildings be appreciated by 30%. (2) Machinery be depreciated by 20%. (3) Closing

stock to be valued at $ 75,000. (4) Provision for bad debts be made at 5%. (5) Old credit

balances of Sundry Creditors 20,000 be written back. (6) Joint Life Policy of the partners

surrendered and cash obtained $ 80,000. (7) Goodwill of the entire firm be valued at $

1,40,000 and A's share of the Goodwill be adjusted in the accounts of B and C who share the

future profits equally. No Goodwill Account being raised. (8) The total capital of the firm is to

be the same as before retirement. Individual capitals be in their profit sharing ratio. (9)

Amount due to A is to be settled 50% on retirement and the balance 50% within one year.

Prepare Revaluation Account and Capital Accounts of Partners.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning