On a multiple-step income statement, income from operations is arrived at after considering all except: a. administrative salaries. b. marketing expense. cost of goods sold. c. d. interest expense.

On a multiple-step income statement, income from operations is arrived at after considering all except: a. administrative salaries. b. marketing expense. cost of goods sold. c. d. interest expense.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Question

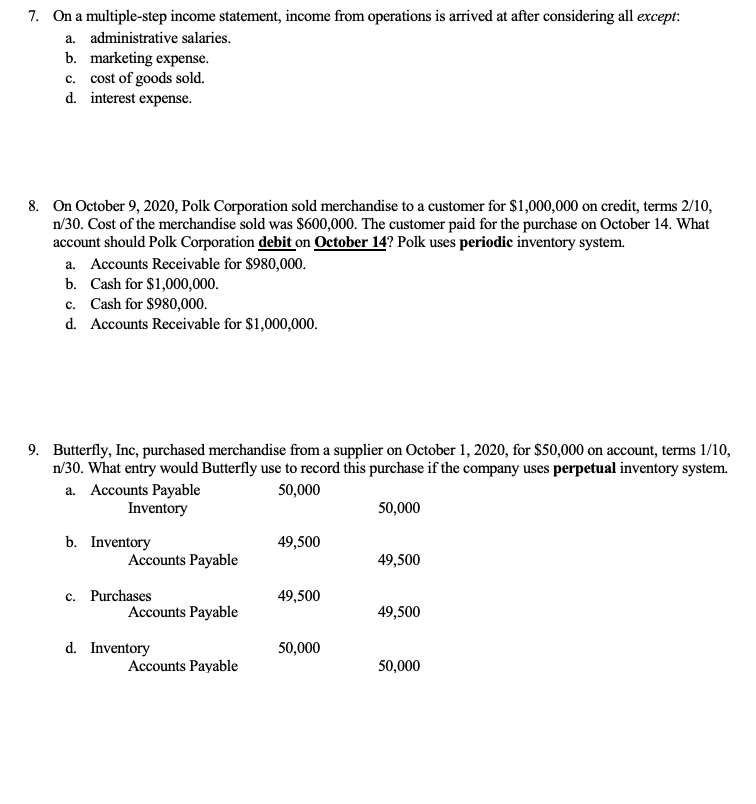

Transcribed Image Text:7. On a multiple-step income statement, income from operations is arrived at after considering all except:

a. administrative salaries.

b. marketing expense.

c. cost of goods sold.

d. interest expense.

8. On October 9, 2020, Polk Corporation sold merchandise to a customer for $1,000,000 on credit, terms 2/10,

n/30. Cost of the merchandise sold was $600,000. The customer paid for the purchase on October 14. What

account should Polk Corporation debit on October 14? Polk uses periodic inventory system.

a. Accounts Receivable for $980,000.

b. Cash for $1,000,000.

c. Cash for $980,000.

d. Accounts Receivable for $1,000,000.

9. Butterfly, Inc, purchased merchandise from a supplier on October 1, 2020, for $50,000 on account, terms 1/10,

n/30. What entry would Butterfly use to record this purchase if the company uses perpetual inventory system.

a. Accounts Payable

50,000

Inventory

50,000

b. Inventory

49,500

Accounts Payable

49,500

c. Purchases

49,500

Accounts Payable

49,500

d. Inventory

50,000

Accounts Payable

50,000

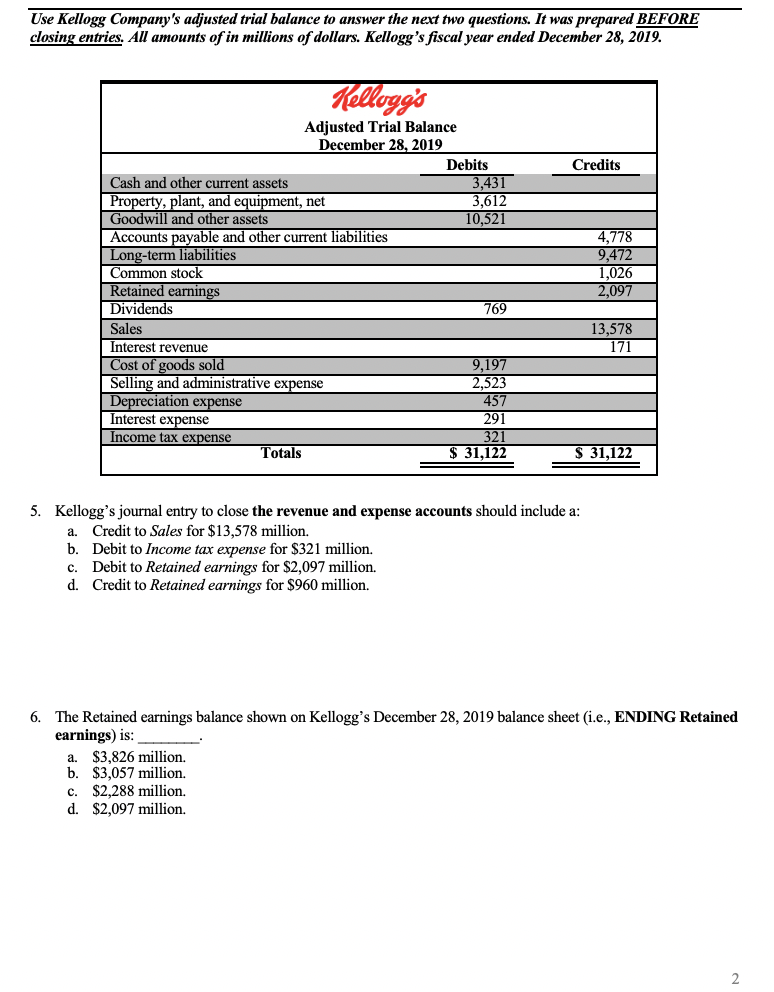

Transcribed Image Text:Use Kellogg Company's adjusted trial balance to answer the next two questions. It was prepared BEFORE

closing entries. All amounts of in millions of dollars. Kellogg's fiscal year ended December 28, 2019.

Hellogg's

Adjusted Trial Balance

December 28, 2019

Debits

Credits

3,431

3,612

10,521

Cash and other current assets

Property, plant, and equipment, net

Goodwill and other assets

Accounts payable and other current liabilities

Long-term liabilities

Common stock

Retained earnings

Dividends

4,778

9,472

1,026

2,097

769

13,578

171

Sales

Interest revenue

Cost of goods sold

Selling and administrative expense

Depreciation expense

Interest expense

Income tax expense

9,197

2,523

457

291

321

$ 31,122

Totals

$ 31,122

5. Kellogg's journal entry to close the revenue and expense accounts should include a:

Credit to Sales for $13,578 million.

b. Debit to Income tax expense for $321 million.

Debit to Retained earnings for $2,097 million.

d. Credit to Retained earnings for $960 million.

а.

C.

6. The Retained earnings balance shown on Kellogg's December 28, 2019 balance sheet (i.e., ENDING Retained

earnings) is:

$3,826 million.

a.

b. $3,057 million.

c. $2,288 million.

d. $2,097 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT