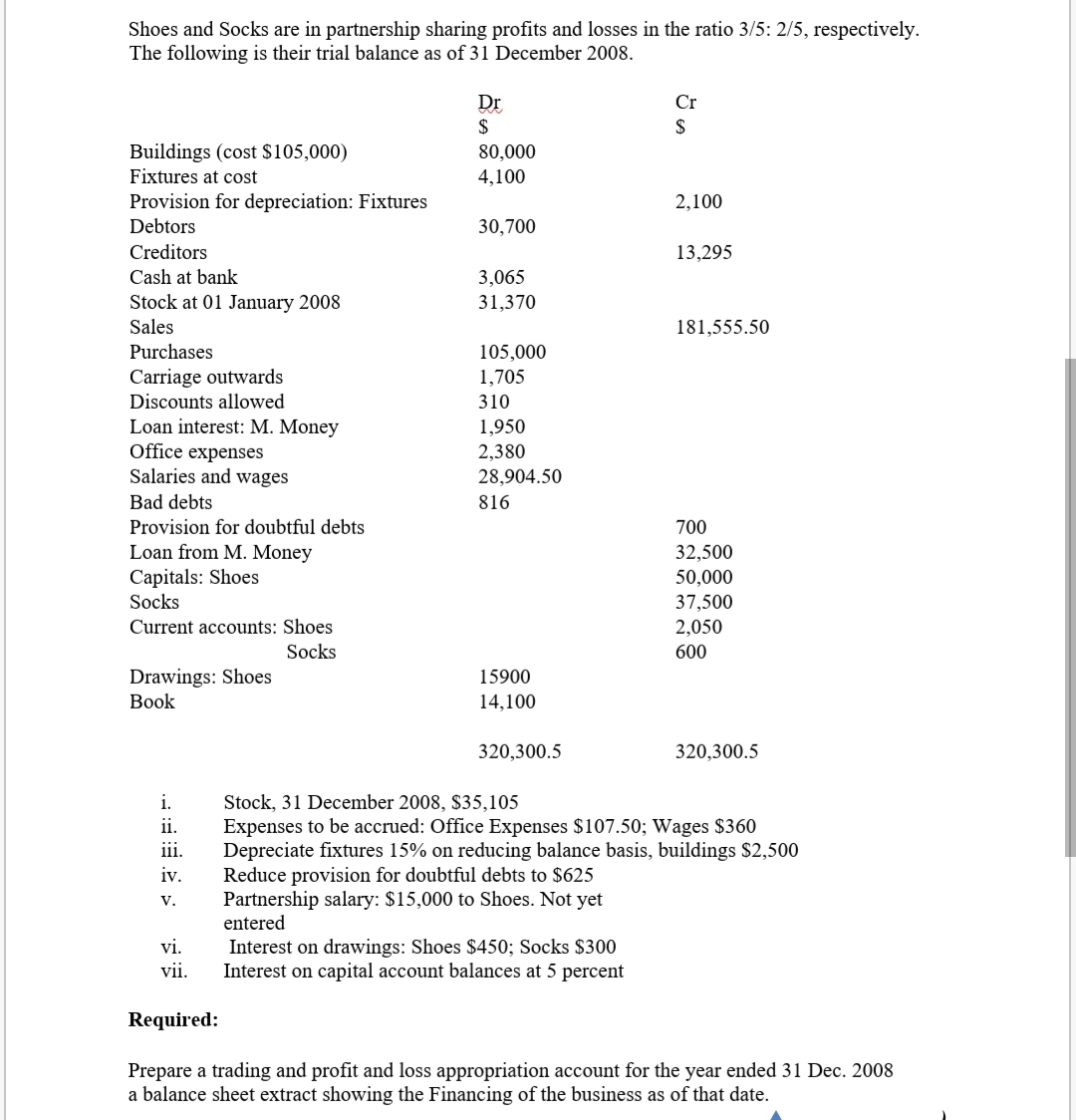

Shoes and Socks are in partnership sharing profits and losses in the ratio 3/5: 2/5, respectively. The following is their trial balance as of 31 December 2008. Dr 2$ Cr Buildings (cost $105,000) 80,000 Fixtures at cost 4,100 Provision for depreciation: Fixtures 2,100 Debtors 30,700 Creditors 13,295 Cash at bank 3,065 Stock at 01 January 2008 Sales 31,370 181,555.50 Purchases 105,000 Carriage outwards Discounts allowed Loan interest: M. Money Office expenses Salaries and wages 1,705 310 1,950 2,380 28,904.50 Bad debts 816 Provision for doubtful debts 700 Loan from M. Money Capitals: Shoes Socks Current accounts: Shoes 32,500 50,000 37,500 2,050 Socks 600 Drawings: Shoes 15900 Book 14,100 320,300.5 320,300.5 i. Stock, 31 December 2008, $35,105 Expenses to be accrued: Office Expenses $107.50; Wages $360 Depreciate fixtures 15% on reducing balance basis, buildings $2,500 Reduce provision for doubtful debts to $625 Partnership salary: $15,000 to Shoes. Not yet entered ii. ii. iv. V. Interest on drawings: Shoes $450; Socks $300 Interest on capital account balances at 5 percent vi. vii. Required: Prepare a trading and profit and loss appropriation account for the year ended 31 Dec. 2008 a balance sheet extract showing the Financing of the business as of that date.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 3 steps with 2 images