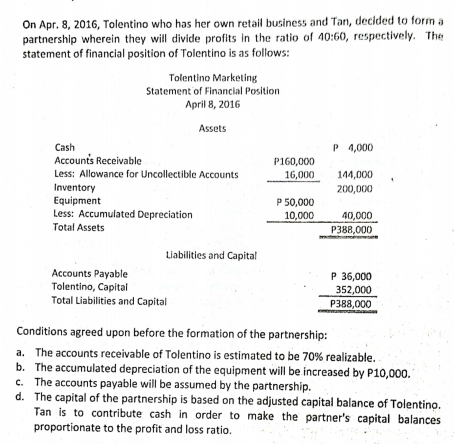

On Apr. 8, 2016, Tolentino who has her own retail business and Tan, decided to form a partnership wherein they will divide profits in the ratio of 40:60, respectively. The statement of financial position of Tolentino is as follows: Tolentino Marketing Statement of Financial Position April 8, 2016 Assets Cash Accounts Receivable Less: Allowance for Uncollectible Accounts Inventory Equipment Less: Accumulated Depreciation Total Assets P 4,000 P160,000 16,000 144,000 200,000 P 50,000 10,000 40,000 P388,000 Liabilities and Capital Accounts Payable Tolentino, Capital Total Liabilities and Capital P 36,000 352,000 P388,000 Conditions agreed upon before the formation of the partnership: a. The accounts receivable of Tolentino is estimated to be 70% realizable. b. The accumulated depreciation of the equipment will be increased by P10,000. c. The accounts payable will be assumed by the partnership. d. The capital of the partnership is based on the adjusted capital balance of Tolentino. Tan is to contribute cash in order to make the partner's capital balances proportionate to the profit and loss ratio.

On Apr. 8, 2016, Tolentino who has her own retail business and Tan, decided to form a partnership wherein they will divide profits in the ratio of 40:60, respectively. The statement of financial position of Tolentino is as follows: Tolentino Marketing Statement of Financial Position April 8, 2016 Assets Cash Accounts Receivable Less: Allowance for Uncollectible Accounts Inventory Equipment Less: Accumulated Depreciation Total Assets P 4,000 P160,000 16,000 144,000 200,000 P 50,000 10,000 40,000 P388,000 Liabilities and Capital Accounts Payable Tolentino, Capital Total Liabilities and Capital P 36,000 352,000 P388,000 Conditions agreed upon before the formation of the partnership: a. The accounts receivable of Tolentino is estimated to be 70% realizable. b. The accumulated depreciation of the equipment will be increased by P10,000. c. The accounts payable will be assumed by the partnership. d. The capital of the partnership is based on the adjusted capital balance of Tolentino. Tan is to contribute cash in order to make the partner's capital balances proportionate to the profit and loss ratio.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.3DC: Comparing Two Companies in the Same Industry: Chipotle and Panera Bread This case should be...

Related questions

Question

A Sole Proprietor and an Individual With No Business Form a

(See attached image)

Question: What are the necessary

Transcribed Image Text:On Apr. 8, 2016, Tolentino who has her own retail business and Tan, decided to form a

partnership wherein they will divide profits in the ratio of 40:60, respectively. The

statement of financial position of Tolentino is as follows:

Tolentino Marketing

Statement of Financial Position

April 8, 2016

Assets

Cash

P 4,000

Accounts Receivable

P160,000

16,000

Less: Allowance for Uncollectible Accounts

144,000

Inventory

Equipment

Less: Accumulated Depreciation

Total Assets

200,000

P 50,000

10,000

40,000

P388,000

Liabilities and Capital

Accounts Payable

Tolentino, Capital

Total Liabilities and Capital

P 36,000

352,000

P388,000

Conditions agreed upon before the formation of the partnership:

a. The accounts receivable of Tolentino is estimated to be 70% realizable.

b. The accumulated depreciation of the equipment will be increased by P10,000.

c. The accounts payable will be assumed by the partnership.

d. The capital of the partnership is based on the adjusted capital balance of Tolentino.

Tan is to contribute cash in order to make the partner's capital balances

proportionate to the profit and loss ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning